Stock futures rise ahead of Biden’s inauguration, Netflix and Morgan Stanley gain on results

Stock futures gained on Wednesday ahead of President-elect Joe Biden’s inauguration. Netflix, Procter & Gamble and Morgan Stanley shares jumped after their earnings reports.

Futures on the Dow Jones Industrial Average were 63 points higher. S&P 500 futures gained 0.4% and Nasdaq-100 futures added 0.8%.

Netflix soared more than 13% in premarket trading after the company reported strong subscriber growth and said it’s considering share buybacks. Netflix handily beat estimates for global paid net subscriber additions, reporting 8.5 million versus the 6.47 million analysts anticipated. The company also said it expects to be break even on a cash flow basis this year.

Shares of streaming-competitor Disney jumped 3% in early trading following Netflix’s strong subscriber numbers.

Procter & Gamble shares jumped 2% in the premarket as the consumer staple raised its forecast and said revenue last quarter jumped on higher pandemic demand for cleaning products.

Morgan Stanley gained 2.4% in early trading after earnings and revenue topped estimates on solid trading and wealth management results.

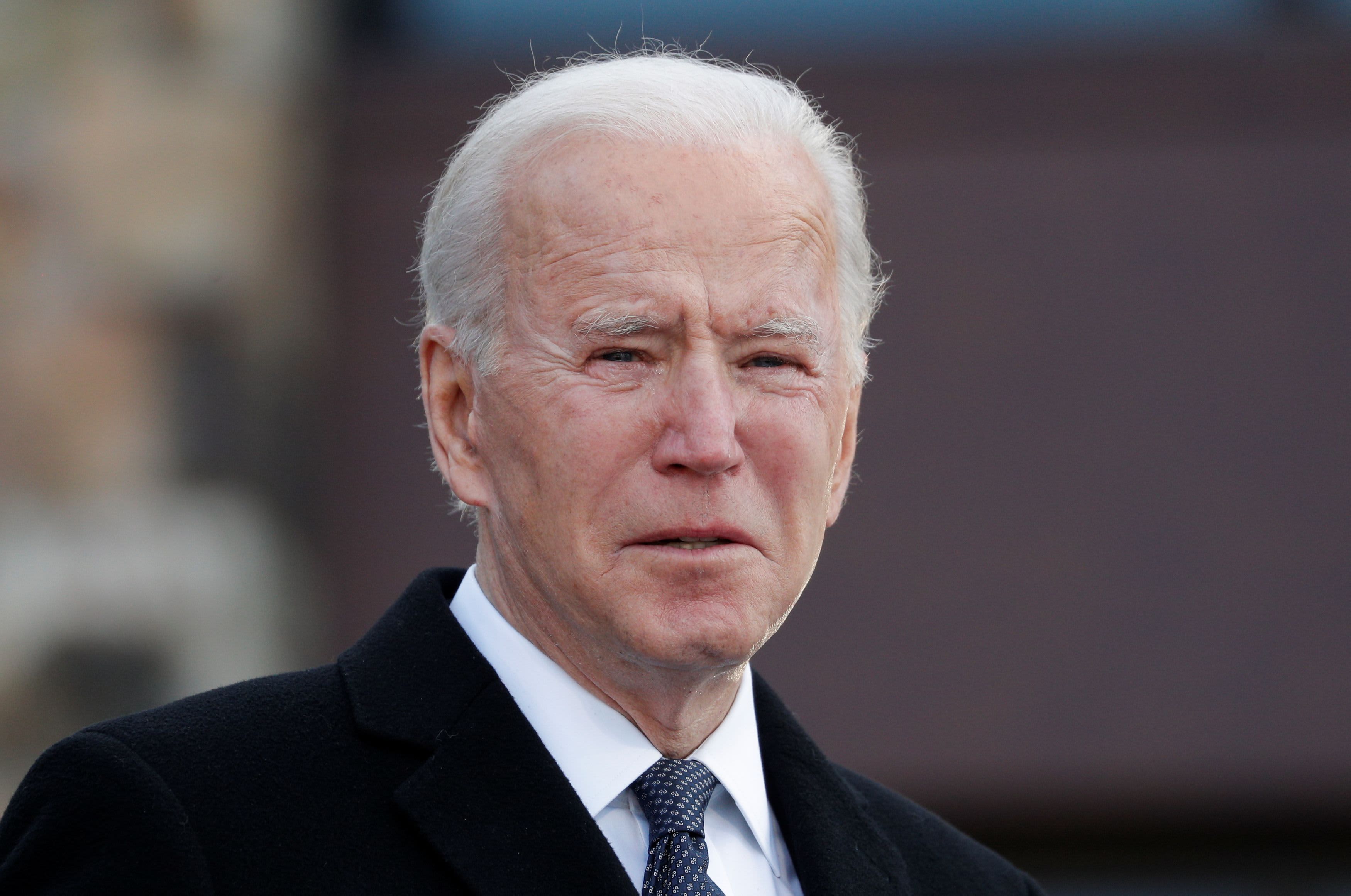

Biden will succeed President Donald Trump as the 46th president of the United States shortly after noon ET. His inauguration speech will focus on the need to bring the country together on the heels of a violent riot on Capitol Hill and amid extreme partisanship in Congress.

Investors will also be on the lookout for any further information about Biden’s $1.9 trillion Covid-19 relief plan unveiled last week. On Tuesday, Janet Yellen, Biden’s designated nominee for Treasury Secretary, endorsed higher aid spending and urged lawmakers to “act big.”

“Everything else could take a back seat to events in Washington as investors look ahead to big changes in policy and outlook from a new administration,” TD Ameritrade’s chief market strategist JJ Kinahan said.

Wall Street started the week with modest gains. The Dow rose more than 100 points on Tuesday, while the S&P 500 gained 0.8%, snapping a two-day losing streak. The Nasdaq Composite rallied 1.5% as big technology stocks rebounded from last week’s sharp losses.

Biden’s stimulus proposal calls for direct payments of $1,400 to most Americans as well as additional unemployment benefit as well as state and local government aid. He also announced a sweeping plan to combat the pandemic in the U.S., which includes a nationwide vaccine campaign.

The U.S. has fallen far short of its goal of vaccinating 20 million people by the end of last year. While the Trump administration’s Operation Warp Speed has delivered over 31.1 million doses across the country, only 12.3 million people have been inoculated.

“I believe there is a very bright light at the end of the tunnel. We just need to make it through the next few months,” Invesco Chief Global Market Strategist Kristina Hooper said. “I expect markets to continue to move in expectations of a robust recovery later in 2021 when vaccines are broadly distributed.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.