Base metals get supercharged thanks to China rebound

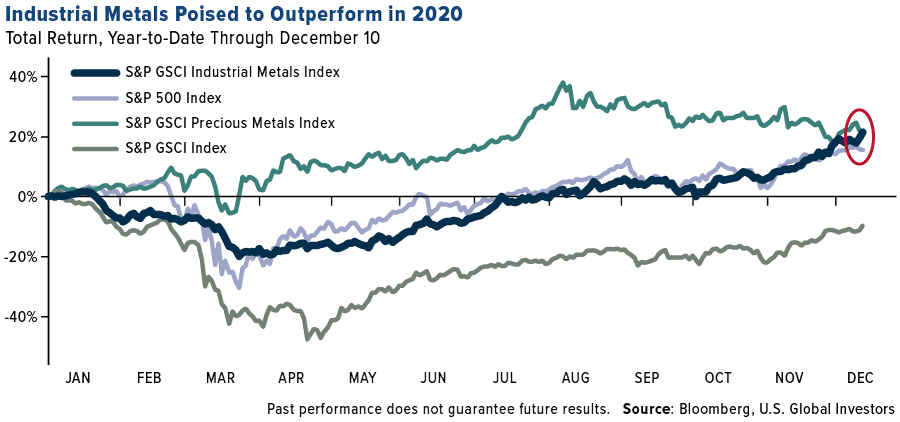

As of Friday, the MSCI Industrial Metals Index—which tracks the price of copper, nickel, aluminum and more—was up 21.4% year-to-date, just below the index of precious metals, up 21.9%. The broader S&P GSCI, which measures metals as well as agricultural and energy-related commodities, was underwater by nearly 10%.

As I’ve already discussed, copper prices have been on a tear this year thanks not only to the economic strength of China, the metal’s biggest consumer, but also because of its essential role in nascent technologies such as electric vehicles (EVs) and renewable green energy.

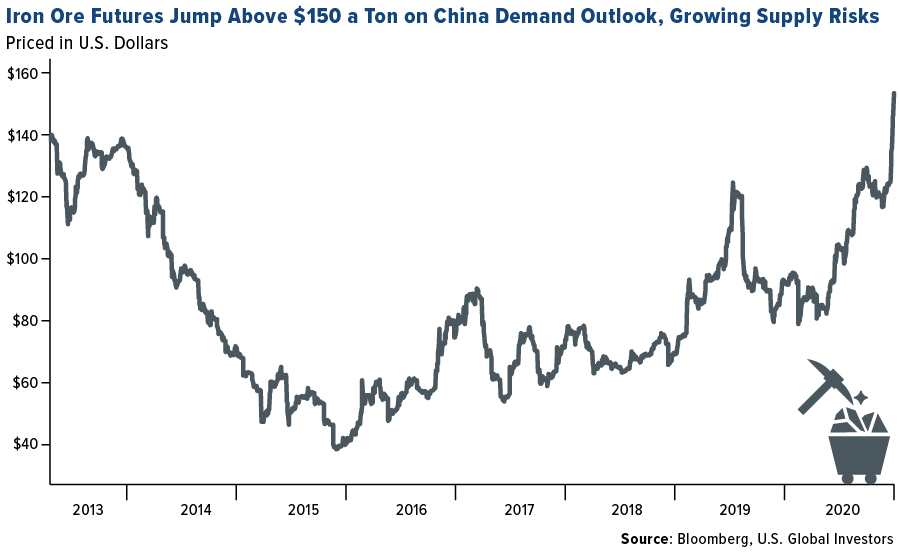

The very hottest major commodity, however, has been iron ore. Used to make steel, the metal has increased nearly 70% in 2020, with iron futures trading on the Singapore Exchange topping $155 per metric ton Friday for the first time since the contract came online in 2013.

At the very heart of this rally is rapidly strengthening factory activity around the globe. In November, a number of countries’ manufacturing sectors were in expansion mode, according to the monthly purchasing manager’s index (PMI), which is a leading indicator for demand.

But the big standout is China, the only major economy to see a robust recovery following the pullback that was triggered by the coronavirus pandemic.

The U.S., by comparison, is rebounding nicely, but it still has a long way to go before it reaches pre-pandemic levels. As of November, the number of jobs in the country was still below the February peak by nearly 10 million.

Plenty of gas in the tank

I believe the rally is only getting started, and we could see ever higher asset prices in 2021, for a couple of significant reasons.

Number one, President-elect Joe Biden plans to make infrastructure one of his top priorities soon after taking office next month. Proposals have the U.S. spending as much as $2 trillion not only to improve roads, bridges and seaports but also beef up the EV sector, add charging stations, convert school buses to zero emissions and more.

Biden’s plans could attract private investment in infrastructure, including from pension and insurance investment funds, according to Reuters. This, in turn, could prop up the base metals market.

The second big reason has to do with inflation driven by additional stimulus packages and money-printing. Last week, legendary Bridgewater Associates money manager Ray Dalio held an “Ask Me Anything” event on Reddit, during which he said that the “flood of money and credit” was unlikely to recede next year. As such, “assets will not decline when measured in the depreciating value of money,” the billionaire investor suggested.

All that money will need to go somewhere, in other words, and that includes base metals and other commodities.

Congress is currently considering a $908 billion stimulus bill that’s supported by the White House. According to Barron’s, the International Monetary Fund (IMF) chief economist Gita Gopinath is urging Congress to pass the relief package even at the risk of heating up inflation, which would be supportive of commodities.

Remember, the Federal Reserve seems no longer interested in containing inflation. In August, Fed Chair Jerome Powell unveiled a new policy approach that would allow inflation to average 2% over time, meaning price spikes month-to-month would be tolerated.