What if the markets are misreading the Fed

Stocks surged after last week’s Federal Reserve meeting as some experts argued that the central bank effectively “pivoted” its tone from being uber hawkish about monetary policy to being a bit dovish.

If this interpretation is true, then this could be very bullish as there may be a more clear end in sight for the Fed-sponsored market beatings.

The unfortunate irony, however, is that a market rally reflects easing financial conditions during a time when the Fed is actively trying to tighten financial conditions in its effort to bring inflation down.

In other words, we’re in a period where it’s the markets versus the Fed. And in this battle, there are no winners. A market rally risks stimulating economic growth and fanning inflation, which is bad. On the other hand, an effective Fed means financial market and economic deterioration, which is also bad. It’s a hell of an economic quandary where good news is bad news.

“The fact that the Fed hiked 75 basis points and financial conditions have eased is a problem,” Neil Dutta, head of U.S. economics at Renaissance Macro Research, wrote in an email on Wednesday. “Looser financial conditions make the Fed’s objectives more difficult to achieve. Pricing in cuts after you have hiked undoes the efficacy of hikes in the first place.“

The market’s current enthusiasm for something that may come months from now is the exact opposite of what the Fed needs right now, and it may force the central bank to react aggressively.

“If financial markets get over their skis and start pricing in a rapid move towards less hawkish policy, the FOMC may feel a need to ramp up the pressure once again or at least hold off less,” Bespoke Investment Group analysts wrote on Wednesday.

With that in mind, let’s take a closer look at the events of the past week.

The Fed still sounds pretty hawkish ?

At the conclusion of its monetary policy meeting on Wednesday, the Fed acknowledged what we’ve been discussing about the economy in its policy statement:

“Recent indicators of spending and production have softened. Nonetheless, job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures…“

So big parts of the economy are slowing, but inflation is still a problem. And because the labor market continues to be hot, the Fed has room to be more aggressive with monetary policy as it fights inflation. Therefore, the Fed hiked short-term interest rates by another 75 basis points.

During the post-meeting press conference, Fed Chair Jerome Powell reiterated the central bank’s “unconditional” commitment to bring inflation down — even if it means some serious economic pain. From the press conference (emphasis added):

“We are highly attentive to inflation risks and determined to take the measures necessary to return inflation to our 2% longer-run goal. This process is likely to involve a period of below trend economic growth and some softening in labor market conditions, but such outcomes are likely necessary to restore price stability and to set the stage for achieving maximum employment and stable prices over the longer-run.”

Indeed, Thursday’s disappointing Q2 GDP report confirmed the Fed’s effort to slow the economy is working.

Unfortunately, we have yet to get “clear and convincing” evidence that inflation is actually coming down.

Inflation is still bad ?

Some measures of inflation continue to get hotter. Other measures are cooling but continue to be troublingly high.

