Gold price: quarterly demand plummets to 11-year low

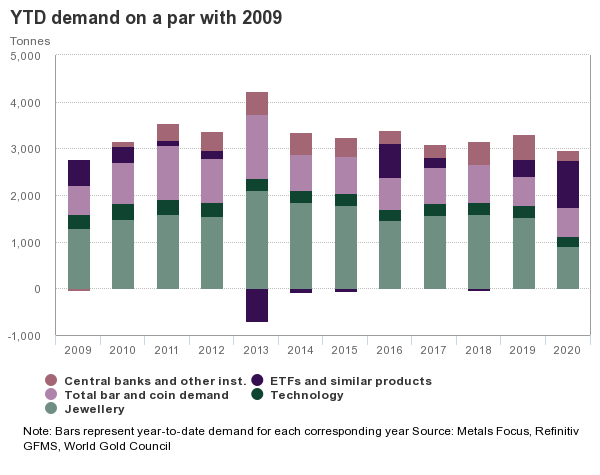

Although jewellery demand improved from the Q2 record low, the combination of continued social restrictions, economic slowdown and a strong gold price proved onerous for many jewellery buyers, says WGC. Jewellery demand of 333t was 29% below an already relatively anaemic Q3 2019.

By contrast, bar and coin demand strengthened, gaining 49% y-o-y to 222.1t. Much of the growth was in official coins, due to continued strong safe-haven demand in Western markets and Turkey, where coins are the more prevalent form of gold investment.

However, the slump in consumer demand was offset by extremely strong investment demand.

The third quarter saw continued inflows into gold-backed ETFs, although at a slower pace than in the first half. Investors globally added 272.5t to their holdings of these products, taking y-t-d flows to a record 1,003.3t.

Central banks generated small net sales of gold in Q3, the first quarter of net sales since Q4 2010. Sales were generated primarily by just two central banks – Uzbekistan and Turkey – while a handful of banks continued steady albeit small purchases.

Demand for gold used in technology remained weak in Q3, down 6% y-o-y at 76.7t. But the sector saw a decent quarterly improvement as some key markets emerged from lockdown.

The total supply of gold fell 3% y-o-y in Q3 to 1,223.6t, despite 6% growth in gold recycling, with mine production still feeling the effects of the covid-19 restrictions during the first half of the year.