ESG, geopolitics ranked top risks for mining companies, EY survey shows

“These external factors combined with inflation will continue to shift the sector’s risks and opportunities as pressure form stakeholders and capital markets hold leaders accountable on multiple fronts. Companies that can demonstrate their ability to future-proof their business models to better deal with disruption and changing commercial relationships will ultimately gain a competitive advantage.”

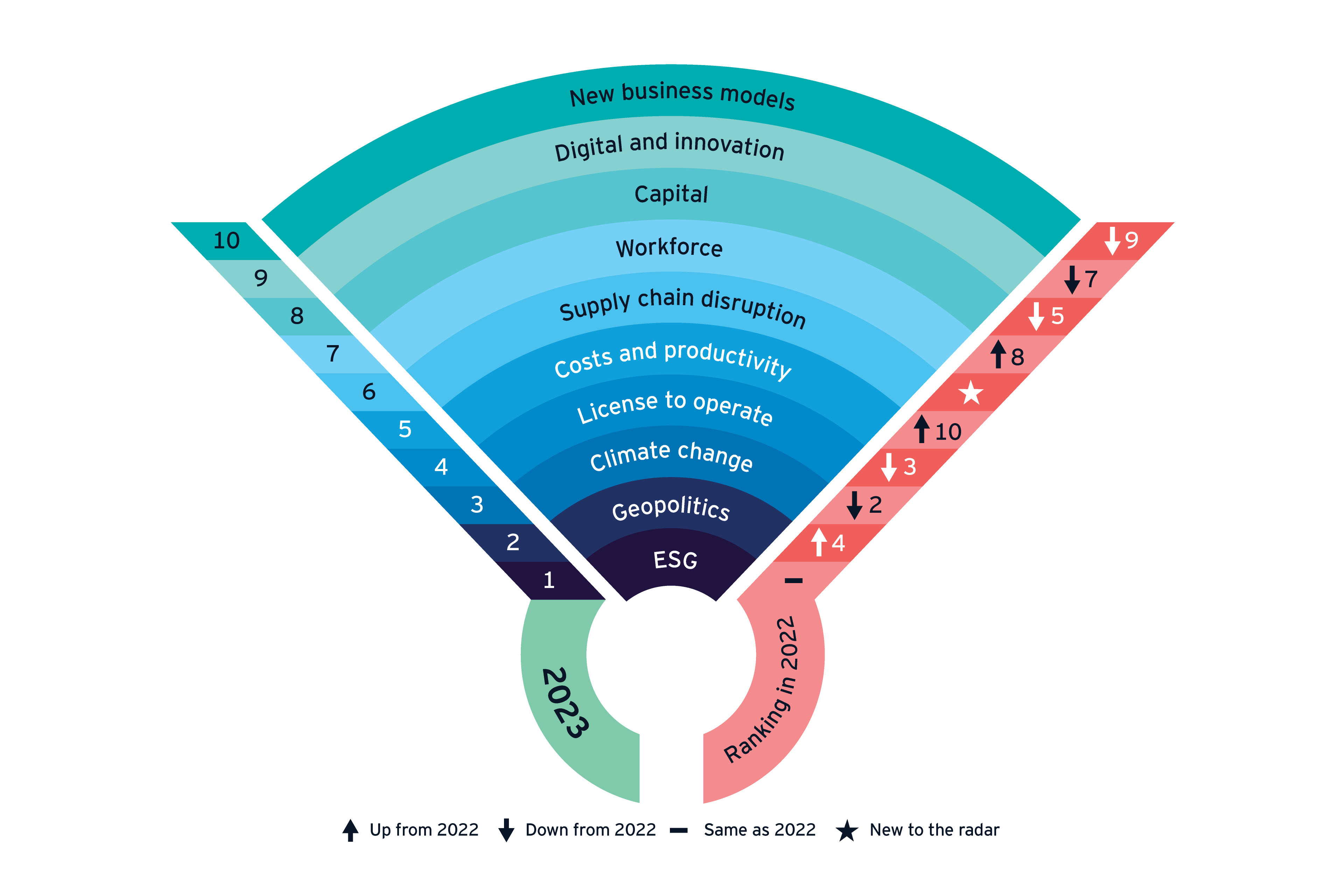

While evidence has shown that mining and metals companies are integrating ESG factors into corporate strategies, decision-making and reporting, survey respondents continued to rank ESG issues as the number one risk to their business, with climate change following closely behind in the third position (see below).

“Net zero is still a focus, but mining and metals companies are also mitigating broader transition and physical risks,” says Yameogo. “Companies must play a role in enabling a just transition — achieving decarbonization targets while considering the long-term impact of mine closures on workers and communities.”

