Gold price slump led to $4.6bn monthly loss in ETFs

As a result, global assets under management now stand at 3,681 tonnes – valued at $207 billion – levels last seen in June 2020 when the price of gold was near the February closing level of $1,743 per ounce.

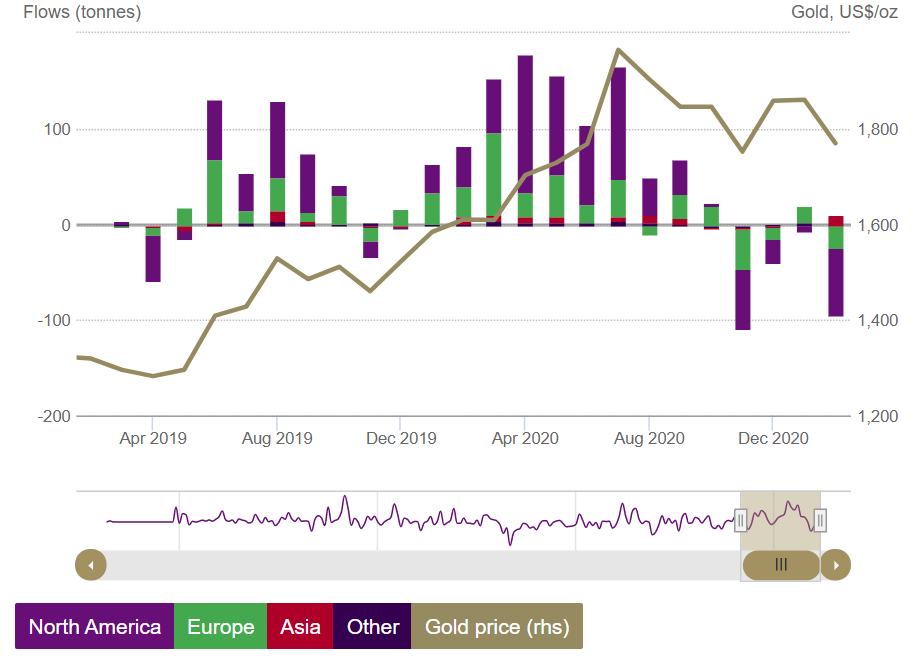

Regionally, the WGC reports that momentum trading impacted larger funds in North America, with outflows falling by 3.4% or 71.2 tonnes for a total loss of $4.1 billion.

Holdings in European funds, meanwhile, fell by 1.1% or 23.8 tonnes, with a value of $1.1 billion.

However, funds listed in Asia had strong net inflows, increasing by 8.4% or 10.6 tonnes for a gain of $596 million.

The remaining regions had outflows amounting to a 0.7% decrease or 0.3 tonne, and worth $27-million.

Long-term trends

According to the WGC, global assets under management have retraced the last six months of overall inflows over the past four months.

The larger gold ETFs accounted for most of the asset losses in recent months, likely from momentum trading, while low-cost gold-backed ETFs continued to see assets grow.

As such, month-to-month swings in overall global flows will continue to be dominated by US and UK funds, says the organization, adding that the Asian ETFs will continue to grow assets despite other regions faltering.

Spot gold saw a slight rebound on Thursday, up 0.2% to $1,713.14/oz by 12:10 p.m. EST. However, US gold futures continued to decline, down 0.1% to $1,713.20/oz.

Click here for an interactive chart on gold prices.