Unconvincing price moves as the economy cools

This post was originally published on TKer.com.

Inflation data released last week was mixed. It certainly wasn’t the “clear and convincing” evidence of cooling prices that the Federal Reserve has been looking for.

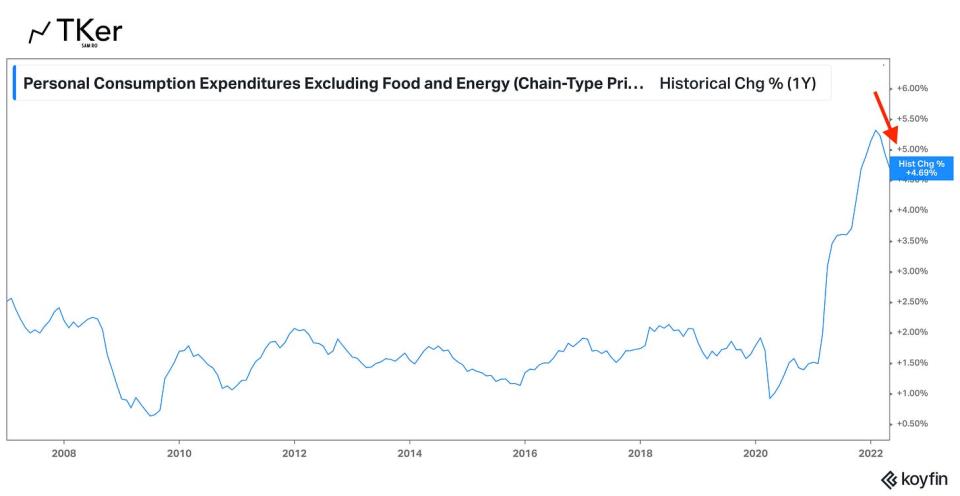

The core PCE price index — the Fed’s preferred measure of inflation — climbed 4.7% in May from a year ago (chart above), which was cooler than the 4.8% rate economists expected. It was also down from the 4.9% rate in April, the 5.2% rate in March, and the 5.3% peak rate in February.

On a month-over-month basis, the core PCE price index climbed by 0.3% in May, which was cooler than the 0.4% economists expected. It was the fourth straight month the metric climbed at a 0.3% rate.

While the metric is generally moving in the right direction, it remains elevated.

“That is not the ‘clear and compelling’ evidence the Fed needs to shift to less aggressive rate hikes,” Michael Pearce, senior U.S. economist at Capital Economics, wrote on Thursday.

“Federal Reserve Chairman Jay Powell has underscored that the Fed would like to see a cooling of inflation on both a month-to-month and year-over-year basis,” Diane Swonk, chief economist at Grant Thornton, wrote on Thursday. “The former is most important and is not yet happening. Core PCE remains more than double the Fed’s 2% target, which is just too hot.“

It doesn’t help that consumers remain gloomy on the outlook for prices.

According to the Conference Board’s June Consumer Confidence survey (via @RenMacLLC), consumer expectations for the inflation rate 12 months from now was a record high 8%.

Cooler prices may be on their way

Inventory levels across industries continue to rise.

This week alone, Nike, Bed Bath & Beyond, and Micron were among big companies flagging elevated inventory levels.

Ed Yardeni of Yardeni Research has a composite index consisting of delivery times and order backlogs — two good proxies for supply chain delays — from five regional Fed bank surveys. The metric has tumbled to lows last seen before anyone mentioned anything about pandemic-related supply chain disruptions.

“June’s surveys of five of the 12 district Federal Reserve Banks strongly suggest that supply-chain disruptions have eased significantly in recent months,“ Yardeni wrote.

This confirms other indicators of loosening supply chains. From Bank of America’s biweekly trucker survey published July 1 showed: “The Truck Capacity Indicator was 70.9, up from 67.0 last survey, as more shippers see available truckload capacity.“

Loosening supply chains are a good sign for lower inflation.

They would be a great sign if they were reflecting improving supply.

But it looks like slowing demand is playing a significant role here.

Manufacturing is cooling

According to S&P Global US Manufacturing PMI report released on Friday, the headline index fell to 52.7 in June. This suggests manufacturing activity is growing at it slowest pace since July 2020.

Similarly, the ISM Manufacturing PMI fell to 53.0 in June, its lowest level since June 2020.

Both reports saw significant declines in new orders.

“Forward-looking indicators such as business expectations, new order inflows, backlogs of work and purchasing of inputs have all deteriorated markedly to suggest an increased risk of an industrial downturn,“ Chris Williamson, chief business economist at S&P Global Market Intelligence, wrote on Friday.

The June durable goods orders report, which will be released on July 27, will bear watching. According to the May report, orders — including the important core capex orders — were still rising.

