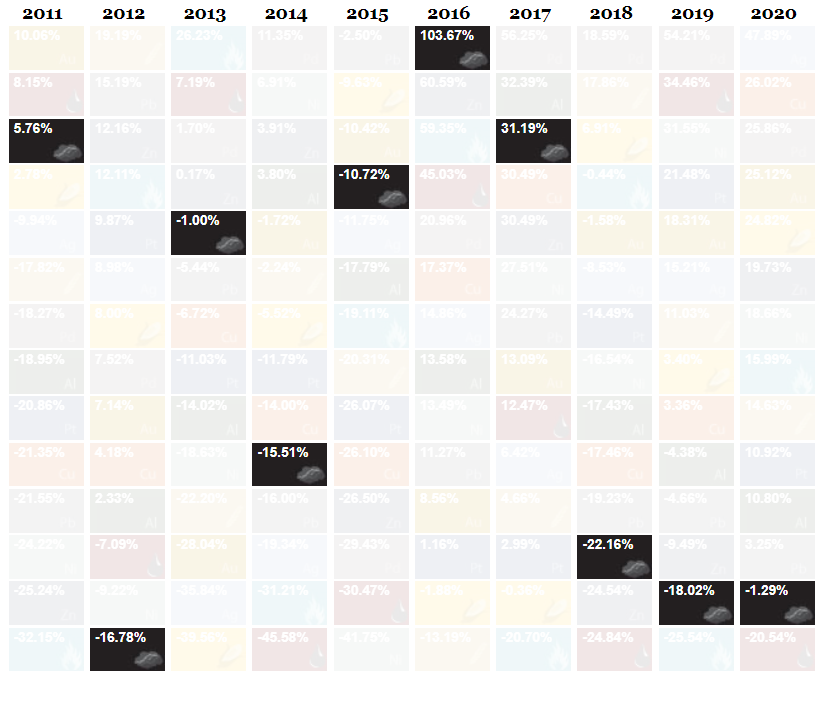

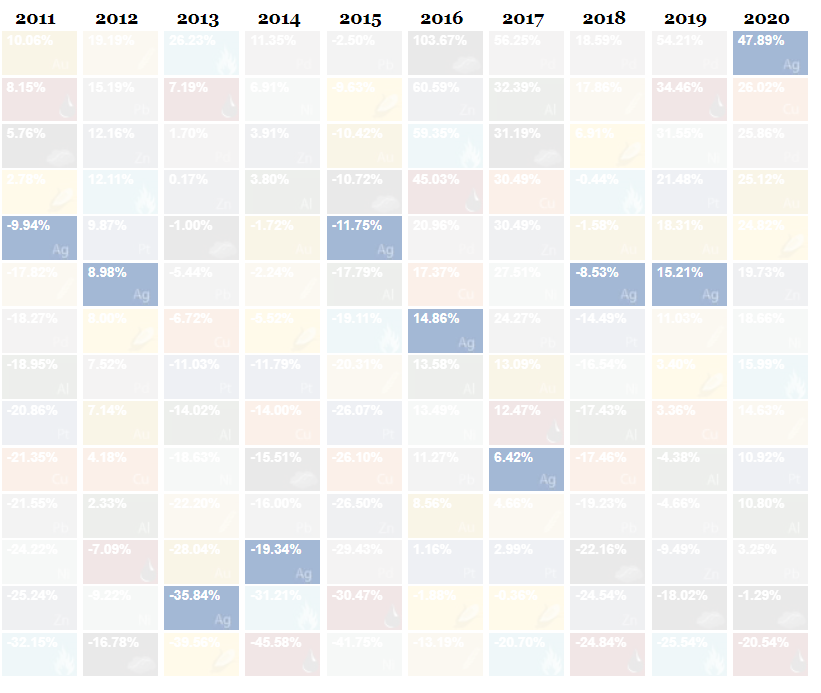

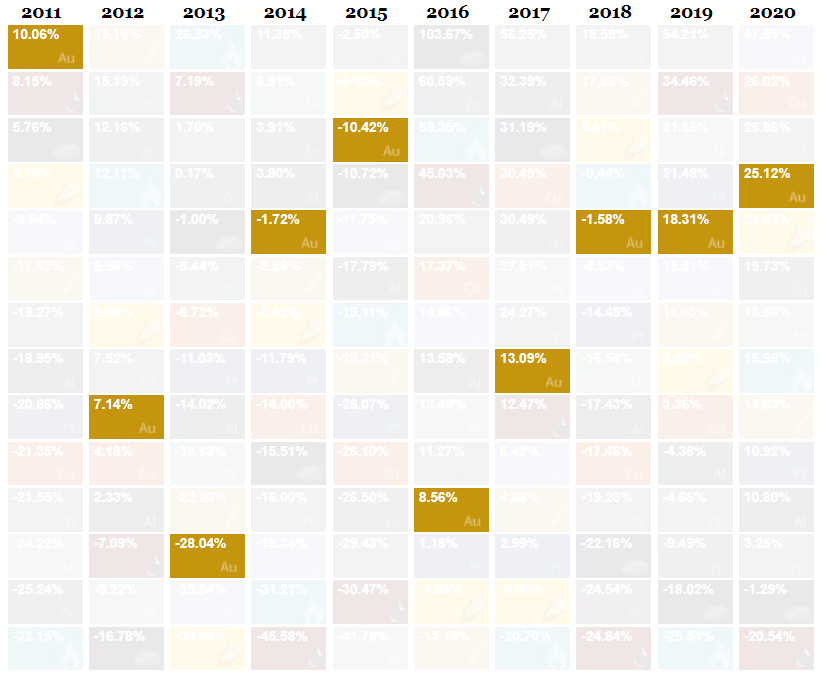

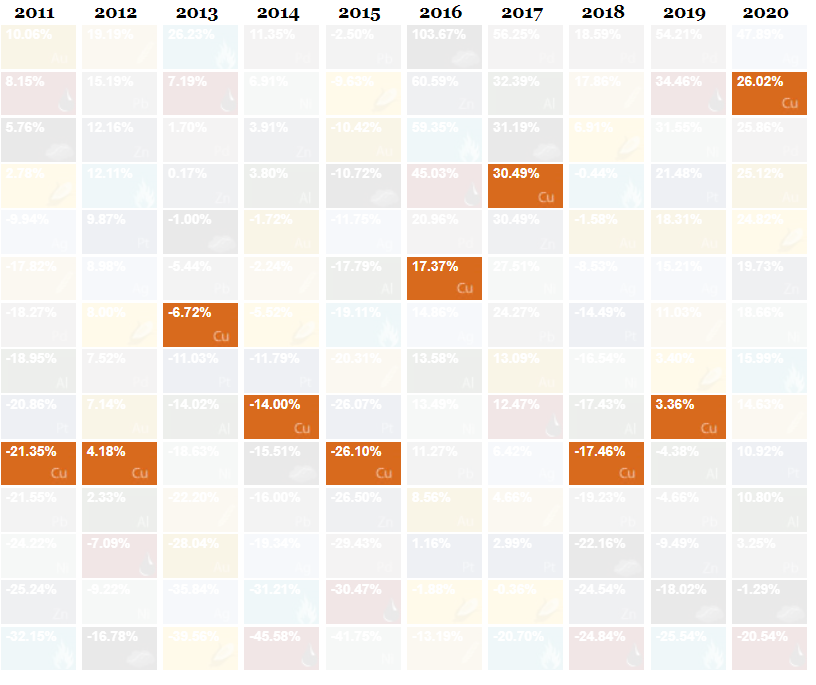

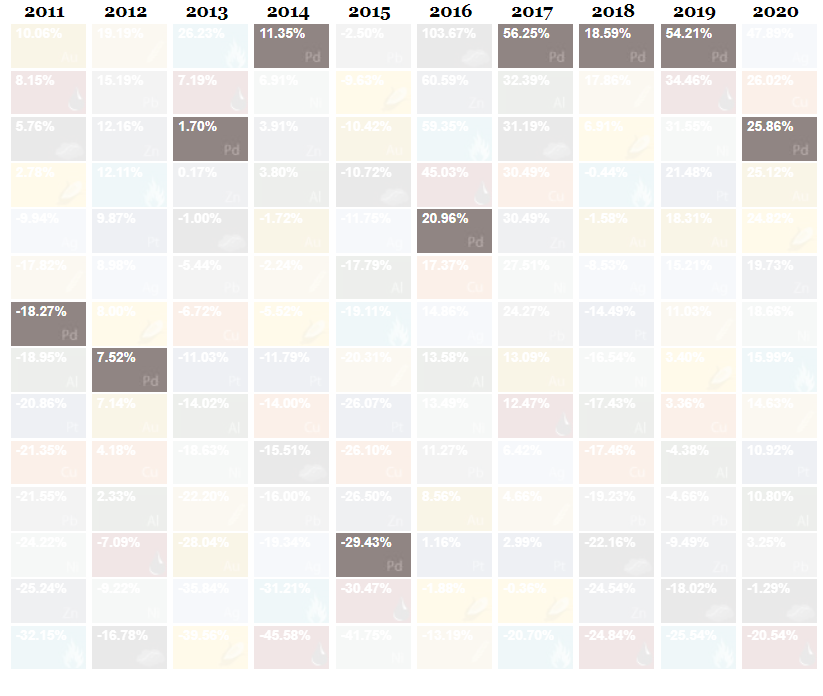

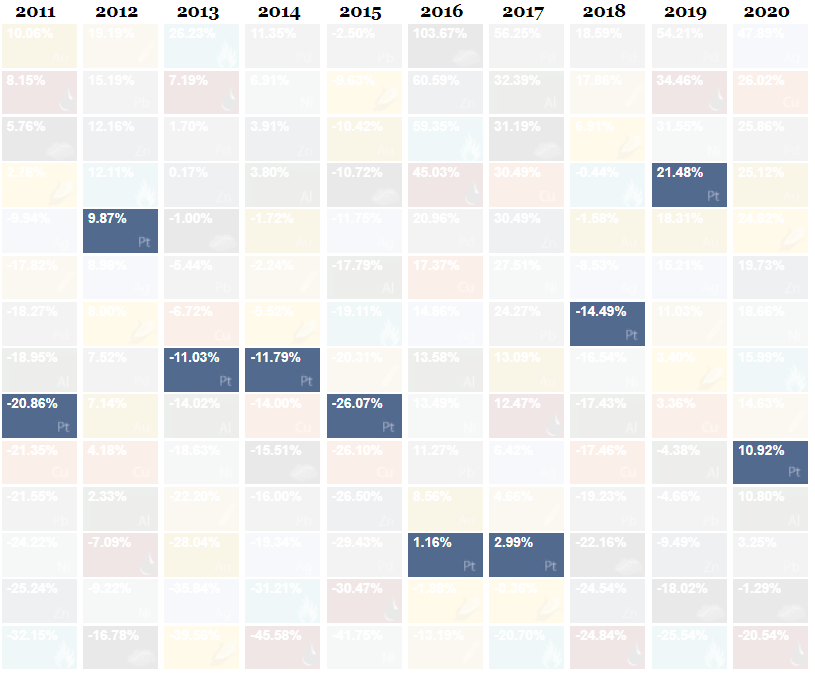

The above graphic from U.S. Global Investors traces 10 years of commodity price performance, highlighting 14 different commodities and their annual ranking over the years.

Silver

After a spectacular year, precious metals are set for further gains in 2021, with silver tipped to outperform.

The metal faced double-digit declines in the first half of the decade, falling over 35% in 2013.

In 2020, silver price reached heights not seen since 2010, jumping 47.89%.

Gold

Gold is off to a good start in 2021 after recording its best yearly gain in a decade.

The safe heaven metal faced its steepest decline in 2013, pressured by strength in the dollar and the Federal Reserve decision to review its quantitative-easing program.

