Copper price forecast up on buoyant demand – report

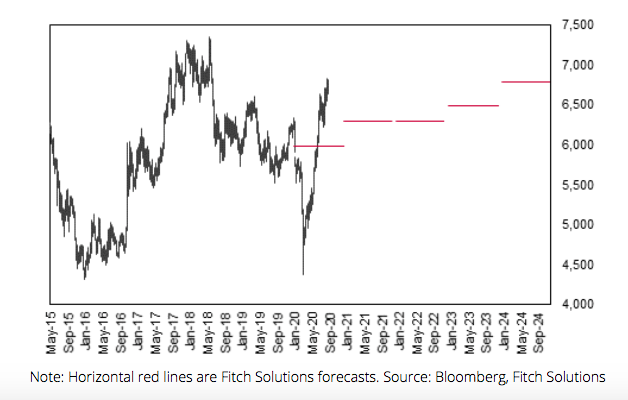

In March 2020, Fitch made a bullish forecast of $5,900/tonne for the year on the back of an expectation for a strong rebound in Chinese demand due to government stimulus. This view has played out well over the past six months, evidenced by China’s copper consumption rising by 24.1% YTD through July and copper prices soaring to near pre-trade-war levels.

Looking to the remainder of the year, Fitch expects Chinese demand to remain robust while seeing continued recovery in global economic activity. Copper prices YTD have averaged $5,790/tonne, which Fitch now forecasts will rise to an average of $6,000/tonne as demand remains buoyant.

Outlook strong as economies turn corner

Fitch also raised its average price forecast for 2021 to $6,300/tonne from $6,100/tonne. The analyst says it expects prices to come down slightly from current levels as increased mining output feeds through to higher refined output next year.

Fitch still expects to see volatility in sentiment as investors react to the latest economic indicator releases, covid-19 news and upcoming US Presidential election outcome in November 2020.

Over the long term, Fitch expects prices to remain elevated due to persistent deficits in the copper market driven by increased demand from the power, construction and autos industries.

Fitch maintains continued recovery in the global economy will also reinforce copper demand growth in 2021 as well as maintain a supportive environment for bullish sentiment in the market.

The analyst’s country risk team maintains the view that the global economic recovery will be bumpy and uneven, thus extending into 2021. As economies recover and make strides toward normal economic activity, this will reinforce copper demand growth globally, Fitch says.

An increase in upstream copper concentrate production will feed through to higher refined output, relieving upside on prices. Fitch expects concentrate production to ramp up over the coming quarter and expects significant growth in copper mine output over 2021.