From mouse house to powerhouse.

Disney shares surged more than 13% to a record high on Friday after the company unveiled an ambitious streaming strategy. Disney now expects as many as 260 million streaming subscribers by 2024, more than double even the high end of its initial projections.

“This is a great lesson for investors that when a world-class franchise is experiencing difficulty as this company has been but then pivots, when they execute, you believe in that company, you take an investment and ultimately you will be rewarded,” Quint Tatro, president of Joule Financial, told CNBC’s “Trading Nation” on Friday.

Even though he applauded the success, Tatro said investors looking to put new money to work in the stock should wait for the right moment.

“Selling 32 times forward earnings with pretty significant debt on the balance sheet, you wait for a pullback, you don’t chase it here, but bravo to Disney and great lesson for investors to be patient and believe in these world-class franchises,” said Tatro.

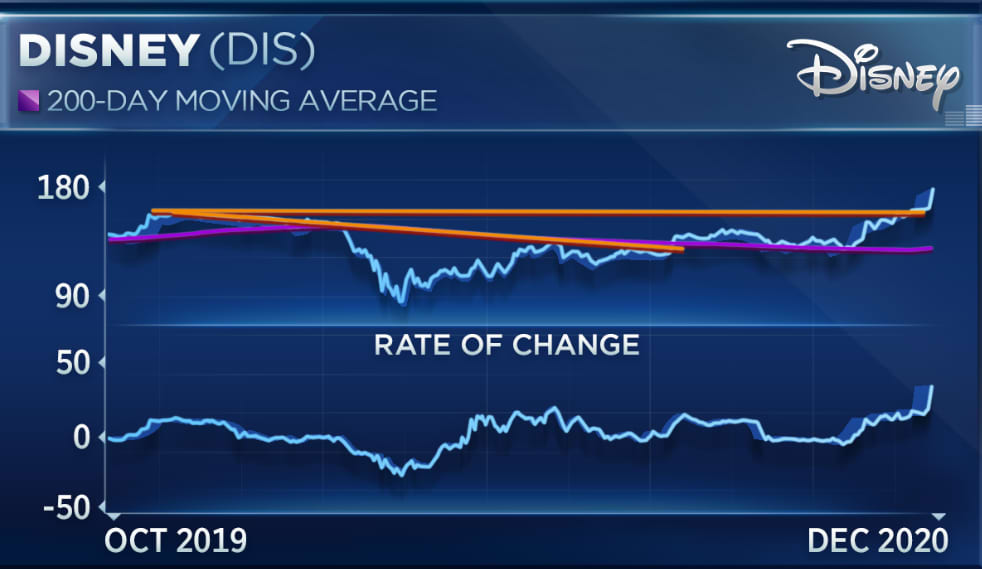

Craig Johnson, chief market technician at Piper Sandler, agreed that Disney’s stock may have run ahead of itself.

“With the stock now 45% above its 200-day moving average, highest level since about ’89, highest it’s ever been was back in about ’86, and with the biggest six-week kind of momentum move since the 1970s, I’m not chasing the stock,” Johnson said during the same “Trading Nation” segment.

Like Tatro, Johnson is on the lookout for some weakness in the shares after their record run.

“Wait for about a 14% pullback back to the breakout point toward about $150. That would be a better entry point for me but again it’s a stock that should be bought on a pullback,” Johnson said.

Disney closed Friday at $175.72 a share.

Disclosure: Joule Financial holds DIS.