Live news: CRTC should regulate Facebook, Instagram once Online News Act takes effect, minister says

The latest business news as it happens

Article content

Top headlines

Advertisement 2

Story continues below

Article content

Article content

1:10 p.m.

CRTC should regulate Facebook, Instagram once Online News Act takes effect, minister says

Heritage Minister Pascale St-Onge says Canada’s broadcasting regulator should look into regulating Meta Platforms Inc. when the Online News Act comes into effect, as users find loopholes to share news on its platforms.

Meta began blocking news on Facebook and Instagram when Parliament passed the law this summer, arguing that will put it in compliance with a bill that requires tech giants to pay up for shared media content that helps them generate revenue.

But news remains accessible on Instagram for some Canadian users when they view posts from media organizations using an internet browser on their phone or computer.

Users have also found other ways to share news stories on Facebook and Instagram, by direct messaging news links, sharing screenshots of articles and shortening news links so they can appear on stories, which are photos and videos that disappear after 24 hours.

The Online News Act compels Google and Meta to enter into compensation agreements with news publishers, and Google recently struck a $100-million deal with Ottawa following months of negotiations.

Advertisement 3

Story continues below

Article content

St-Onge says the Canadian Radio-television and Telecommunications Commission should absolutely regulate Meta, and she can’t wait to see what the regulator will do with regards to Meta once final regulations come into effect by Dec. 19.

The Canadian Press

Noon

Midday markets: U.S. stocks hang near highs on mixed data

Wall Street is hanging near its 20-month high Tuesday after a mixed set of reports kept questions alive about whether the U.S. economy can pull off a perfect landing that kills high inflation and avoids a recession.

The S&P 500 was 0.04 per cent lower at 4,567.85 and potentially heading for its first back-to-back loss since October. The Dow Jones Industrial Average was down 0.36 per cent at 36,077.45 while the Nasdaq composite rose 0.21 per cent to 14,214.70.

U.S. stocks and Treasury yields wavered after reports showed that employers advertised far fewer job openings at the end of October than expected, while growth for services businesses accelerated more last month than expected.

With inflation down from its peak two summers ago, Wall Street’s hope is that the Federal Reserve may finally be done with its market-shaking hikes to interest rates and could soon turn to cutting rates. That could help the economy avoid a recession and give a boost to all kinds of investment prices.

Article content

Advertisement 4

Story continues below

Article content

In Toronto, the S&P/TSX composite index was up 0.14 per cent at 20,437.95 as losses in base metal stocks were offset by gains in the technology and telecommunication sectors.

The Associated Press, The Canadian Press

11:24 a.m.

Financial intelligence agency hands down $7.4M penalty to Royal Bank of Canada

Canada’s financial intelligence agency has levied a $7.4-million penalty against the Royal Bank of Canada for non-compliance with anti-money laundering and terrorist financing measures.

The Financial Transactions and Reports Analysis Centre of Canada says the violations include failing to submit suspicious transaction reports where there were reasonable grounds to suspect ties to a money laundering offence.

The agency, known as Fintrac, tries to pinpoint money linked to illicit activities by electronically sifting millions of pieces of information each year from banks, insurance companies, money services businesses and others.

It then discloses intelligence to police and other law-enforcement agencies about the suspected cases.

Fintrac director Sarah Paquet said in a recent speech that the agency’s priority is to work with businesses to help them comply with their reporting obligations.

Advertisement 5

Story continues below

Article content

But she clearly flagged that some were falling behind and that Fintrac would take appropriate action when needed.

The Canadian Press

10:01 a.m.

Markets open: Stocks lose some steam

Wall Street is sagging again Tuesday as a big rally that sent it to a 20-month high loses some steam.

On Wall Street, the S&P 500 was down 0.06 per cent at 4,567.21. The Dow Jones Industrial Average was down 0.40 per cent at 36,058.58 while the Nasdaq was up 0.31 per cent at 14,229.40.

In Toronto, the S&P/TSX composite index was down 0.02 per cent at 20,404.55.

December’s loss of momentum comes after stocks charged higher through November on hopes the United States Federal Reserve may finally be done with its market-shaking hikes to interest rates and can soon turn to cutting rates, which could help keep the economy out of a recession and juice prices for all kinds of investments.

