Gold price down after upheaval in Turkey

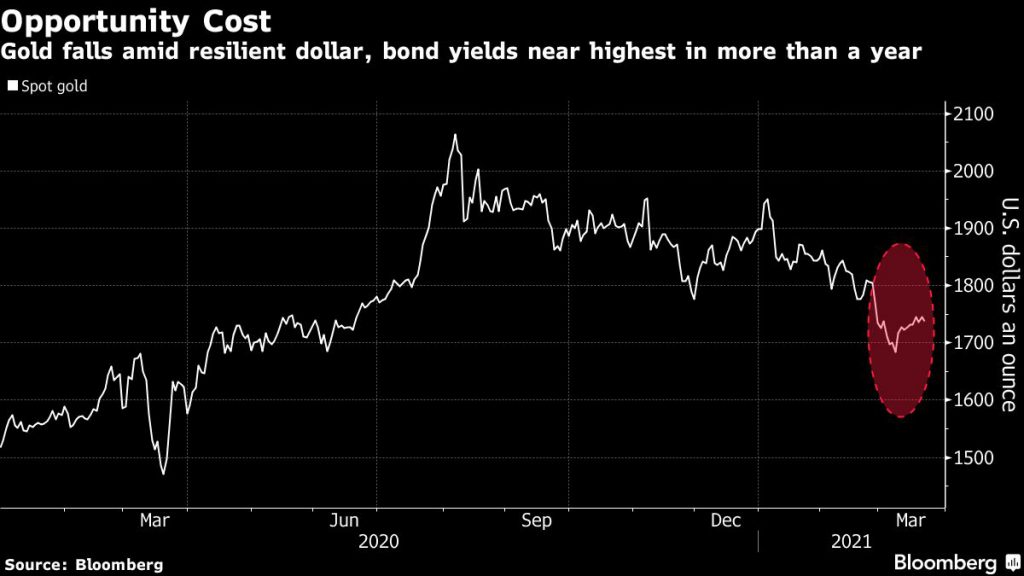

The precious metal remains almost 9% down this year amid pressure from rising US Treasury yields, which make non-interest bearing bullion less attractive. The yield on 10-year Treasuries fell three basis points to 1.69% on Monday.

Gold prices continue to trade weaker, rejecting the range required for algorithmic trend followers to cover their shorts, according to TD Securities analysts in a note to Bloomberg.

“This suggests that money managers continue to sell the yellow metal, as the sustained rise in nominal yields continues to add pressure,” the analysts said.

Traders will turn their attention to a heavy slate of bond auctions, which will provide an indication of appetite for havens when investors are repositioning for an economic recovery.

Tumult in Turkey

Meanwhile in Turkey, one of the world’s major gold buyers, the abrupt decision to fire its central bank head — its third central bank sacking in two years — drove investors towards the safety of the US dollar and bonds.

The US dollar firmed after Turkey’s President Tayyip Erdogan replaced a hawkish central bank chief with an opponent of tight monetary policy on Saturday, which sent the Turkish lira close to its all-time low.

“Some might suggest that Turkish citizens, given the fact their currency is plummeting, will not be buying as much gold going forward,” Commerzbank analyst Eugen Weinberg told Reuters.

“The whole commodity space got out of bed on the wrong side, we got negative price action across the board,” Saxo Bank’s Ole Hansen added. “Lower risk appetite to start the week and the (gold) market is not really catching a bid despite the higher bond prices.”

(With files from Bloomberg and Reuters)