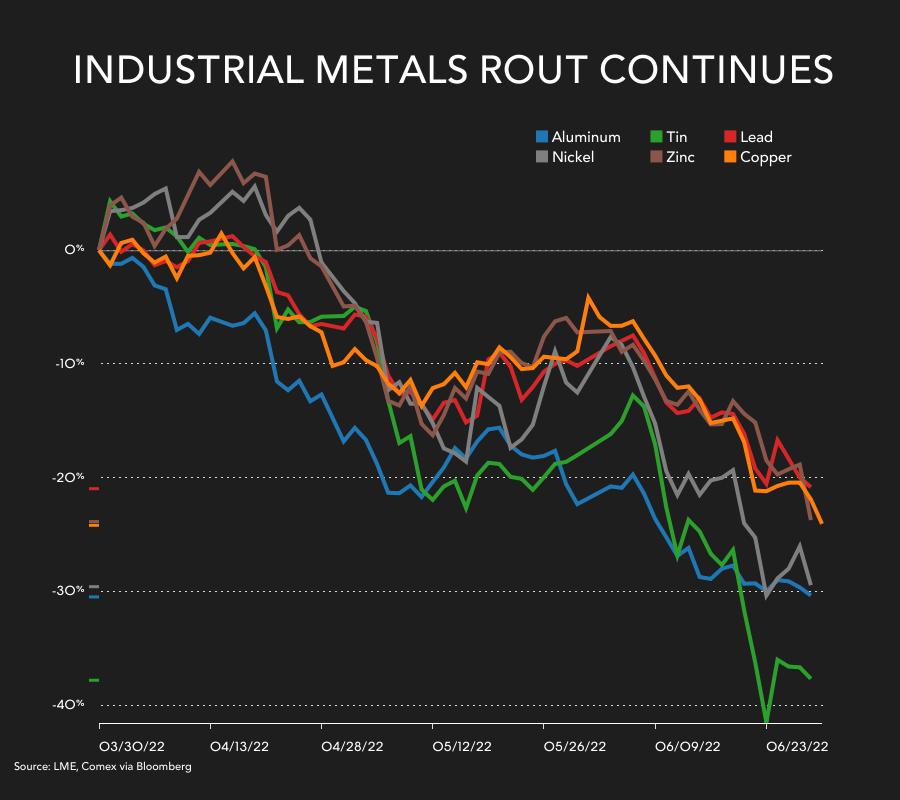

Copper, zinc, nickel price rout continues despite rebound in China manufacturing

Copper for delivery in September fell over 4% from Thursday’s settlement, touching a low of $3.55 per pound ($7,834 per tonne) in morning trade on the Comex market in New York, the lowest since February 2021. The most-traded August copper contract in Shanghai ended the day 4% weaker at 61,630 yuan or $9,190.

In London aluminium slipped 1.9% to $2,400 a tonne, zinc dropped 3.5% to $3,045 bringing its losses for the week to 9% and nickel eased 2.4% to $22,150. Tin fell 4% to $25,400 on Friday, but for the week the metal widely used in the electronics sector managed to gain 6%. Lead was the only gainer on Friday – up nearly 1% to $1,924.

Further to fall

Chinese PMI data showed manufacturing activity hit a 13-month high in June, but in a note Capital Economics said market participants, like the research firm itself, are assuming that the indicator “reflects the lifting of lockdown restrictions rather than an economic revival”:

“It is increasingly clear that concerns about demand are taking precedence of supply issues in the metals markets.

“The prices of all the base metals fell by over 20% in the second quarter, despite still high energy prices (which raise the cost of metals production), ultra-low exchange stocks and, in most cases, subdued refined output.

“We think that prices have further to fall in the second half of the year, but we suspect that the big falls are now behind us.”

Shares of major copper producers came under renewed selling on Friday. Units of BHP trading in New York lost 4.8%, Rio Tinto gave up 3.3%, Vale traded down 4.6% while Glencore was the worst performer with a decline of 5.6% in early afternoon trade in New York.