Commodities of the future: Most linked to green and digital transitions – report

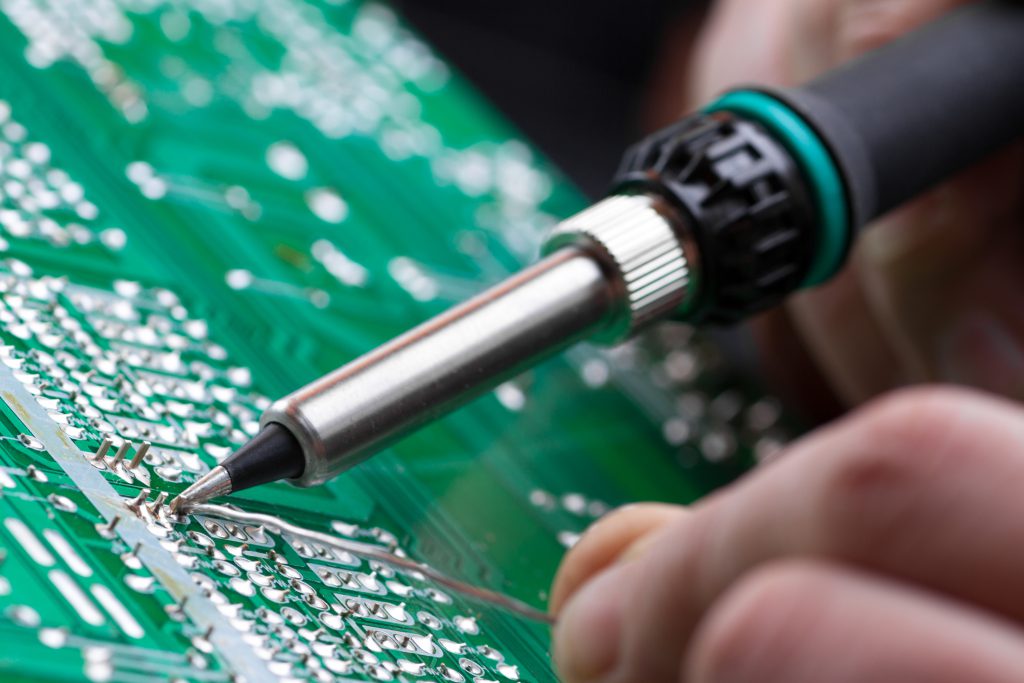

The pace of the digital transition in particular will impact the intensity in the use of energy as productivity rises, as well as direct demand for metals used in the manufacturing of digital products, such as tin and copper.

However, Fitch notes that demand for high-quality and green steel will be much stronger amid the likely multiplication of decarbonisation policies on a 10-to-20-year horizon.

As the green and digital transitions accelerate in the coming years, they will support demand for a number of commodities, including copper for the green transition, nickel, lithium and cobalt for green transition, electric vehicle batteries, tin for digitalisation and consumer demand and aluminium for the green transition.

While the mining and refining sectors for ‘traditional’ base metals such as copper, nickel, tin and aluminium are well established, Fitch notes that the lithium and cobalt mining sectors will develop quickly in the coming years and these markets will mature.

Extensive research and development to improve the efficiency, cost and sustainability of batteries will lead to fast-moving developments in the types of battery chemistries, leaving some materials at risk of a fall in demand.

Cobalt is a case in point, Fitch says, as many players along the battery supply chain are aiming to reduce or entirely phase out cobalt from batteries given the elevated sustainability/ESG risk associated with the commodity.

For some of these metals, this will also come with supply vulnerabilities either due to a concentration in production in geopolitical hotspots or to sustainability issues, Fitch notes, as is the case of cobalt and rare earths.

Metal scraps also have a bright demand outlook in the coming years as recycling and the use of steel electric arc furnaces (EAFs), which require scrap, rise significantly over the next 10 years.

Digitalisation and modernisation initiatives in the infrastructure sector such as China’s ‘New Infrastructure’ plan, along with decarbonisation of the manufacturing sector, will require high-quality, lighter and lower carbon steel, Fitch notes, adding that demand for steel scrap will also be strong out to 2030 as the less- polluting EAF’s capacity will rise significantly.

(Read the full report here)