Respondents ranked geopolitics as the second business risk — up from fourth last year, with 72% identifying resource nationalism as the top geopolitical factor likely to impact their operations as governments seek to fill revenue gaps after spending throughout the pandemic and capitalize on higher commodity prices through new or increased mining royalties.

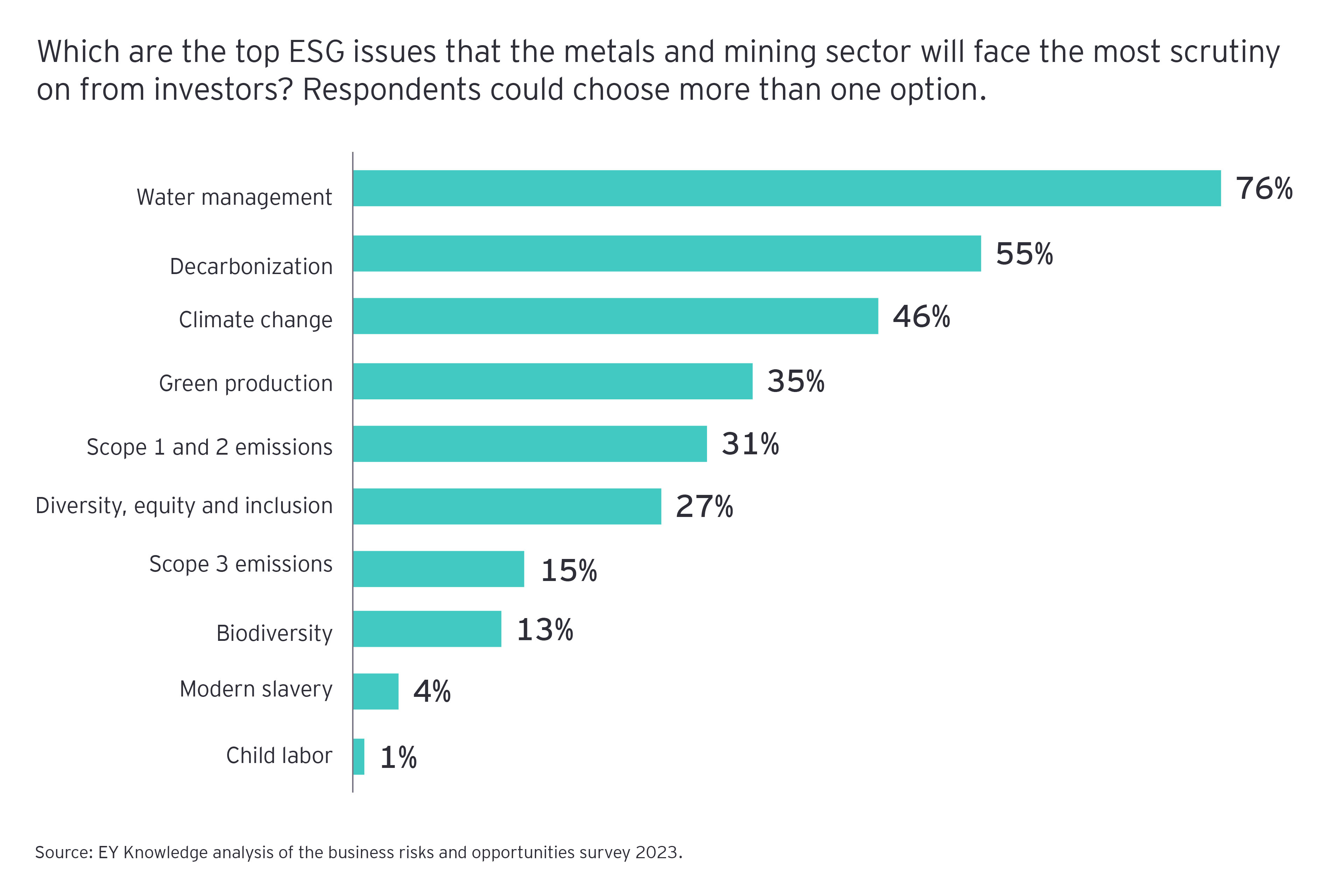

Respondents also listed water stewardship (76%), decarbonization (55%) and green production (35%) as the top issues they expect will face the most scrutiny from investors (see below).

Various external and societal factors such as the impact of Covid-19, the war in Ukraine and rising energy prices have magnified the challenges that have been looming for some time. In response, respondents say they are seeking to improve end-to-end supply chain visibility, leverage technology to improve operations and performance, and be more strategic when analyzing new technologies and supplier portfolios.

“Major disruption and rapidly changing expectations, together, may impact the ability for mining and metals companies to build sustainable value,” Yameogo adds. “Risk mitigation and maximizing opportunity requires companies to make significant changes to their business through a proactive, diversified approach that’s integrated into strategy and broader planning.”

Read the report for more insight into the top risks and opportunities for mining and metals companies.