Montreal sees ‘shift in market dynamics’ as home sales and prices slip

Sales down 18% from last year

Article content

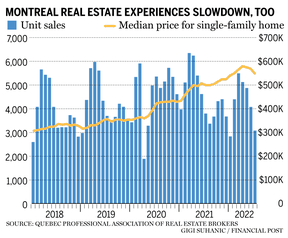

Montreal’s real estate market saw its slowdown intensify in July, joining other Canadian housing markets showing weakness in the latest data as interest rate hikes weigh on demand.

Article content

The median price of a single-family home in Montreal in July was $550,000, down $30,000 from the April peak, according to data from the Quebec Professional Association of Real Estate Brokers. Prices, however, are still 10 per cent higher than last year at this time.

Condominiums, often seen as a more affordable housing market entry point, saw their first price drop this year to a median of $391,500, though that is still nine per cent higher than last year.

The number of homes changing hands also slumped, with sales dropping 18 per cent from the year before to a total of 3,080 during July. The board added that as interest rate hikes continue, the market slowdown is “showing signs of intensifying.”

“Following on from what was recorded in June, the shift in market dynamics is clearly confirmed,” said Charles Brant, the director of QPAREB’s market analysis department, in a press release accompanying the data. “The magnitude of the interest rate hike, in just four months, has accelerated the market’s slowdown, albeit much more gradually than in other major Canadian cities.”

Article content

“While it is true that the summer season is usually quieter, we are seeing a marked deceleration of July’s sales pace while, simultaneously, active listings continue to reflect a decidedly upward trend…” Brant continued.

Active listings in the city rose for the sixth consecutive month to 12,668, 28 per cent higher than in July 2021.

Montreal joins other major Canadian cities like Calgary, Vancouver, and Toronto in seeing the pace of sales slow precipitously on rising rates and fears of a recession on the horizon. Supersized rate hikes, such as the full percentage increase in July, could put further strain on these markets.

-

Toronto home prices slip further as sales plunge 47% from last year

-

Vancouver home sales tumble, Calgary’s slide as rising rates and uncertainty take toll

-

Prices are falling but rents are rising in Canada’s paradoxical housing market

Article content

On the other hand, Quebec City’s housing market remained strong, with sales rising one per cent over last year. The Quebec brokers association said this was the second straight month of gains, but warned there are signs this market too is slowing.

“Even if this increase will have to be confirmed in August and September before we can talk about it being a trend, it is a precursor to a market slowdown and much weaker price growth or their stabilization over the next few months, which is consistent with the context of the sharp rise in interest rates that we have been experiencing since the beginning of spring,” said Brant.

• Email: shughes@postmedia.com | Twitter: StephHughes95