Dow futures slip, stock market on track for more losses ahead of jobless claims, Powell speech

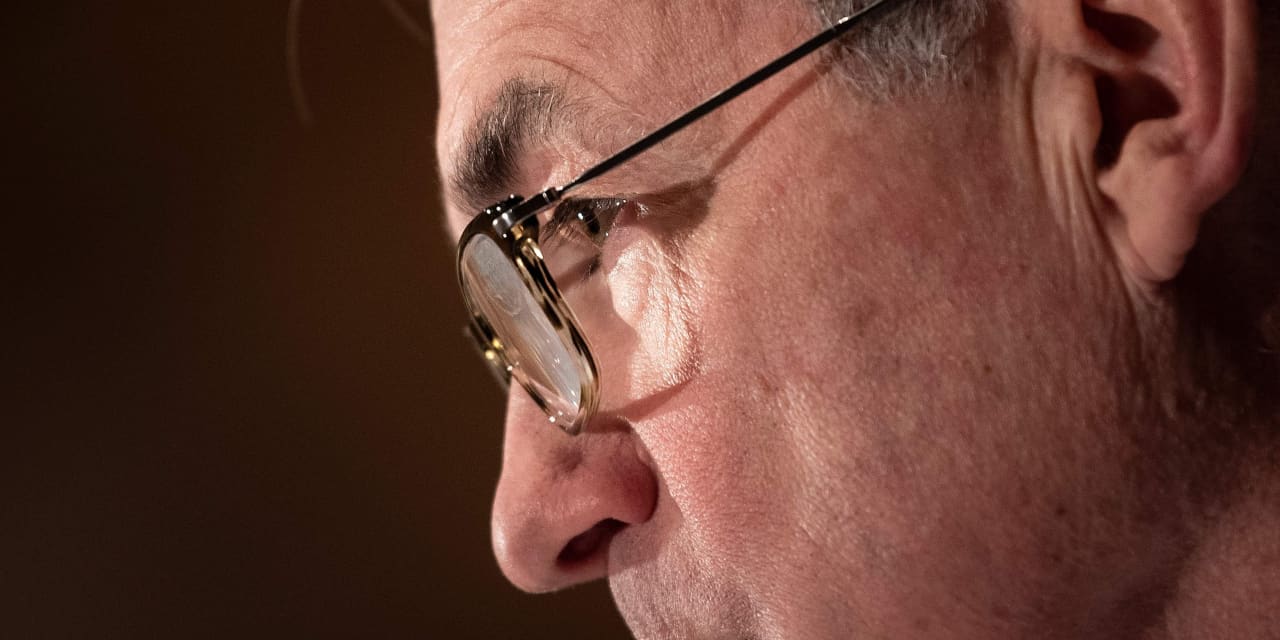

Stock-index futures headed lower early Thursday, putting the three main benchmarks on track to notch a third straight decline, as investors awaited weekly jobless benefit claims data and a speech by Federal Reserve chair Jerome Powell at a noon Wall Street Journal conference.

How are stock benchmarks performing?

- Futures for the Dow Jones Industrial Average YM00,

+0.15% YMH21,+0.15% were off 36 points, or 0.1%, at 31,200. - S&P 500 index futures ES00,

+0.01% ESH21,+0.01% were retreating 9.70 points at 3,807, a decline of 0.3%. - Nasdaq-100 futures NQ00,

+0.06% NQH21,+0.06% fell 39.75 points, or 0.3%, to reach 12,641.75.

On Wednesday, the Dow DJIA,

What’s driving the market?

The “great rotation” is under way as some analysts describe a shift out of highflying technology stocks, viewed as expensive by some measures, to other areas of the market considered undervalued, including energy and financials.

The move has been mostly precipitated by a recent selloff in government bonds, which has pushed yields higher as investors price in economic recovery and better times for stocks hit in the past year by the COVID-19 pandemic, after technology stocks did well from business lockdowns and social-distancing protocols last year.

The 10-year U.S. Treasury note TMUBMUSD10Y,

Worries stem from expectations that further fiscal aid from Congress will add fuel to an inflationary fire that some fear my cause a more rapid series of interest-rate hikes by the Fed.

Powell may touch on these growing concerns when he speaks at The Wall Street Journal Jobs Summit at 12:05 p.m. Eastern.

“We suspect Powell will once again try and calm the markets but todays macro news could be challenging for the bond market,” wrote Peter Cardillo, chief market economist at Spartan Capital Securities, in a research note, referring to the Fed chair’s semiannual testimony in front of congressional lawmakers last week.

“In other words, expect a choppy and volatile market,” the analyst said.

So far, central bank officials have said that they aren’t overly concerned about the move up in bond yields though they are monitoring it closely. Powell’s comments will mark the last from Fed officials before a self-imposed “blackout” period ahead of the next two-day policy meeting starting on March 16.

Meanwhile, investors are watching the progress of negotiations over the Biden administration’s $1.9 trillion COVID aid package, after Senate Democrats agreed Wednesday to narrow eligibility for some of the direct payments that are part of the proposal.

In economic reports, investors await the weekly report on the number of Americans seeking unemployment benefits at 8:30 a.m. ET, which has become a high-frequency gauge of the pace of the economy’s recovery. Economists estimate that jobless claims for the Feb. 27 week are expected to rise 30,000 to 760,000, according to Econoday. Those surveyed by Dow Jones are expecting a 750,000 rise.

Beyond claims, a reading of productivity and costs are due to be released at the same time as the report on joblessness and a report on factory orders is set for 10 a.m. ET.

Which stocks are in focus?

- Flipkart, the online Indian retailer mostly owned by Walmart WMT is considering a U.S. listing by merging with a special-purpose acquisition company, Bloomberg News reported, citing people familiar with the matter.

- BJ’s Wholesale Club Holdings Inc. BJ reported Thursday fiscal fourth-quarter profit, revenue and same-store sales that topped expectations as the COVID-19 pandemic provided a boost, while not providing a financial outlook given uncertainties related to the pandemic.

- Discount retailer Burlington Stores Inc. BURL said Thursday it had net income of $155.9 million, or $2.33 a share, in the fourth quarter, down from $206.3 million, or $3.08 a share, in the year-earlier period.

- Ciena Corp. CIEN reported Thursday fiscal first-quarter profit and revenue that beat expectations, with networking revenue falling less than forecast, while the company didn’t provide financial guidance.

- Kate Spade, part of the Tapestry Inc. TPR, said Thursday that Nicola Glass, the brand’s creative director, has stepped down from that role, effective April 1.