Why the blockage of the Suez Canal matters for oil prices

The importance of the Suez Canal in Egypt was laid bare for all to see on Wednesday, as oil prices rallied after a cargo ship ran aground, blocking the critical chokepoint for Persian Gulf oil.

Wednesday’s “blip” in the oil market “represents people buying in after recent declines in oil prices, with the Suez closing the trigger factor,” said Michael Lynch, president of Strategic Energy & Economic Research. However, he believes the Suez Canal “won’t be closed for long.”

“The Suez Canal will not spare any efforts to ensure the restoration of navigation and to serve the movement of global trade,” said Lt. Gen. Ossama Rabei, head of the Suez Canal Authority, according to the Associated Press.

Still, prices for oil on Wednesday, rebounded to recoup much of their recent losses, after settling Tuesday at their lowest in about six weeks.

In Wednesday dealings, U.S. benchmark May West Texas Intermediate crude CLK21,

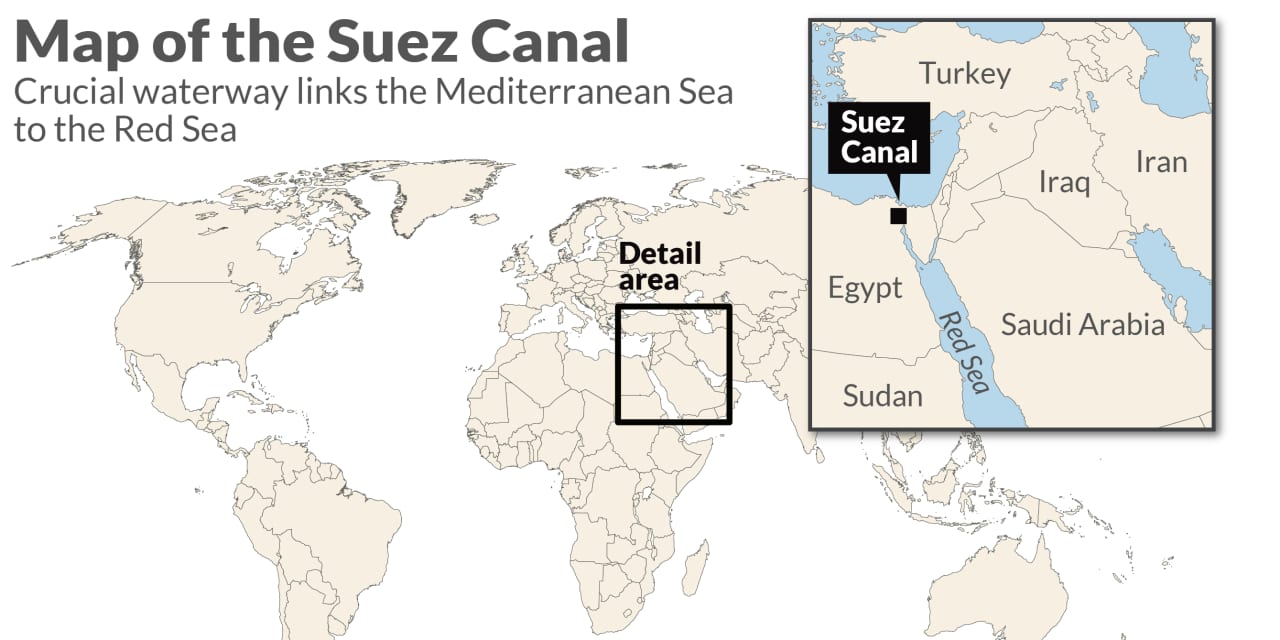

The MV Ever Given, a Panama-flagged ship with an owner listed in Japan, turned sideways in the canal on Tuesday, blocking traffic in the waterway, which divides continental Africa from the Sinai Peninsula. An estimated 10% of total seaborne oil trade passes through the Suez Canal, which connects the Red Sea with the Mediterranean Sea.

In a tweet Wednesday, oil analytics firm Vortexa said the approximate rate of backlog is around 50 vessels per day, and “any delays leading to re-routings will add 15 days to a Middle East to Europe voyage.”

In a separate tweet early Wednesday, it said 10 crude tankers, representing approximately 13 million barrels of oil, could be affected by the disruption so far.

In the bigger picture, however, some analysts emphasize that the incident at the canal is not expected to be a lasting event.

“The Suez Canal, in our opinion, is not a long-term issue,” said Tariq Zahir, managing member at Tyche Capital Advisors. The biggest concern is demand for oil, which is threatened by the new COVID-19 related lockdowns in Europe, and the fear that the situation is “going to replicate here in the United States.”