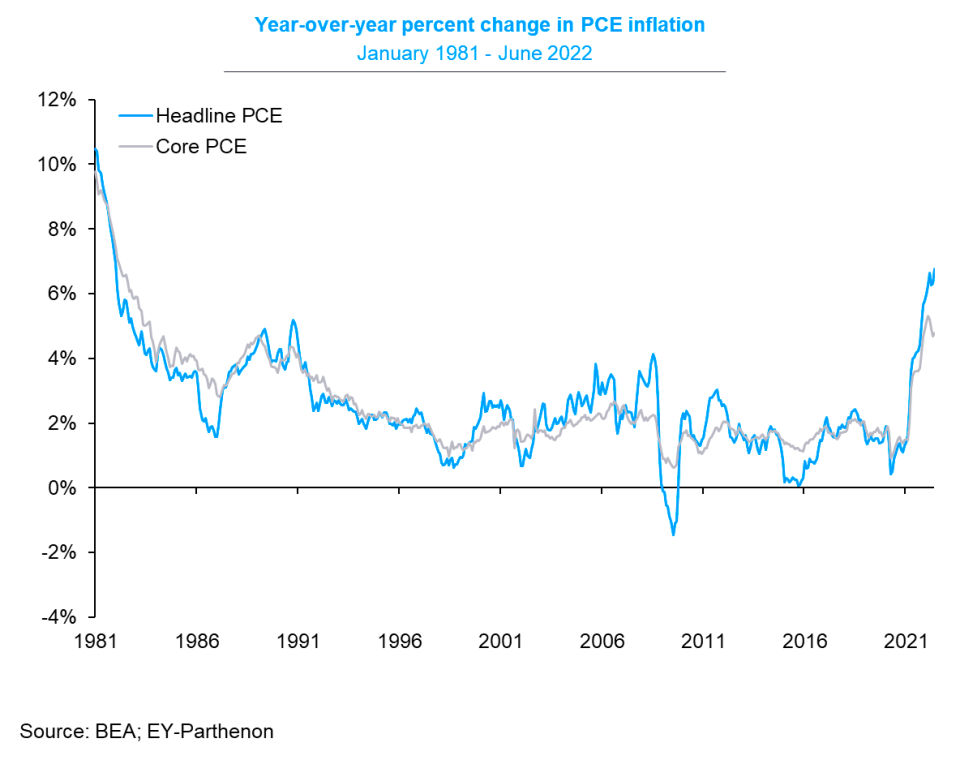

The core PCE price index — the Fed’s preferred measure of inflation — climbed 4.8% in June from a year ago, which was a bit hotter than the 4.7% print in May. Though it’s also down from the 5.3% peak rate in February.

When you include food and energy prices, which tend to be very volatile in the short term, the headline PCE price index jumped 6.8% from a year ago. This was the highest print since March 1982.

“Over coming months, we will be looking for compelling evidence that inflation is moving down, consistent with inflation returning to 2%,” Fed Chair Powell said on Wednesday.

Friday’s PCE price index report reflects anything but “compelling evidence.”

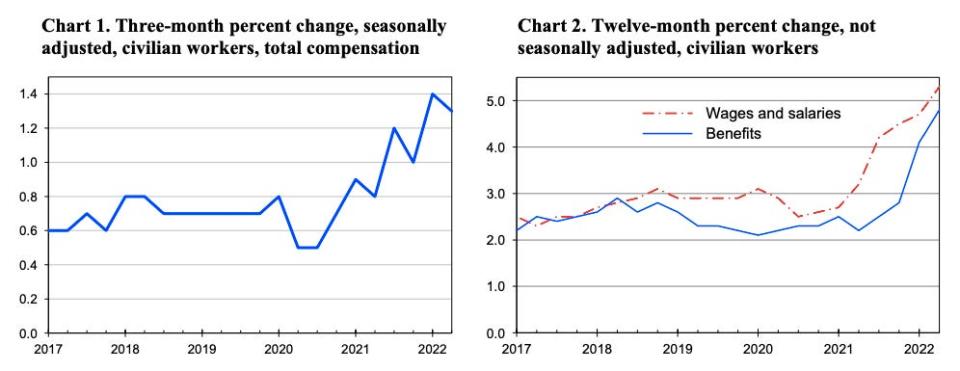

Similarly, wage growth data released Friday confirmed that inflationary pressures are pervasive.

The employment cost index (ECI) increased by 1.3% during the three months ending in June, which was hotter than the 1.2% expected by economists. This reflects a 5.1% jump from a year ago, the largest annual increase in at least 20 years.

Sure, workers will enjoy wage growth. However, wage growth has given businesses the ability to pass rising costs off unto their customers in the form of price increases.

Indeed, according to BEA data released Friday, personal spending increased by a better-than-expected 1.1% in June. This was largely driven by inflation. Adjusted for inflation, spending rose by 0.1%.

The key takeaway here is that, high wage growth is contributing to high inflation. And the Fed has explicitly said it was targeting wage growth as it works to bring inflation down.

