Quantum computing is so last-decade. Get ready to invest in the final frontier… teleportation

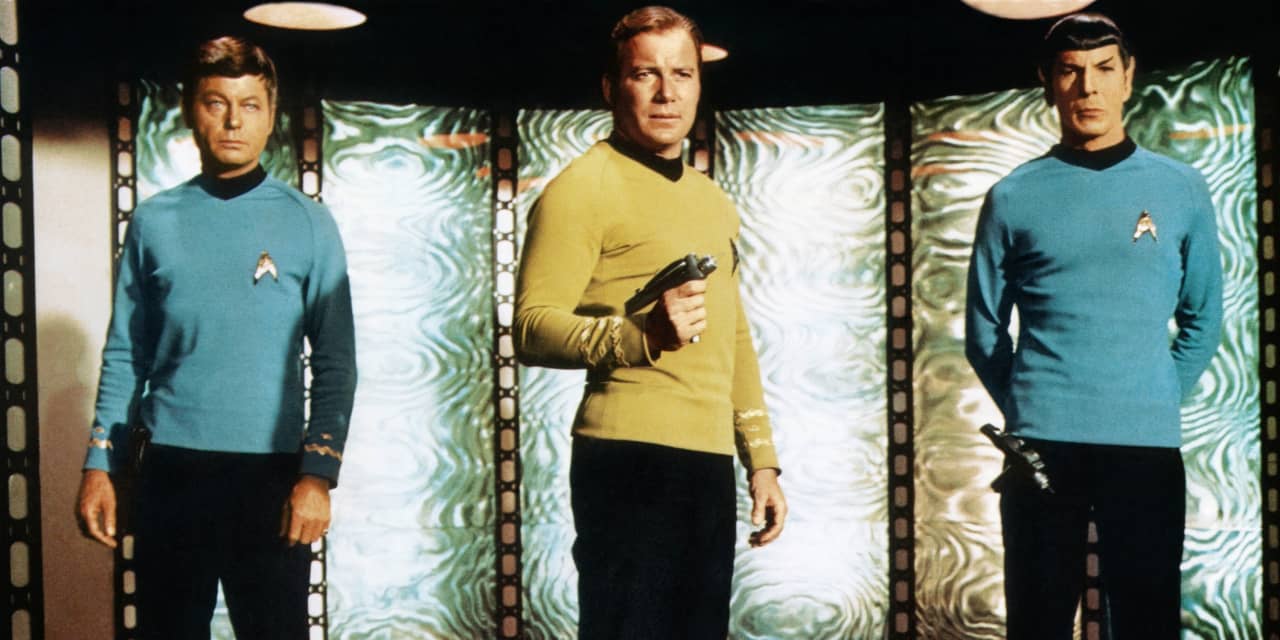

If 2020 had you wishing you could say “Beam me up, Scotty,” you’re not alone. You may be one tiny step closer to getting your wish… in a few decades or so.

Scientists from Fermilab, Caltech, NASA’s Jet Propulsion Laboratory and the University of Calgary achieved “long-distance quantum teleportation” in mid-2020, they confirmed in an academic journal article published last month. It’s another step toward realizing what’s often called quantum computing, and also toward understanding physics on a different level than we do now, perhaps well enough to someday teleport humans. And while there is no ETF specifically for that yet, here are some broad guidelines for thinking about how to invest in very nascent technologies.

For starters, it’s good to understand the broad contours of the industry supporting the idea. A 2020 market research analysis estimates the quantum computing market will top $65 billion per year by 2030, while a 2019 BCG report makes the case for investing now, rather than waiting for things to take off. As MarketWatch reported in late 2019, quantum computing is expected to remake everything from pharmaceuticals to cybersecurity.

Right now, there are several blue-chip biggies involved in the quantum race. Scientists from AT&T were involved in the 2020 experiments, and big companies like Microsoft MSFT,

It’s easy enough to find exchange-traded funds with big holdings of those giants — likely easier than finding publicly-traded small companies on the bleeding edge of these technologies — but it’s also important to remember how small a share of their revenues experimental ventures like these are.

There are still some good models for funds constructed around developing industries like this one, noted Todd Rosenbluth, head of mutual fund and ETF research at CFRA. One is the Procure Space ETF UFO,

The one ETF that might now be said to be closest to offering access to quantum technology takes a similar approach. The Defiance Quantum ETF QTUM,

Another consideration might be an ETF specializing in very early-stage technology. In December, MarketWatch profiled the Innovator Loup Frontier Technology ETF LOUP,

Disruptive technology themes have gotten a boost from one of biggest success stories of 2020, he said in an interview. ARK Invest’s fund lineup took in billions of dollars and enjoyed triple-digit gains as their bets on technology had a moment.

The next-gen narrative seems to resonate with investors, and complex themes like these make a good case for investing in actively-managed funds that benefit from researchers’ expertise. That means that when it succeeds, “There’s a snowball effect of investors coming to see the benefits of using ETFs for these kinds of themes,” Rosenbluth said.

“I think the future is bright for these types of ETFs,” Rosenbluth told MarketWatch. “There’s less white space in the ETF world than there was before, but it’s inevitable that there will be a teleportation-related ETF.”

Read next: What will 2021 bring for ETFs?