Amazon stock chart showing ‘breakout’ rally ahead of earnings

Shares of Amazon.com Inc. rose Tuesday, enough to suggest a “breakout” technical rally ahead of the e-commerce giant’s earnings report after the close.

Janney technical strategist Dan Wantrobski said with the “bullish breakout,” he now sees potential for the stock AMZN,

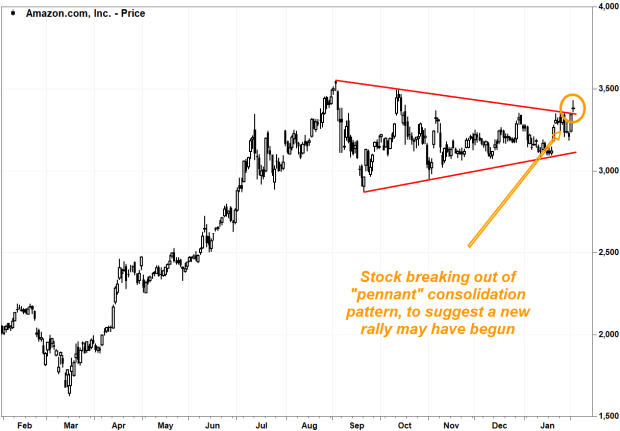

After a sharp climb off the March lows, as investors saw Amazon as a beneficiary of COVID-19-related lockdown measures, the stock had been consolidating within a narrowing range over the past several months.

That range, in the form of what many Wall Street chart watchers call a “pennant” pattern, is defined by a declining trendline at the top of the range and a rising trendline at the bottom. Many technicians see pennants as continuation patterns, meaning they tend to be resolved in the direction of the trend that preceded them.

On Tuesday, Amazon’s stock gapped above the top of the pennant as it opened at $3,380.00, above Monday’s closing price of $3,342.88. That would suggest the consolidation was over, and that the stock may have started a new uptrend.

The stock rose 1.8% in midday trading, putting it on track for the highest close since Oct. 13.

“We believe this actions bodes well for further gains ahead, and would recommend investors stay the course above $3,100-$3,200 support going forward,” Wantrobski wrote in a note to clients.

Amazon is scheduled to report fourth-quarter results after Tuesday’s closing bell, with analysts surveyed by FactSet expecting, on average, net income of more than $6.3 billion and revenue approaching $120 billion.

Don’t miss: Amazon earnings preview: Prime Day and the holidays mean Amazon will add to its most profitable year.

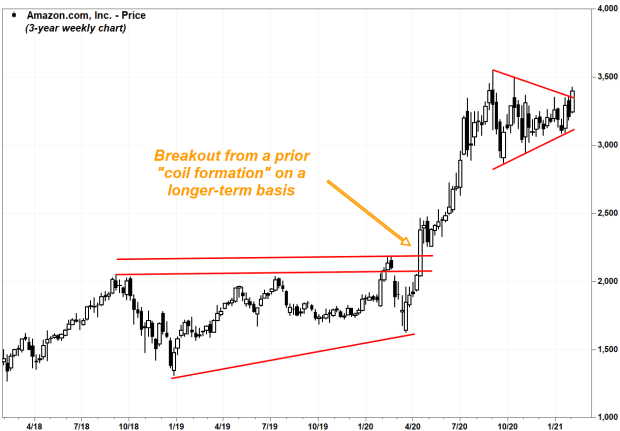

Wantrobski said a weekly chart also suggests a bullish outlook on a longer-term basis, as the stock had already broken out of a prior, larger coiling formation last April, before the current apparent breakout.

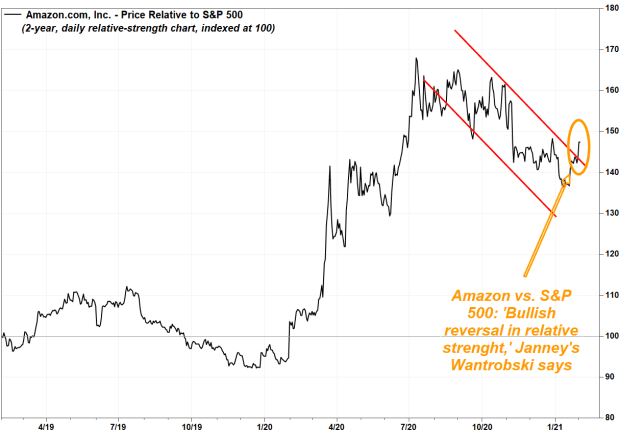

He said Amazon’s stock is also showing a “potential bullish reversal” relative to the S&P 500 index.

“[T]his implies the stock may start to outperform the broader markets on a relative basis once again,” Wantrobski wrote.

Amazon’s stock has rallied 13.3% over the past three months, but has underperform the S&P 500’s SPX,