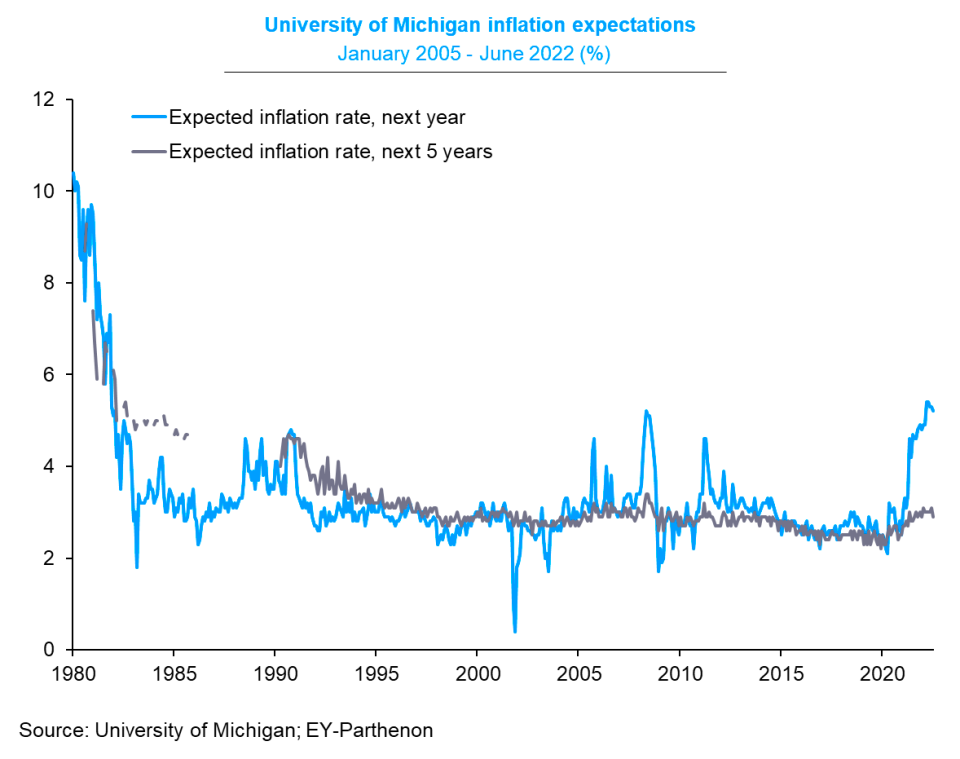

To top off all of this inflation talk, it’s not great that consumers continue to expect high inflation to persist.

According to the University of Michigan’s July Survey of Consumer Sentiment report released Friday, consumers expect the inflation rate to be a very high 5.2% a year from now.

Because consumers continue to be concerned about inflation, measures of sentiment derived from University of Michigan and Conference Board surveys continue to be in the dumps

The so-called dovish pivot was ambiguous at best ?

The Fed’s monetary policy statement and press conference on Wednesday came with a lot of typically vague language that some folks decided was dovish. Here’s a quote that’s been cited as sounding dovish:

“We will continue to make our decisions meeting by meeting and communicate our thinking as clearly as possible. As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.”

I’m pretty sure it’s always been understood that the Fed would eventually ease up on its tightening of monetary policy. The outstanding question has been, “When?” Powell didn’t provide that answer, so it’s arguably odd to think this represented a dovish pivot.

“The market may be interpreting Powell’s ‘meeting-to-meeting attitude’ as a sign that a peak in rate is near,” Roberto Perli, head of global policy research at Piper Sandler, said on Wednesday. “That interpretation is wrong. He didn’t decline to give forward guidance [because] he thinks they are nearly done but [because] he genuinely doesn’t know.“

Here’s another quote that some argued was dovish:

“We’ll be looking at the incoming data as I mentioned, and that’ll start with economic activity. Are we seeing the slowdown that we— the slowdown in economic activity that we think we need? And there’s some evidence that we are at this time.”

Okay, so he’s acknowledged that the economy is moving in the direction needed to slow inflation. But there’s no clear signal here if he thinks we’re any closer to the end of the tightening cycle.

“Markets seem to have taken relief from Fed Chair Powell acknowledging ‘some evidence’ of a ‘necessary’ slowdown and that the pace of hikes will eventually slow,” Jean Boivin, head of BlackRock Investment Institute, said on Wednesday. “I think a dovish pivot will come eventually but today was NOT it.”

In a series of tweets, Boivin listed an array of statements and signals from Powell that confirmed the Fed’s firmly hawkish stance.

Perhaps the most clear signal that the Fed continues to embrace a hawkish slant was Powell saying “another unusually large [rate] increase could be appropriate at our next meeting.”

“We think market optimism about a dovish Fed pivot is premature,“ Michael Gapen, chief U.S. economist at Bank of America, wrote on Friday.

And if it is true that the market’s have it wrong, then the Fed will probably have to come through with a more clear message.

“I suspect that the Fed will be unhappy with the new market pricing and the implied easing of financial conditions, and we will see speakers push a hawkish story in coming days,” Tim Duy, chief U.S. economist at SGH Macro Advisors, wrote in a research note Wednesday.

Why markets are so quick to judge ?

The market rally that followed the Fed’s meeting on Wednesday was very robust. The S&P 500 surged 2.6% that day. It climbed another 1.2% on Thursday, and jumped another 1.4% on Friday.

What’s going on in investors’ minds to get them to be so bullish on some vague statements from the Fed?

I think Nicholas Colas, co-founder of DataTrek Research, really nailed it. From his note on Thursday (emphasis added):

“After a very difficult year-to-date, U.S. equity markets desperately want to forecast an end to rate increases, start assuming rate cuts, and look through the valley to the next economic expansion. Hence today’s rally in stocks …After a series of rate decisions that caused very high levels of stock market volatility this year, Chair Powell and the FOMC are far enough along in the current tightening cycle that they feel they can provide some reassurance about the predictability of future monetary policy.The bottom line: stocks have one less thing to worry about, at least for now. This speaks to the issue of investor confidence that we discussed in “Markets” yesterday, and our conclusion is the same even with the new kinder, gentler Fed we saw today. If you think corporate earnings will either remain strong or rebound quickly from any recession, then stocks are modestly attractive here. Equities are an optimist’s game, and this bullish narrative may have some legs here. We are more in the ‘realist’ camp at the moment and remain somewhat cautious.”

