Airbnb IPO comes as competition ramps up and some see post-Covid return to hotels

Airbnb is hoping to capitalize on the growing popularity of home rentals during the coronavirus pandemic with its $3 billion initial public offering, but the sun may be setting soon. A key question is whether travelers will continue to book short-term home rentals or return to hotels as the health crisis improves.

While home rental bookings surged over the summer, some travel executives point to weakening fall and winter trends and contend there will be a return to hotels in 2021 once a vaccine is made readily available.

Tracking real-time data, BTIG analysts said Airbnb has weakened so far in the fourth quarter with absolute volume trending back toward May levels.

“There’s potential for a double dip in booking volumes here, which is probably a factor in [Airbnb’s] decision to make a move on the IPO now,” Steven Jankowski, head of growth at data analytics firm AllTheRooms, told CNBC.

Booking Holdings CEO Glenn Fogel also is seeing bookings soften for alternative accommodations. Following third-quarter earnings, released earlier this month, the largest online travel operator said home rentals made up a smaller share of bookings in the third quarter versus the second quarter.

Fogel also told CNBC that as coronavirus case counts declined over the summer, hotel bookings improved. Expedia CEO Peter Kern made similar comments on the earnings call.

While travel experts are anticipating an increase in cancellations this holiday season as Covid-19 cases rise to record levels, most are still anticipating an eventual rebound in travel sometime in 2021 once a vaccine becomes more widely available.

‘Demand is going to return’

TripAdvisor CEO Steve Kaufer said he sees a vaccine helping both home rentals and traditional hotels, particularly as travelers start visiting places that have become less popular during the pandemic.

“As the great vaccine news that’s coming out, as we and so many other companies plan for a robust travel recovery, especially in the leisure sector, we know that demand is going to return to all those wonderful places that everyone loves to go — the big cities, the tours, the activities,” Kaufer said Tuesday on CNBC’s “The Exchange.” “And, of course, there’s no shortage of amazing properties, hotels as well as rentals to stay at when you go to our wonderful big cities around the globe.”

Average hotel occupancy across the nation broke above 50% in August, according to data from STR, a global hospitality research company. Since then, hotel bookings — following a path similar to that of home rentals — have been on the decline as states reintroduce public-health restrictions and as seasonality factors kick in.

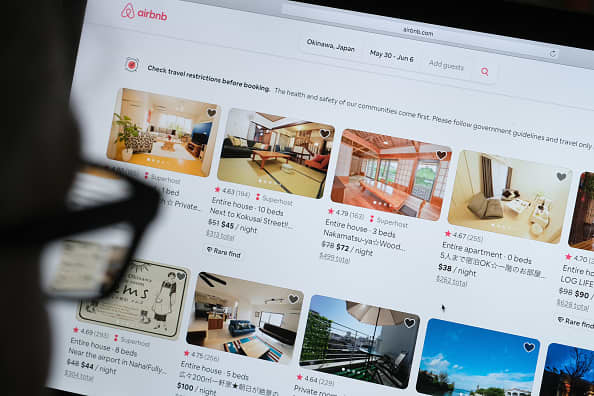

In this photo illustration, a man looks at the website of Airbnb on April 20, 2020 in Katwijk, Netherlands.

Yuriko Nakao | Getty Images News | Getty Images

While industry titans are anticipating the approval of a vaccine coinciding with an uptick in travel, Airbnb’s outperformance this year is notable. “Airbnb displayed clear strength in domestic travel, closer-to-home travel and longer duration trips,” said Jake Fuller, managing director and digital services analyst at BTIG.

In gross bookings for the first nine months of 2020, Airbnb is down 39%, Booking Holdings is down 63% and Expedia is down 65% versus the same period last year. While the comparison isn’t apples to apples because Expedia and Booking Holdings both offer flights and hotels in addition to home rentals, analysts say it does reflect the consumer pivot to vacation rentals during the last six months.

Data from AllTheRooms also shows that Airbnb beat one of its chief rivals, Expedia’s VRBO, in terms of rental nights booked in 2020.

With Airbnb going public before the end of the year, investors will be watching to see how preferences change and whether homes or hotels will be the go-to option. Despite travel CEOs expecting a return to hotels, Jankowski of AllTheRooms said he thinks travelers will continue to book home rentals for social distancing reasons.

“Going forward, Airbnb looks well positioned in that short-term rentals will probably continue to be preferred versus hotels due to the social distancing factor, even as travel hopefully rebounds in 2021 with a vaccine arriving,” Jankowski said.