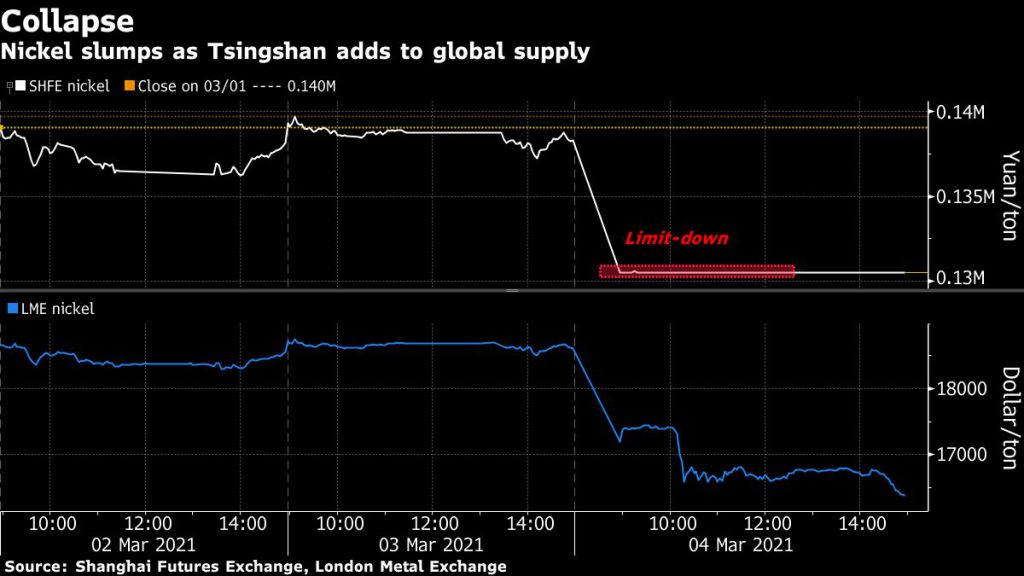

Three-month nickel on the London Metal Exchange dropped as much as 8.5% to $15,945 a tonne, its biggest intraday loss since December 2016, also on the news that Norilsk Nickel expects to stabilize flooding issues at its Oktyabrsky and Taimyrsky mines next week.

The most-traded June nickel contract on the Shanghai Futures Exchange ended 6% lower at 130,510 yuan ($20,180.61) a tonne, posting its biggest intraday loss since May 2020.

[Click here for an interactive nickel price chart]

Tsingshan Holding Group Co., the world’s top stainless steel producer, will soon start supplying nickel matte to Chinese battery material producers and plans to expand its nickel investments in Indonesia. Matte is an intermediate product made from concentrate that can be further processed into battery-grade chemicals.

“Tsingshan’s mass production of nickel matte triggered a supply-side reform. The supply bottleneck for nickel sulphate has been broken. There’s limited room for nickel price to increase,” Huatai Futures said in a note.

Nickel-pig-iron producers can now make nickel matte by slightly adjusting the manufacturing process, Celia Wang, an analyst at Mysteel told Bloomberg.

“This will substantially ease concerns of a shortage of battery materials,” she said.

The drop in nickel prices pushed share prices lower. In Sydney, Nickel Mines Ltd. fell 10% and IGO Ltd. lost almost 8%. In China, Zhejiang Huayou Cobalt Co. slumped 10% and Ganfeng Lithium Co. declined 9.7%.

(With files from Bloomberg and Reuters)