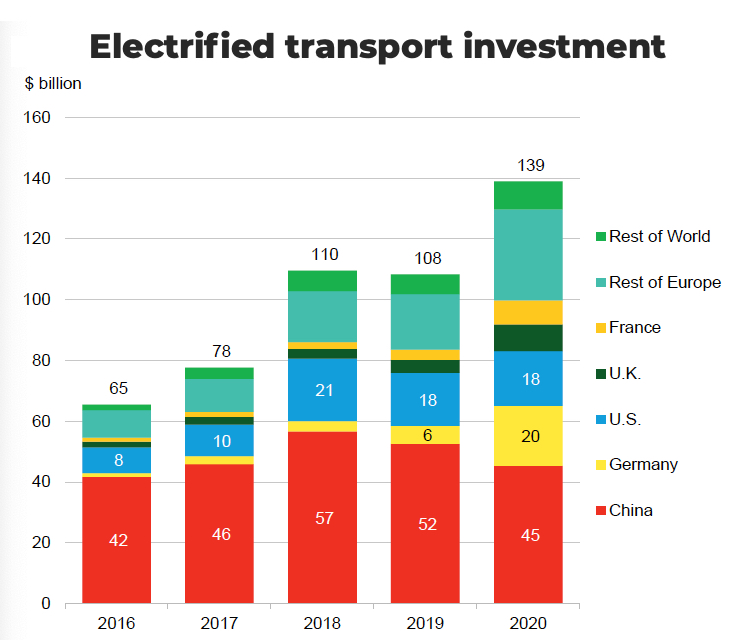

CHART: US spending less on electric cars than three years ago

BNEF found that spending in China also decreased, but the authors of the report ascribes this more to cheaper average costs of EVs, a saturated electric bus market in the country (China accounted for 99% of all e-bus sales worldwide over the last four years) and a shift away from heavy commercial electric vehicles.

The fourth and fifth largest markets are the UK and France. Europe as a whole represented 48% of global electrified transport investment in 2020, followed by China at 33%. The US represented just under 13% of total investment in 2020.

Source: BloombergNEF. Note: * ET investment includes investment in vehicles and charging infrastructure. 2020 investment numbers are based on preliminary EV sales data. Totals include estimated vehicle prices. Excludes two- and three-wheelers. Private charging investment for commercial vehicles not captured.

EV momentum to build in 2021

BNEF sees 4.4 million passenger EV sales worldwide this year with Europe likely taking the lead again.

BNEF points out that while emissions targets in the EU are staying the same in 2021, automakers are no longer able to exempt their worst 5% of vehicles from the calculations and have used up some of their banked credits.

EVs should be around 14-18% of light-duty vehicle sales on the continent in 2021, and come in around 1.9 million according to BNEF.

Chinese passenger EV sales is expected to rise to 1.7m, but North American registrations BNEF expects to come in a little over 500,000:

This is far behind Europe and China, but 2021 marks a dramatic change on the policy front in the US.

The incoming Biden administration’s appointments and statements so far show strong ambitions on EVs and charging infrastructure.