NIO: There’s a New Bull in Town

InvestorPlace

5 Stocks to Buy in 2021 for Rapid-Fire Growth

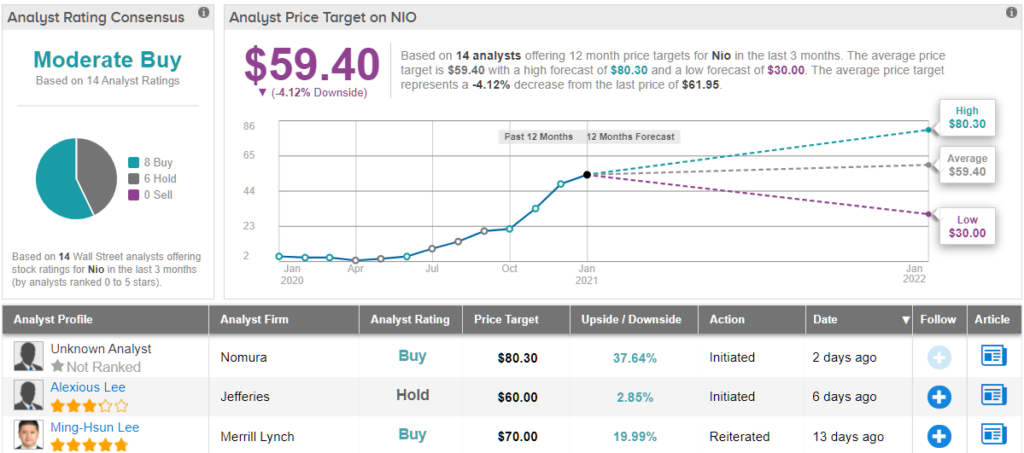

This is a year of innovation. The top stocks to buy in 2021 will reflect that and will represent huge growth opportunities for investors. Think the next generation of electric vehicles (EVs). Alternate energy plays. Space travel. Legal cannabis. Fintech disruptors. These themes accelerated in 2020 and will propel winning stocks higher this year. Acknowledging all of the change the novel coronavirus pandemic drove in recent months, Seismic Capital Company President Eric White is looking at these emerging themes to pick stocks. He told InvestorPlace that as a new normal solidifies, new opportunities will emerge in the stock market. “My advice would be to continue to follow the recent growth sectors, but side-step the ones that have been growing solely because of the pandemic, as it won’t last forever. Also, be sure to look at ‘green companies’ as growth continues in this sector in both the U.S. and worldwide. … [T]he new Biden administration will be pushing for infrastructure legislation, and many of the funds would be allocated to further alternative energy production and other pro-environmental policies that will help those related businesses.”InvestorPlace – Stock Market News, Stock Advice & Trading Tips Considering these trends, however, investors do face one big challenge. Seemingly every day a new initial public offering (IPO) or special purpose acquisition company (SPAC) stock advertises itself as a huge growth opportunity in a hot field. How do you sort through the noise and find the real winners? As you do your own research, White recommends mapping out the big picture for each company. “For general investors, my advice is to also look at industry comps and make sure to pay attention to how the company will sustain growth rather than just how rapidly a company is growing. Also, be sure to monitor the general market for the company you’re interested in, as well as their competitors, and their traction within the space.” 7 Great Sub-$20 Stocks to Buy After Inauguration Day With that in mind, InvestorPlace has rounded up five top stocks to buy in 2021 for rapid-fire growth. Each company on this list represents a sustainable, long-term growth trend: Nio (NYSE:NIO) Stem (NYSE:STPK) Affirm (NASDAQ:AFRM) Canoo (NASDAQ:GOEV) Momentus (NASDAQ:SRAC) Stocks to Buy in 2021: Nio (NIO) Source: Sundry Photography / Shutterstock.com There is no denying that Chinese electric vehicle maker Nio has already come far. Shares started 2020 below $5 and now trade for nearly $60. The company has blown past concerns it would run out of cash, emerging as an innovative and fast-growing EV leader. So where does the company go next? As one of the top stocks to buy for 2021, many analysts are starting to raise their price targets. JPMorgan analyst Nick Lai just raised his price target to $75, while Credit Suisse analyst Bin Wang raised his to $71. However, InvestorPlace analyst Luke Lango sees much more upside ahead for NIO stock, even to $150. That’s because the company continues to deliver on its promises and chart a growth-filled course. In fact, Nio kicked off the year with bold plans. It unveiled its first all-electric sedan, giving it further leverage in its battle against Tesla (NASDAQ:TSLA). Not only is this sedan a great way to target another niche of the passenger market, it also comes with brand-new autonomous vehicle tech. Investors should see the new ET7 as a milestone for Nio with battery, AV and vehicle design advancements. Now, Nio just needs one catalyst to bring that $150 price target into the spotlight. CEO William Li has previously mentioned plans to expand outside of China. Over the summer, he identified Europe as the next target market. Talk of expansion has grown cold since then, but bulls are still confident. The company recently started advertising