Gold began to rise as economic growth slowed in 2019, but the pandemic accelerated the rally and in August 2020 prices hit a record high of $2,072.50.

Copper

Copper prices continued their momentum from the second half of 2020 as the second wave of coronavirus infections intensifies in South America, the world’s top copper-producing region.

Copper futures for March delivery advanced 0.3% to $3.652 per pound on the Comex this week, surpassing a near eight-year high set in December.

Some banks and investors are now drawing comparisons to the spike in the early 2000s, when a jump in Chinese orders ushered in the last supercycle for commodities.

Platinum and palladium

Analysts and traders have cut their forecasts for autocatalyst metals platinum and palladium as the coronavirus outbreak curtails vehicle sales, but they still expect prices for both to rise gradually through 2021, a Reuters poll showed.

Years of undersupply pushed palladium to record highs above $2,800 an ounce in 2020, while surpluses have kept platinum near multi-year lows.

Palladium will average $2,138 in 2021, according to the median result from a poll of 32 analysts and traders.

Platinum will average $913 this year.

Coal

After being one of the biggest surprises in 2016, jumping over 103% pushed by new mining rules in China designed to curtail production and mine closures around the world, coal has underperformed since 2018.

Global fossil fuel demand fell by 5% in 2020 as the impact of the pandemic curbed usage, according to the International Energy Agency (IEA). Coal price dropped 1.29% in 2020.

Demand is set to jump 2.6% in 2021, as recovering economic activity will lift use for electricity and industrial output, IEA said.