Stocks, US Futures Struggle; Bitcoin Retreats Anew: Markets Wrap

(Bloomberg) — Asian stocks fell Monday and US equity futures erased a climb as tightening monetary policy kept sentiment in check.

Most Read from Bloomberg

MSCI Inc.’s gauge of Asia-Pacific shares hit the lowest since June 2020 amid drops in Japan and Hong Kong and mixed performance in China, where banks kept their main lending rates unchanged.

S&P 500 contracts turned lower, while those for the Nadsaq 100 reversed a gain of more than 1%.

Bitcoin slid anew, sinking back below the closely-watched $20,000 mark. A volatile crypto slump has become emblematic of the pressure on a range of assets from sharp Federal Reserve interest-rate hikes to tame high inflation.

The dollar was mixed against key peers. Crude oil added to a near-7% Friday plunge. Treasury futures advanced — there’s no cash trading as Wall Street is closed Monday for a holiday.

Markets are set to remain on edge amid elevated price pressures and concern that monetary tightening in a range of nations portends more losses.

“Data over the coming months will indeed point to the need for a greater degree of tightening, and market prices will need to adjust,” Sonal Desai, chief investment officer at Franklin Templeton Fixed Income, wrote in a note.

In the latest Fed commentary, Governor Christopher Waller said he would support another 75-basis-point rate increase at the central bank’s July meeting should economic data come in as he expects.

Bank of Cleveland Fed President Loretta Mester said the risk of a US recession is increasing, adding it will take several years to return to the 2% inflation goal. Fed Chair Jerome Powell is due to appear before US lawmakers this week.

What to watch this week:

-

China loan prime rates, Monday

-

RBA minutes, Governor Philip Lowe due to speak, Tuesday

-

Fed Chair Jerome Powell semi-annual Senate testimony, Wednesday

-

Bank of Japan April minutes, Wednesday

-

Powell US House testimony, Thursday

-

US initial jobless claims, Thursday

-

PMIs for Eurozone, France, Germany, UK, Australia, Thursday

-

ECB economic bulletin, Thursday

-

US University of Michigan consumer sentiment, Friday

-

RBA’s Lowe speaks on panel, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.1% as of 10:48 a.m. in Tokyo. The S&P 500 rose 0.2% Friday

-

Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 1.2% Friday

-

Japan’s Topix index fell 1.1%

-

Australia’s S&P/ASX 200 index fell 0.6%

-

South Korea’s Kospi fell 2.3%

-

Hang Seng Index fell 0.4%

-

Shanghai Composite Index was little changed

-

Euro Stoxx 50 futures fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was steady

-

The euro was at $1.0496

-

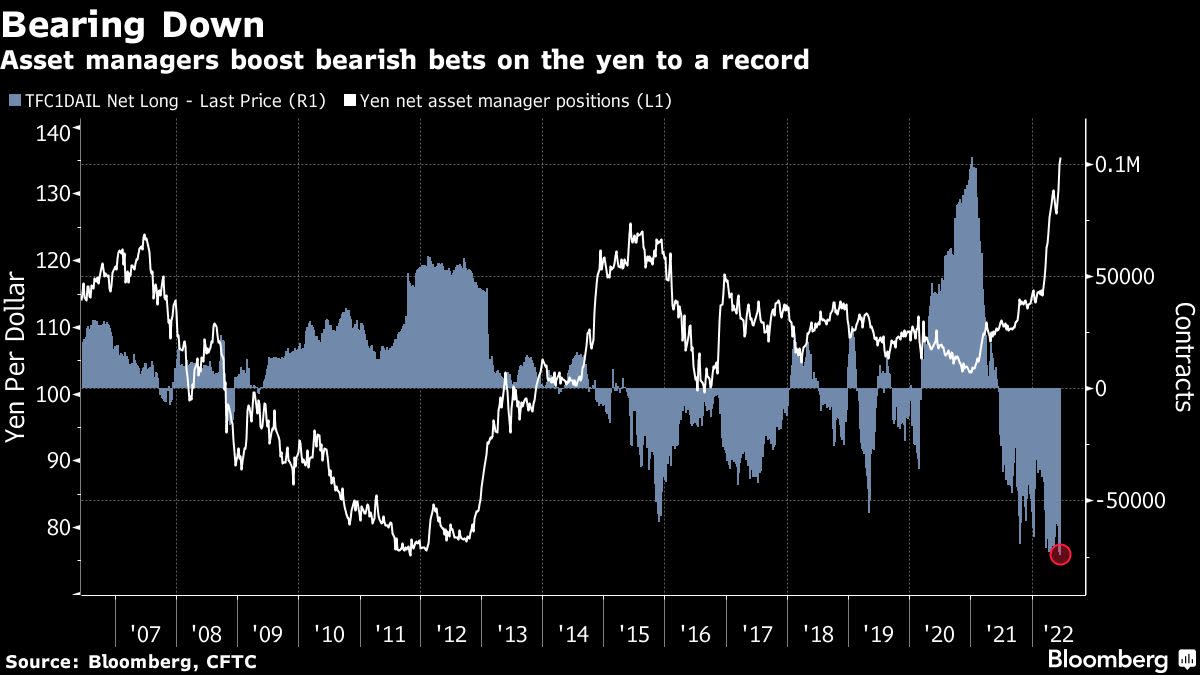

The Japanese yen was at 135.07 per dollar

-

The offshore yuan was at 6.7088 per dollar

Bonds

Commodities

-

West Texas Intermediate crude fell 0.5% to $109.03 a barrel

-

Gold was at $1,839.61 an ounce

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.