for job openings in Oslo, Norway. If we receive more confirmation of those plans in 2021, rapid-fire growth will be on the way. Stem (STPK) Source: Shutterstock Stem may not be a household name, but experts are confident it is about to transform the renewable energy landscape. In fact, iconic Citron Research said it is the most exciting alt-energy play since Tesla. That is high praise and speaks to why STPK is one of the top stocks to buy in 2021. For unfamiliar investors, Stem is an energy storage play currently trading through blank-check company Star Peak Energy Transition. When the deal closes, likely this quarter, it will start trading under the ticker STEM. So, what does Citron like about STPK stock? The company is one of the last pure plays on energy storage to come public. Plus, it already has an edge against competitors. Stem specializes in behind-the-meter storage, which means it provides on-site storage options. The company started on its growth path by owning the batteries, software, contracts and services for these on-site storage options. However, as the company comes public, it is moving into the front-of-meter market. To do this, it is increasingly relying on its Athena platform, a software offering that blends artificial intelligence (AI) with energy storage. Athena essentially allows customers to optimize energy use and cut costs. That is where Citron really sees potential. In a recent note, the firm said that Stem is a leader in the AI-driven energy storage market and “couldn’t be better positioned.” And perhaps most importantly, it seems that energy storage will be key as President Joe Biden targets $2 trillion in clean energy infrastructure investments. 7 Stocks To Buy As The Biden Presidency Begins Looking to the future, Stem will offer rapid-fire growth if it can lean into this front-of-meter shift. Investors should also note that the company is looking to use its SPAC merger proceeds to fund expansion into Europe, Japan and Canada. Affirm (AFRM) Source: Piotr Swat / Shutterstock.com One of the top themes Seismic Capital President Eric White identified for 2021 is fintech and it is easy to see why. Fintech stocks have prevailed in recent months, continuing their disruption of traditional financial institutions. PayPal (NASDAQ:PYPL) and its peers are starting to embrace cryptocurrencies. These companies also led the way with direct payments and small business loans as part of the CARES Act. And this disruption will only continue as names like SoFi and Payoneer come public. However, one segment of the fintech market is particularly interesting right now. Buy now, pay later (BNPL) firms represent a new era of retail and recent IPO Affirm stands out in that category. Essentially, BNPL companies are the next generation of payment installment solutions. Not too sure about dropping $100 on an online purchase? What about four interest-free payments of $25? Affirm says it encourages customers to buy more, supporting the retailers it partners with. This has been particularly true amid Covid-19, especially as more retailers rely on e-commerce models. Current Affirm partners include Shopify (NYSE:SHOP), Peloton (NASDAQ:PTON) and Walmart (NYSE:WMT). According to CEO Max Levchin, a former PayPal executive, demand for its solutions quadrupled in the first months of the pandemic. If that growth can continue, it will certainly be one of the top stocks to buy in 2021. So, what should fintech-hungry investors be looking for? As InvestorPlace Market Analyst Tom Yeung wrote, Affirm looks like a stock to instantly add to cart. If the company can avoid traditional moneylending risks, it has a massive growth runway. Look for it to add new customers as well as for its existing customers to grow as e-commerce blossoms. Canoo (GOEV) Source: Shutterstock Nio is not the only electric car stock promising big growth this year. On the other side of the world, startup Canoo looks ready to transform transportation as we know it and will be one of the most compelling stocks to buy in 2021. Canoo wants to change the way cars look as well as the way we buy them. It started on this path by rolling out plans for its flagship passenger vehicle. The company rethinks what consumers want, creating more space for riders and adding fully customizable features. Instead of offering its Canoo at a set price, it touts a subscription model. Designed to lower the overall cost of vehicle ownership and get at the heart of the young, city-living driver, the company thinks it can cash in on growing transportation trends. Importantly, Canoo is also differentiating itself by moving into a different niche of the EV market. Right as it started trading, the company revealed plans for a last-mile delivery vehicle. The multi-purpose delivery vehicle (MPDV) has the same futuristic look. It also promises to maximize cargo capacity while reducing costs for customers. So, where is the growth for GOEV stock? According its own executives, the MPDV taps huge EV potential with its focus on both last-mile delivery fleets and independent contractors. Plus, as competition in the passenger EV space heats up, the MPDV allows Canoo to soar on its own terms. Right now, the company needs to bring these vehicles to life and ultimately prove what it is capable of. If it can do that, GOEV stock could soon hit the consensus $30 price target, which implies more than 70% upside. The 7 Best Stocks To Buy In The Dow Jones Today There is also one more path for growth here. Earlier this month, we learned that Apple (NASDAQ:AAPL) was in talks with Canoo, either to acquire it or make an investment. Those talks fell apart, but they represent serious potential. Building on that interest and attracting new big-name partners would be a game-changer for GOEV stock this year. Momentus (SRAC) Source: Alones / Shutterstock.com One of the most interesting themes to watch in 2021 may just be space. That’s because Ark Invest just announced a new exchange-traded fund (ETF) focused on all things space — and investors are paying close attention. Soon to trade under the ticker ARKX, the fund promises to bring the up-and-coming space economy to the mainstream. According to Luke Lango, we are embarking on a new age that will see companies commercialize space like never before. As they do so, this space economy will grow to nearly $2 trillion in 2040, up 400% from today. Backing from Ark and its founder Cathie Wood, as well as analysts like Adam Jonas from Morgan Stanley, guarantees that this innovative sector will continue to heat up. Right now, investors can access pure plays like Virgin Galactic (NYSE:SPCE) and Maxar Technologies (NYSE:MAXR). However, there is one lesser-known play that stands out as a stock to buy. That company is Momentus, which is currently trading through Stable Road Acquisition under the ticker SRAC. Momentus says it is the first company offering the infrastructure that will allow humans to flourish in space. These infrastructure services include last-mile satellite and cargo delivery, payload hosting and in-orbit servicing. In other words, Momentus wants to make space missions as easy as possible. Through a satellite-as-a-service business model, or what some call a space tow truck service, SRAC stock promises to capitalize on the growing space economy and be one of the best stocks to buy in 2021. Plus, it looks like an awfully good fit for that ARKX ETF. On the date of publication, Sarah Smith did not have (either directly or indirectly) any positions in the securities mentioned in this article. Sarah Smith is a Web Content Producer for InvestorPlace.com. More From InvestorPlace Why Everyone Is Investing in 5G All WRONG Top Stock Picker Reveals His Next 1,000% Winner It doesn’t matter if you have $500 in savings or $5 million. Do this now. The post 5 Stocks to Buy in 2021 for Rapid-Fire Growth appeared first on InvestorPlace.