Here’s the problem the Fed is fueling — and it’s not inflation, strategist says

The recent spike in bond yields finally has the attention of Federal Reserve policy makers. Gov. Lael Brainard said on Tuesday that “some of those moves last week and the speed of the moves caught my eye.” San Francisco Fed President Mary Daly said the central bank could alter the maturity of its bond purchases — or even, as it has done before, sell shorter-term securities to buy longer-term government bonds in a so-called “twist.”

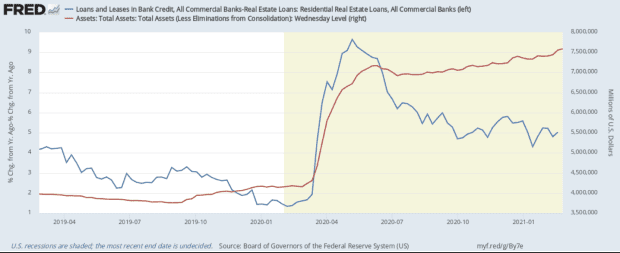

Steven Blitz, chief U.S. economist and managing director for global macro at research service TS Lombard, says the Fed’s determination to keep interest rates low through quantitative easing is fueling another problem. Lending growth from commercial banks is slowing, at a time when the economy is accelerating.

Separating out mortgages — which banks don’t retain on their balance sheet — commercial bank lending is growing at about a 5% year-over-year clip, according to the most recent weekly data from the Federal Reserve. That is down from as high as 10% in April.

The Fed’s holding of Treasury debt to manage yields isn’t inflationary because it requires the central bank to hold commercial bank assets, Blitz says. Commercial banks don’t mind since the Fed pays them interest for what is essentially a riskless transaction. The Fed now holds 16% of commercial bank assets, up from 6% in 2019.

“This exercise is a reminder that the Fed cannot forever shield the markets from the cost of financing Treasury debt growing faster than nominal GDP. For now, the economy enjoys below equilibrium interest rates, but high reserves and capital constraints more broadly means banks are not fully able to help others leverage growth through lending that these low rates would suggest,” says Blitz.

Far from predicting an inflation surge, Blitz says the core personal consumption expenditures measure of prices will be growing just 1.3% in the fourth quarter, and 1.7% next year. Blitz says the likely $1,400 stimulus checks, and COVID-19 vaccinations, will boost the economy, but to a relatively tepid 4.5% annualized rate by the fourth quarter, slowing to 2.8% next year.

The buzz

Texas is ending its mask-wearing mandate and eliminating all restrictions on businesses. Rides provider Lyft LYFT,

Rocket Cos. RKT,

Server and storage provider Hewlett Packard Enterprise Co. HPE,

ADP reported a slowdown in private-sector hiring, down to 117,000 in February, from 195,000 in January. The ISM services report, and the Fed’s Beige Book of economic anecdotes, also are due for release.

The market

U.S. stock futures ES00,

The yield on the 10-year Treasury TMUBMUSD10Y,

The chart

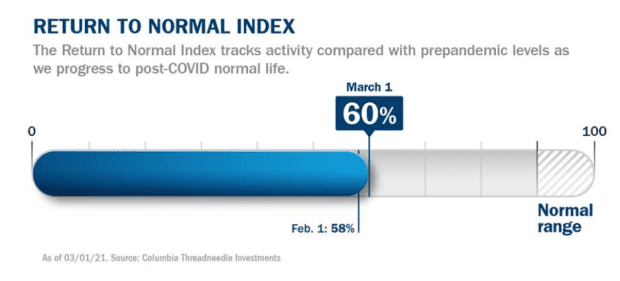

Fund manager Columbia Threadneedle has concocted a return-to-normal index for the U.S. based on a variety of measures, such as travel, shopping at stores and eating out. It isn’t meant to track economic indicators like gross domestic product but instead is focused on measuring components of daily life. The most recent increase came on a return to in-person schooling.

Random reads

Singer-songwriter Dolly Parton converted her “Jolene” track to “Vaccine” as she received the first dose of the Moderna MRNA,

Cuttlefish, unlike some toddlers, can pass what’s called the marshmallow test, which is designed to measure self-control.

Here’s some deep value for you — a small porcelain bowl bought for $35 at a Connecticut yard sale is going to be auctioned off. Broker Sotheby’s says it may fetch as much as $500,000.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.