Here’s what Morgan Stanley says will fuel another decline in stocks

Morgan Stanley’s been widely credited, at least among the major Wall Street banks, for correctly predicting the rough ride that stocks would endure this year.

Morgan Stanley strategist Mike Wilson says there’s more pain in store, but for a different reason.

What’s hit U.S. stocks so much this year– the S&P 500 SPX,

“With the Fed emphatically dashing hopes for a dovish pivot, we think that asset markets may be entering fire and ice part deux. In contrast with part one, this time the decline in stocks will come mostly via a higher [equity risk premium] and lower earnings rather than higher rates,” says Wilson.

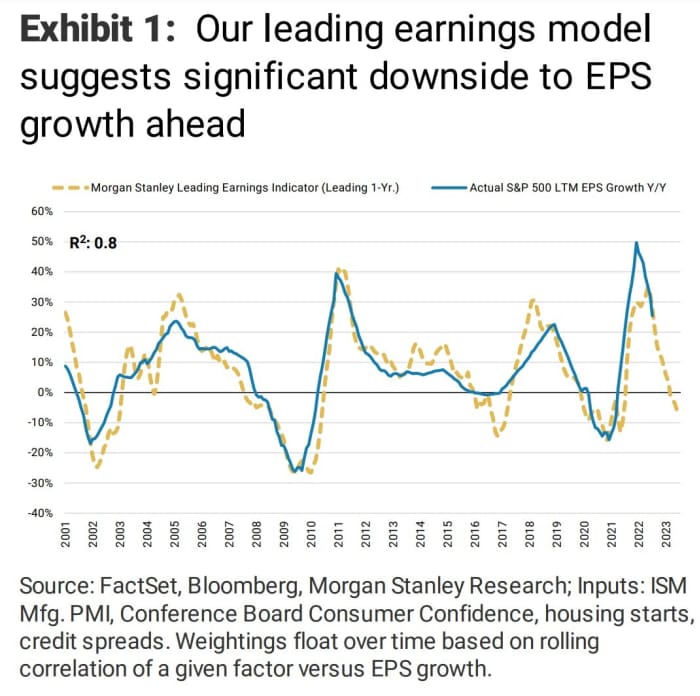

Morgan Stanley says its earnings model, based on inputs including the ISM manufacturing report, the Conference Board’s consumer confidence index, housing starts and credit spreads, suggests a big drop in earnings to come. Another model, based mostly on regional Fed data, also is forecasting an earnings slump.

The equity risk premium is the return that investing in the stock market provides over a risk-free rate.

Wilson says the firm is more confident, however, that bonds have bottomed. The yield on the 10-year Treasury TMUBMUSD10Y,

“If Friday marked a short-term low for long-duration bonds (high in yields), the S&P 500 and many stocks could get some relief again as rates come down prior to the next round of earnings cuts. However, make no mistake, as the weather turns chilly this fall, so will growth, which will weigh mightily on stocks given the paltry ERP investors are getting paid to take this risk,” he said.

The U.S. stock market is closed Monday in observance of Labor Day. European stocks declined sharply after a key gas pipeline was shut.