As we often say here at TKer, the stock market usually goes up. And stocks are a discounting mechanism, which means they trade based on expectations for the future. And history shows that the future is generally better for the economy, earnings, and ultimately stocks.

The Fed may not have signaled that an unambiguous dovish pivot is coming, but the market may be anticipating such a signal may be coming.

As Fundstrat’s Tom Lee pointed out, during the inflation crisis of the late 1970s and early 1980s, the stock market bottomed two months before then-Fed Chair Paul Volcker signaled a shift in policy as it appeared inflation was coming under control.

But just because the market is anticipating better things to come doesn’t necessarily mean it’s right.

“While the recent rally in equity markets has been understandable, we are skeptical that we have really reached the Fed pivot point yet given their volatility of late,“ Bespoke Investment Group analysts noted.

–

From TKer:

Last week ?

? Stocks climb: The S&P 500 rose 4.3% last week to close at 4,130.29. The index is now down 13.9% from its January 3 closing high of 4,796.56 and up 12.6% from its June 16 closing low of 3,666.77. For more on market volatility, read this and this. If you wanna read up on bear markets, read this and this.

As I wrote in June, it appears that the markets will be held hostage by the Fed as long as inflation isn’t showing “clear and convincing” signs of easing. And investors should be prepared for market volatility. Read more about this here and here.

? GDP falls: U.S. GDP fell at a 0.9% rate in Q2, according to the Bureau of Economic Analysis. This follows a 1.6% decline in Q1. While two negative quarters do not indicate the official start of a recession, the underlying details of the new report confirmed that the economy is slowing. Read more about this here.

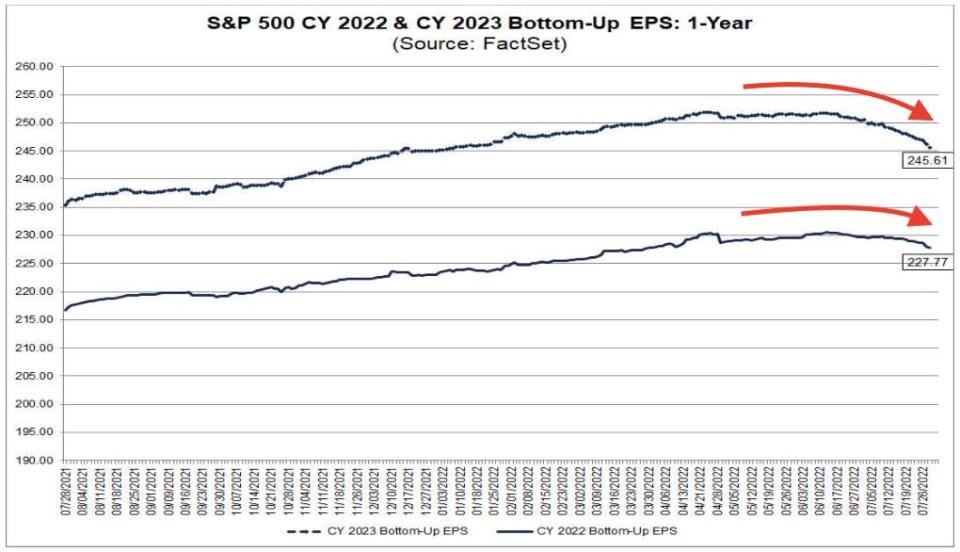

? Earnings estimates are getting slashed: Analysts’ expectations for earnings are finally coming down in a significant way. Estimates for S&P 500 earnings in 2022 now stand at $227.77 per share as of July 28, according to FactSet. This is down 0.8% from the $229.63 per share estimate as of June 30. For 2023, analysts expect EPS of $245.61, down 2.0% from the $250.59 estimate as of June 30. Read more about what this means here.

Next week ?

The labor market has been a beacon of optimism amid the economic slowdown. But it’s only a matter of time before cooling demand starts to affect employment. And so, this coming week’s flood of labor market data will be of high interest.

Tuesday comes with the June Job Openings & Labor Turnover Survey. Friday comes with the July Employment Situation report, which includes updates on job growth (+250k est.) and the unemployment rate (3.6% est.). The fact that there continues to be nearly two job openings per unemployed person has come with above-average wage growth, which has been blamed for causing inflation to surge. Those looking for inflation to come down will be interested to see how this gap in the labor market is evolving.

Earnings season continues. Below are some of the big names releasing their Q2 financial results this week (via The Transcript).

This post was originally published on TKer.com.

Sam Ro is the founder of Tk.co. Follow him on Twitter at @SamRo.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube