Cruise stocks price targets boosted on evidence of ‘pent-up demand,’ but analyst won’t say buy

Shares of cruise ship operators rose Friday, after Truist analyst Patrick Scholes raised his price targets, citing evidence that “pent-up demand” was a real thing, but he still doesn’t recommend investors buy, at least not yet.

Shares of Royal Caribbean Group RCL,

Scholes raised his price target for Royal Caribbean’s stock by 42% to $68 and his target for Norwegian’s stock by 25% to $25, while bumping up his target on Carnival shares by 14% to $16.

Although sales this year through early March are still “deeply negative” from the same time in pre-COVID 2019, 2022 bookings are looking 30% to 35% above 2019 levels, Scholes said.

On Thursday, Norwegian said it was seeing “strong demand” for future cruises, with 2022 booking trends showing “very positive” booking trends.

Scholes said conversations with executives at large travel agencies that specialize in cruises, and from examining “big data” on future bookings, have reaffirmed that people are itching to go cruising again, especially on higher-end cruises in 2022 and beyond.

“Clearly there is significant pend-up demand, especially from experienced cruisers and those that had their cruises canceled (far less for new to cruise customers) and most notably for seniors on higher-end/premium cruises,” Scholes wrote in a note to clients.

However, he also noted that travel agency executives expressed frustration that the Centers for Disease Control and Prevention (CDC) is essentially “unwilling to engage in a ‘real’ conversation with the cruise lines regarding technical instructions for what it will take for the cruise lines to begin test cruises,” Scholes wrote.

The CDC (Centers for Disease Control and Prevention) currently recommends that “all people avoid travel on cruise ships,” with the last order issued on Oct. 30 introducing a “phased approach” for resuming cruises.

But currently, Royal has suspended cruise operations for most ships through at least April, while Norwegian and Carnival Cruise Line has suspended cruises through May.

“[I]n the near term, things look less favorable as many of these [travel agency] executives are beginning to think that 2021, with perhaps the exception of 4Q, will be another ‘write-off’ year and are more focused on 2022 at this point,” Scholes wrote.

Despite the price target increases, Scholes reiterated the hold ratings he’s had on Royal and Norwegian since July, as Royal’s new target is 23.6% below current prices and Norwegian’s target represents an 18% discount.

For Carnival, he maintained the sell rating he’s had on the stock since July, as his new target is 43.5% below current prices.

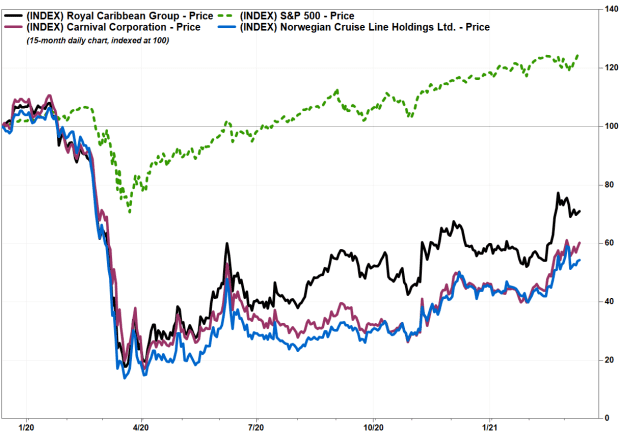

Royal shares have run up 193.9% over the past 12 months, as they were tumbling toward post-COVID-19 lows a year ago, Norwegian shares have run up 216.7% and Carnival’s stock has hiked up 89.1%, while the S&P 500 has gained 58.5%.