Looking to avoid an obscenely overpriced U.S. stock market? Here’s one strategist’s advice on how to ride the inflation wave

The fund manager who bet against U.S. mortgages before the 2008 crisis and recognized the deep value in GameStop sold out his stake entirely before the wild rally in the videogames retailer. That, and Warren Buffett’s latest moves, were among the revelations of Tuesday night’s wave of 13-F filings at the Securities and Exchange Commission. More on that in a second.

GameStop is now the poster child for what are called “stonks,” the seemingly one-way-only ascent in often hopeless equities. Vincent Deluard, director of global macro at StoneX, expects the madness to continue. “On the one hand, the market is obscenely overpriced and I am certain that stocks will deliver negative real returns in the next decade. On the other hand, the underlying drivers of the bubble are unlikely to go away in the next months: easy-money and financial repression are here to stay,” he says.

A fresh $1,400 check is likely to make it into the hands of Americans by April, special-purpose acquisition companies will have to make purchases with all the firepower they have accumulated, private-equity and venture-capital firms have nearly $2 trillion in dry powder, and many paused corporate stock buyback programs will continue, he says.

“In the U.S., fiscal and monetary authorities have inflated a massive stock bubble. When all is said and done, Europeans will have savings under their mattresses, Asians will have even more productive assets, and Americans will have funny memes,” Deluard says.

Inflation, which investors are increasingly betting on, is the obvious answer to the problems the U.S. faces. “Inflation will act as a ‘debt jubilee,’ will restore the equilibrium between the asset-owning old and pauperized youth, and will allow a stealth default on unfunded liabilities that the boomer generation awarded itself,” he writes.

What will benefit from a period of inflation? Deluard has some interesting ideas. Latin American currencies already reflect a decade of weakness and a very poor response to the COVID-19 pandemic. On a commodity export model, Brazil’s real BRLUSD,

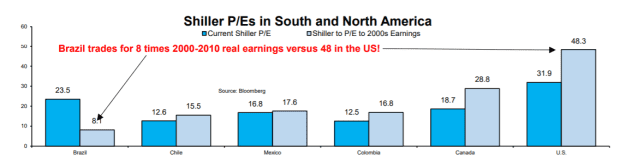

Deluard says it makes more sense to compare Latin American stock prices now to the 2000-2010 decade. “The 2010s was a lost decade for Latin America: commodity prices cratered and the U.S. dollar strengthened, a horrible combo for USD-indebted commodity exporters. If, as I believe, the 2020s will resemble the 2000s (weak USD, reflation, outperformance of EM, value, and inflation-sensitive sectors), the denominator of the Shiller P/E must be shifted by a decade,” he says.

After performing his Shiller shift, MSCI Brazil 907600,

The same analysis finds Spain 972400,

The buzz

Retail sales surged 5.3% in January, a gain far ahead of the 1% increase seen in an economist poll. “The remarkable surge in sales is concentrated in big-ticket items, particularly furniture (+12.0%) and electronics (14.7%), suggesting that some of the latest round of one-time stimulus payments found its way to retailers quite quickly. But other retailers did well too, with internet sales up 11.0%, clothing up 5.0%, and general merchandise up 5.5%. The contrast with December’s weakness, when the surge in Covid cases and the accompanying tightening of restrictions hit spending, is stark,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics, in a note to clients.

Producer prices also rose by more than forecast, increasing 1.3%. Industrial production also rose more than forecast in January.

Some 2.9 million Texans didn’t have power as of Wednesday morning, according to the PowerOutage website. Tesla TSLA,

Warren Buffett’s Berkshire Hathaway BRK.B,

Scion Asset Management — run by Michael Burry, the fund manager popularized in “The Big Short” for betting against mortgages ahead of the U.S. mortgage crisis — sold out of GameStop GME,

Cannabis firm Sundial Growers SNDL,

The markets

After the huge spike on Tuesday in the yield on the 10-year Treasury TMUBMUSD10Y,

U.S. stock futures ES00,

The chart

Via Scott Grannis of the Calafia Beach Pundit, here’s the ratio of copper-to-gold prices, compared with the yield on the 10-year Treasury. “This chart suggests that interest rates are only just beginning to turn higher. Copper and nearly every other commodity are up quite strongly since last March; crude oil prices have nearly tripled over the same period,” he says.

Random reads

Probably used for royal burial rites, a 5,000-year-old brewery was found in the ancient Egyptian city of Abydos.

Tiny wasps are being deployed at a historic mansion to stop moths damaging treasures.

Mount Etna erupted again, closing the nearby Catania airport.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.