“Some welcome news is that the drop in demand for inputs has brought some pressure off supply chains and calmed prices for a wide variety of goods, which should help alleviate broader inflationary pressures in coming months,” Williamson added.

Keep in mind that bad news about the economy can be good news for inflation. And so if decelerating manufacturing activity is causing prices to come down, then it’s the bad news the Fed is looking for.

Is the consumer cracking?

Consumer spending data has been less than spectacular.

According to a BEA report released Thursday, personal consumption expenditures (i.e., consumer spending) increased by 0.2% in May from the prior month to a new record high.

On one hand, it’s good that consumers are continuing to spend albeit at a decelerating rate.

On the other hand, inflation played a significant role here. When adjusted for inflation, real spending actually fell 0.4%.

And consumers are very aware of the inflation.

The Conference Board’s Consumer Confidence Index fell to its lowest level since February 2021 as deteriorating inflation expectations caused the survey’s Expectations Index to plunge to its lowest level since March 2013.

“Consumers’ grimmer outlook was driven by increasing concerns about inflation, in particular rising gas and food prices,” Lynn Franco, senior director at The Conference Board, said on Tuesday. “Expectations have now fallen well below a reading of 80, suggesting weaker growth in the second half of 2022 as well as growing risk of recession by yearend.“

While consumer sentiment continues to sour, actual consumer spending behavior doesn’t seem to reflect an economic downturn. It’s a bullish contradiction that’s been playing out for months. Bank of America recently analyzed its customers’ card spending activity and published its findings in a June 24 report:

“Our analysis suggests the consumer is not displaying the usual recessionary patterns at this time…Interestingly, we find that consumers do not necessarily dine out less during downturns, but rather they tend to shift to cheaper restaurants. Aggregated Bank of America card data indicates consumers currently are not shifting to this direction…Travel spending also usually drops during recessions. However, aggregated Bank of America card spending data as of June points to the highest travel spending share since the pandemic began.”

Indeed, the number of passengers going through TSA checkpoints are at pre-pandemic levels and continue to climb. And despite lots of unfavorable headlines about flight cancellations and surging airfares, searches for flights remain very high.

Keep in mind that consumer finances continue to be very robust. And there is a growing number of consumers earning income: U.S. employers have added 2.4 million jobs during the first five months of 2022 alone.

Meanwhile, unemployment continues to be low.

Initial claims for unemployment insurance declined to 231,000 for the week ending June 25 from 233,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion.

Zooming out

There continue to be massive tailwinds — including excess savings, capex orders, and demand for workers — bolstering the economy and limiting the negative impacts of tight monetary policy. Perhaps, this will buy the economic recovery some time as supply catches up with demand.

But until we get “clear and convincing” evidence that inflation is coming down, the Fed is going to keeping putting pressure on financial markets in its effort to destroy demand in the economy. So don’t be surprised to see economic data continue to sour and stock prices continue to not go up.

–

Related from TKer:

Recap ?: For a little over a year, the rapid economic recovery came with demand growth sharply outpace supply, causing inflation rates to rise. However, supply has failed to catch up, which is why the Federal Reserve has been tightening monetary policy in an effort to bring down inflation by cooling demand. While economic growth has indeed been slowing in recent months, high inflation persists. And now we have an even more hawkish Fed putting even more pressure on the economy, and it’s doing so by targeting the financial markets.

Last week ?

? Stocks fall: The S&P 500 fell 2.2% last week to close at 3,825.33. The index is now down 20.2% from its January 3 closing high of 4,796.56 and up 4.3% from its June 16 closing low of 3,666.77. For more on market volatility, read this and this. If you wanna read up on bear markets, read this and this.

As I wrote last month, it appears that the markets will be held hostage by the Fed as long as inflation isn’t showing “clear and convincing” signs of easing. Read more about this here and here.

Next week ?

The marquee event of the week will be the June jobs report released on Friday morning. We know the labor market has been cooling. But to what degree has months of tighter monetary policy slowed hiring? Economists estimate U.S. employers added 275,000 jobs during the month as the unemployment rate sat unchanged at 3.6%.

Wednesday comes with the May Job Openings & Labor Turnover Survey. There were 11.4 million job openings as of April, which is nearly double the number of unemployed people. This good news is being blamed for high inflation, which is bad. It’s among the things the Fed is aiming to address with tighter monetary policy. More timely data from Linkup and Indeed suggest the level of job openings have been coming down in recent weeks.

U.S. financial markets will be closed on Monday for the Independence Day holiday.

This post was originally published on TKer.com.

Sam Ro is the founder of Tk.co. Follow him on Twitter at @SamRo.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube