LME’s “green aluminum” plans opposed by industry

Norsk Hydro and Hindalco Industries became this week the latest to openly opposed the LME proposal.

Since then, the LME has faced increasing criticism from industry players who claim the bourse should focus on services its users need more urgently, such as a euro-denominated steel contract.

Norwegian group Norsk Hydro and India’s Hindalco Industries became this week the latest to openly opposed the LME proposal.

Hilde Merete Aasheim, chief executive of Norsk Hydro, told FT.com that a separate contract for low-carbon aluminum risked weakening standards and the LME’s own efforts to decarbonize the energy-intensive industry.

“We are a little bit afraid you will commoditize a specialised product,” Aasheim told FT.com. “There are a number of green products out there — you have to be precise about what is your [carbon] content, it’s not one standard calculation.”

Satish Pai, managing director of Hindalco Industries, said a focus on the energy used to produce aluminum could end up overshadowing other issues in the supply chain, such as the mining of bauxite.

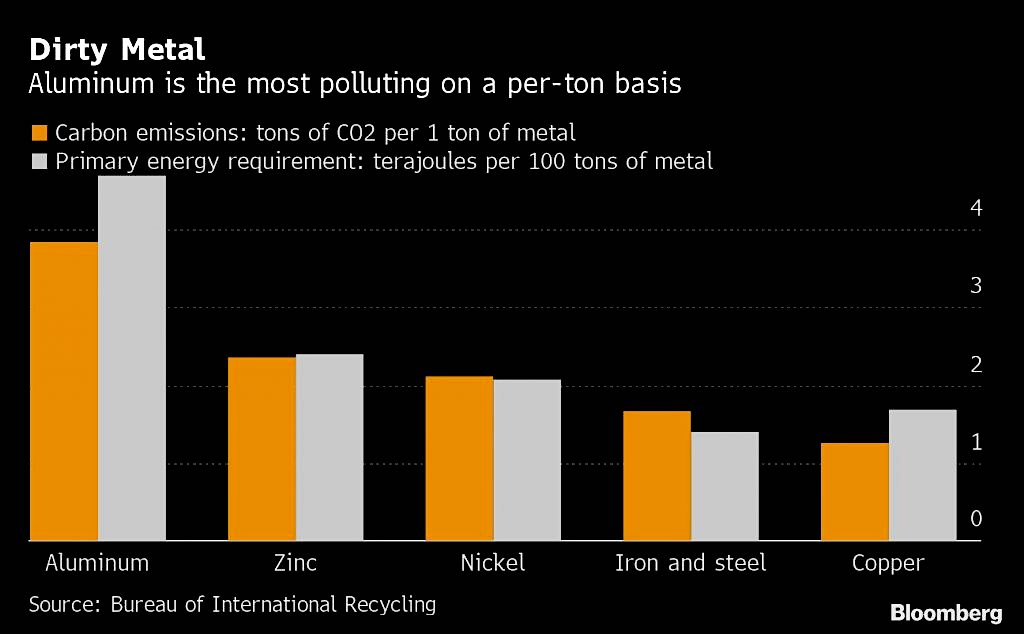

Not all metal is made equal

Aluminum is a key ingredient in the making of high-tech devices, electronics an electric cars. It is also increasingly being used as an alternative to plastics in bottles. But its production requires large amounts of electricity, as well as the mining of bauxite and the refining of alumina.

Producers that use renewable power sources have a much smaller carbon footprint. A handful of companies including United Co. Rusal, Norsk Hydro and Rio Tinto run most or all of their smelters using hydropower, which dramatically reduces the impact on the environment.

Rio has been seeking to push the advantage for years, and has supply deals with Nespresso and Apple Inc. linked to the sustainability of its metal.

According to consultancy CRU, producing one tonne of aluminum in Europe — using mostly renewable energy — generates about four tonnes of carbon-dioxide equivalent.

That compares to 15 tonnes in China, which is responsible for more than 60% the world’s supply of aluminium and uses mostly coal-fired power.