Silver is at a 2-year low, but it’s not gold that will determine what happens next, this analyst says

A tie can feel like a loss if you were in line for a victory. Conversely the draw can be celebrated if you were facing defeat.

After a number of sessions when early gains evaporated, traders will be relieved that Thursday saw an initial sharp decline cancelled and the S&P 500 SPX,

On such reversals are sustainable rallies potentially made, though there’s still a long way to go with the index down 17.3% for the year.

Silver bugs are having an even tougher time. The grey metal SI00,

So, what should investors do now if they are considering making a bet on the infamously volatile sector.

“Don’t pay attention to gold, pay attention to copper HG00,

The reason for this is that unlike its precious metal peer gold, silver has extensive industrial uses, with up to 50% of supply used in areas like electronics and solar products. Fear of a global economic slowdown is thus hurting silver in addition to pressures from higher borrowing costs and a surging dollar that traditionally batter bullion, Hansen notes.

So, while gold is off about 6% this year, silver’s decline of 23% is similar to the 21% drop for copper, widely accepted as the industrial metal benchmark.

“Silver has not only been challenged by the weakness mentioned in gold but also, and more importantly, by China [economic] weakness related selling across industrial metals, especially copper.” Says Hansen.

However, he spies signs that the market may be oversold. “The rout in silver and copper, as well as zinc and aluminum, two metals that recently found support from smelters reducing capacity due to high energy costs, has by now reached the capitulation stage with silver having entered a previous consolidation range between $16.50 and 18.50.”

Should evidence emerge that inflation concerns are fading, causing the dollar to pull back and reducing fears that higher interest rates will curb growth, then the futures market may quickly find itself wrongfooted.

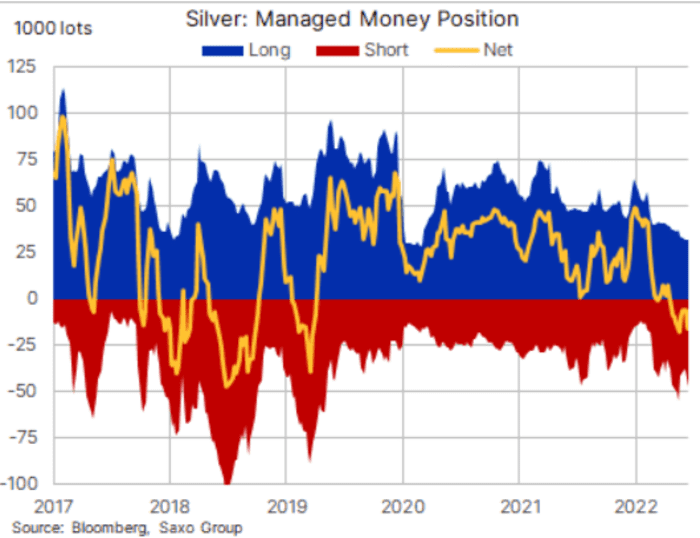

“Speculators, already hold net short positions in both metals, and it would require a change in the technical and/or fundamental outlook to turn those short positions into a tailwind through short covering,” says Hansen.

Should such a trend occur it would help silver recover some poise relative to its bullion peer.

“The gold-silver ratio, last at 96 (ounces of silver per ounce of gold) has retraced more than 50% of the 2020 to 2021 collapse from 127 to 62 with the next level of resistance around 102.5, a potential further 6% underperformance relative to gold, while a break back below 94 would be the first signal of strength starting to come back,” says Hansen.

Markets

It’s jobs Friday again and it certainly feels like Wall Street would rather see a soft nonfarm payrolls report than a strong one. That way the Fed may decide to be a bit more gentle in raising borrowing costs, is the reasoning.

In the event, a net 315,000 positions were created in August, down from 528,000 in July and only a few thousand lower than the 318,000 forecast by economists. The unemployment rate rose from 3.5% to 3.7% and earnings increased 0.3% over the month, lower than July’s 0.5%.

The initial reaction indeed was to consider the report showed a cooling labor market and this boosted equities, with S&P 500 futures ES00,

The buzz

Traders are keeping a wary eye on the dollar DXY,

Russia said it would stop selling oil to countries seeking to impose a price cap on crude. Brent BRN00,

Popular fund manager Cathie Wood has bought more Nvidia NVDA,

Lululemon shares LULU,

Shares in Starbucks SBUX,

Bond markets have entered their first bear market in at least 30 years.

Best of the web

How Dan White turned the UFC into a $4 billion titan

Tech companies are slowly shifting production from China

Dan Niles is bearish and ready to dump Apple

Michael Burry of ‘The Big Short’ fame sees ‘mother of all crashes’.

The chart

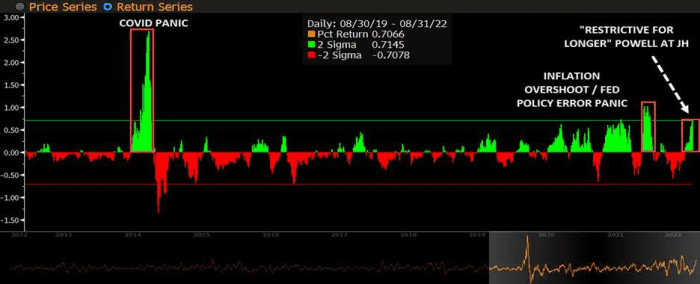

During the great financial crisis and the COVID-19 meltdown the Fed was keen to be seen supporting markets because it believes in the wealth effect. Simply put, this is the idea that when households feel richer because of rising asset values — such as stock or house prices — they will spend more and support the economy.

The problem is this means in order to slow the economy and curb inflation the Fed believes it must stop and even reverse the wealth effect. The chart below from Nomura shows how U.S. financial conditions have indeed experienced some “impulse tightening” again as both stocks and bonds have fallen. Unfortunately for bulls, the Fed will want to see this sustained for some time.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

Gamestop |

| BBBY, |

Bed Bath & Beyond |

| AMC, |

AMC Entertainment |

| APE, |

AMC Entertainment preferred |

| NVDA, |

Nvidia |

| AAPL, |

Apple |

| NIO, |

NIO |

| AVCT, |

American Virtual Cloud Technologies |

| BIAF, |

bioAffinity Technologies |

Random reads

Passenger blimps making a comeback

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.