A spate of recent data inflated hopes on Wall Street that the economy is slowing from its recently hot pace by just the right amount.

Data on jobs openings coming out today and December unemployment numbers scheduled for release on Friday will give investors a fresher view of the U.S. employment picture. The hope is that the jobs market can cool more through employers cutting back on open positions than on employers laying off lots of workers.

Advertisement 6

Story continues below

Article content

The Associated Press

9:05 a.m.

AltaGas raises dividend on strong outlook

AltaGas Ltd. is raising its dividend as it says it expects its earnings to grow next year, helped by its core operations.

The energy infrastructure company said it will pay a quarterly dividend of 29.75 cents per share starting with its March payment to shareholders, up from 28 cents per share.

In its outlook, AltaGas said it expects its normalized earnings per share for 2024 to total between $2.05 and $2.25.

The result would mean year-over-year growth of about 10 per cent, based on the midpoint of its guidance for both years.

The company said its capital spending plan for 2024 is expected to be $1.2 billion, excluding asset retirement obligations.

AltaGas shares closed down 39 cents at $27.33 on the Toronto Stock Exchange on Monday.

The Canadian Press

7:30 a.m.

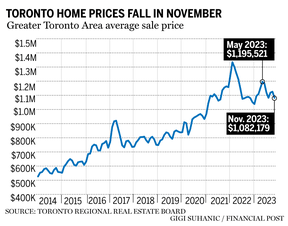

Toronto home prices slide again as high interest rates weigh

Toronto home prices fell for a fourth straight month as buyers were squeezed by interest rates stuck at multi-decade highs.

The benchmark price for a home in Canada’s largest city fell 1.7 per cent in November from the previous month to $1.11 million, according to seasonally adjusted data released Dec. 5 by the Toronto Regional Real Estate Board. That brings the total decline in Toronto home prices since July to 4.8 per cent, the data show.

Advertisement 7

Story continues below

Article content

The Bank of Canada has held its benchmark interest rate at five per cent, the highest level since 2001, since July as it seeks to bring inflation back to its target level. That’s weighed on the country’s housing market, forcing out some buyers and limiting what others can afford. High borrowing costs have also put financial strain on mortgage holders coming up for renewal or individuals with floating-rate loans.

While Bank of Canada governor Tiff Macklem said last month that current rates may be high enough to tame inflation, most economists predict he won’t begin cutting them until the middle of next year. The central bank unveils its last rate decision of the year on Dec. 6.

“Home prices have adjusted from their peak in response to higher borrowing costs,” said Jason Mercer, the Toronto real estate board’s chief market analyst. “As mortgage rates trend lower next year and the population continues to grow at a record pace, expect demand to increase relative to supply. This will eventually lead to renewed growth in home prices.”

Ari Altstedter, Bloomberg

More: Toronto home prices fall in November but relief seen on the horizon

Advertisement 8

Story continues below

Article content

Stock markets before the opening bell

United States equity contracts slid as traders pushed back on optimistic scenarios that central bankers will cut interest rates in time to avert recession.

Futures signalled another day of declines for the S&P 500, after the benchmark rose last week to its highest since March 2022 on bets the U.S. Federal Reserve would soon pivot to monetary easing. Treasury yields were steady near 4.2 per cent.

The S&P/TSX composite index closed down 42.66 points at 20,410.21 on Monday.

Bloomberg

What to watch today

Shopify Inc. will host an investor day for financial analysts and institutional investors in New York.

Kim Adair, Nova Scotia’s auditor general, will release her 2023 financial report.

The Institute for Peace & Diplomacy (IPD) and the Canada West Foundation (CWF) co-host the third annual Indo-Pacific Strategy Forum (IPSF 2023) in Ottawa.

The Scotiabank Global Technology Conference takes place in San Francisco.

Patrick Doyle, executive chairman at Restaurant Brands International Inc., will participate at a Morgan Stanley Global Consumer and Retail Conference in Toronto.

Advertisement 9

Story continues below

Article content

Madhu Ranganathan, executive vice president and chief financial officer at Open Text Corp., will participate in a fireside chat at the Nasdaq Investor Conference in London, United Kingdom.

The Canadian S&P Global Services PMI for November will be released at 8:30 a.m. ET.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content

Comments