Stocks aren’t in a bubble, but here’s what is, according to fund manager Cathie Wood

For all the attention given to the argument that the stock market is in a bubble, it is important to point out that not everyone shares that view.

Few fund managers have been more successful than Cathie Wood, the chief executive of ARK Invest and fund manager of the ARK Innovation ETF ARKK,

Since 2018, there have been outflows of roughly $300 billion from equities, excluding share repurchases by companies. But there have been inflows of $1 trillion into bonds, she said. “If there is a bubble anywhere, it is not in the equity market, it is in the fixed-income market,” she said.

Also see: Is the stock market due for a correction in 2021? Here’s what some experts think

Private equity is feeding this bubble, she said. “It’s amazing to me to watch private equity, with mature [companies], will continue to leverage them up so they can enjoy the private equity distribution,” she said. Private-equity owners are sustaining high-multiple cash flows by not investing in the future. “That’s become problematic for these companies, and their high cash-flow margins will disappear over time.”

The phenomenon of call-buying “moonshots” that videogames retailer GameStop GME,

She also took a swipe at passive investing. “This move toward passive investing we’ve seen over the last 20 years…that now is a setup for disappointing returns,” Wood said. While acknowledging passive funds were inexpensive, she said they were “cheap for a reason,” a phrase often associated with arguments against value stocks. At least have a hedge by investing in innovation, Wood said.

In the equities market, there is a bifurcation between those companies on the leading edge of innovation and investing, versus those companies that haven’t. She gave electric-vehicle maker Tesla TSLA,

The buzz

The economics calendar includes the release of consumer prices for January, and at 2 p.m. Eastern, a speech from Federal Reserve Chair Jerome Powell on the labor market.

Cisco Systems CSCO,

Twitter TWTR,

Under Armour UA,

Other earnings on deck include General Motors GM,

Former quarterback Colin Kaepernick is the latest to create a special purpose-acquisition company, seeking to raise up to $287.5 million in an initial public offering.

As bitcoin BTCUSD,

The market

U.S. stock futures ES00,

The yield on the 10-year Treasury TMUBMUSD10Y,

The chart

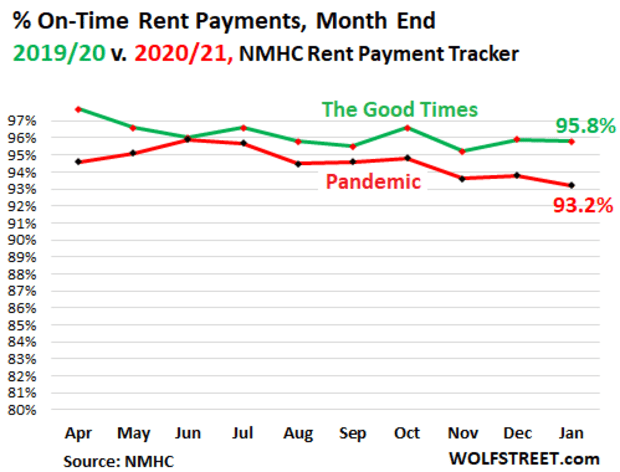

Drawing on data from the National Multifamily Housing Council, here is the proportion of late rent payments, with the chart showing it hasn’t dropped too much during the COVID-19 pandemic. But the data set doesn’t cover subsidized and affordable apartments, and other low-end units. “More of these tenants might experience greater difficulties in making rental payments,” says Wolf Richter of the Wolf Street blog.

Random reads

“Stop moaning” — the advice given by one executive to his 1,500 stay-at-home workers. He later apologized.

Gorilla Glue isn’t a hair spray, it turns out.

House prices may be high, but sharks seem to be moving toward San Francisco.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch