FuboTV plans sports-betting acquisition, with goal to launch sportsbook by year end

Shares of streaming-media company FuboTV Inc. are surging 15% in Tuesday morning trading after the company announced an acquisition that it said “accelerates” its sports-betting aims.

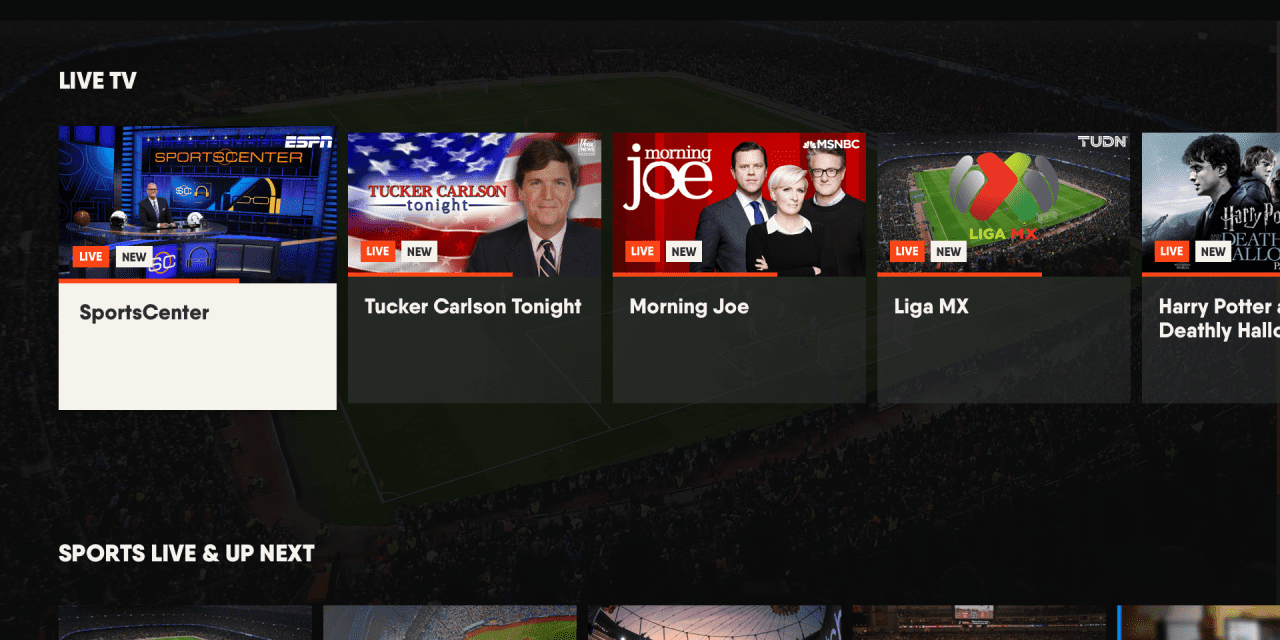

The company, which offers a streaming service that lets those without traditional cable plans watch live sports and other television programming, plans to acquire sports-wagering and interactive-gaming company Vigtory for an undisclosed amount. Fubo FUBO,

Fubo “intends to leverage Vigtory’s sportsbook platform and digital gaming assets, and its consumer-driven betting technology, to develop a frictionless betting experience for fubo’s customers,” the company said in a release. “Vigtory has been in discussions for market access agreements in the eastern part of the United States and currently has a deal secured in Iowa through Casino Queen.”

Fubo initially plans to launch free-to-play gaming over the summer with eventual plans to introduce a sportsbook that will let customers place bets and redeem their winnings. The company intends to integrate this betting product into its streaming TV service, which it says will create “a seamless viewing and wagering experience.”

Wedbush analyst Michael Pachter wrote in a note to clients that sports betting “adds yet another layer of customer monetization beyond premium subscription plans and highly valuable advertising inventory” and could help with subscriber growth. Still, he argued that it’s “not a forgone conclusion that [Fubo] will succeed in this endeavor.”

He has an outperform rating and $40 price target on the stock.

Shares of Fubo have been hot but controversial since going public in October at $10 a share. The stock was trading north of $31 Tuesday morning, though it remains considerably below a Dec. 22 high of $62.

“Fubo’s volatility has not been for the faint of heart; the level of attention given to the stock has caught us off guard, and it’s hard to recall the last time we’ve seen something move so much so fast,” Evercore ISI analyst Kevin Rippey wrote in a Jan. 6 note after Fubo reported better-than-expected preliminary subscriber metrics for its fourth quarter. “[T]he debate on Twitter rages with a few well known commentators recently rattling the Robinhood investors that we believe represented a disproportionate amount of the volume in late December.”

As of that Jan. 6 note, Rippey wrote that he could “appreciate there’s a huge range of potential outcomes” when it comes to sports betting and doesn’t include any benefit in his model “beyond a modest complement to advertising revenues.” He has an outperform rating and $32 price target on the stock.