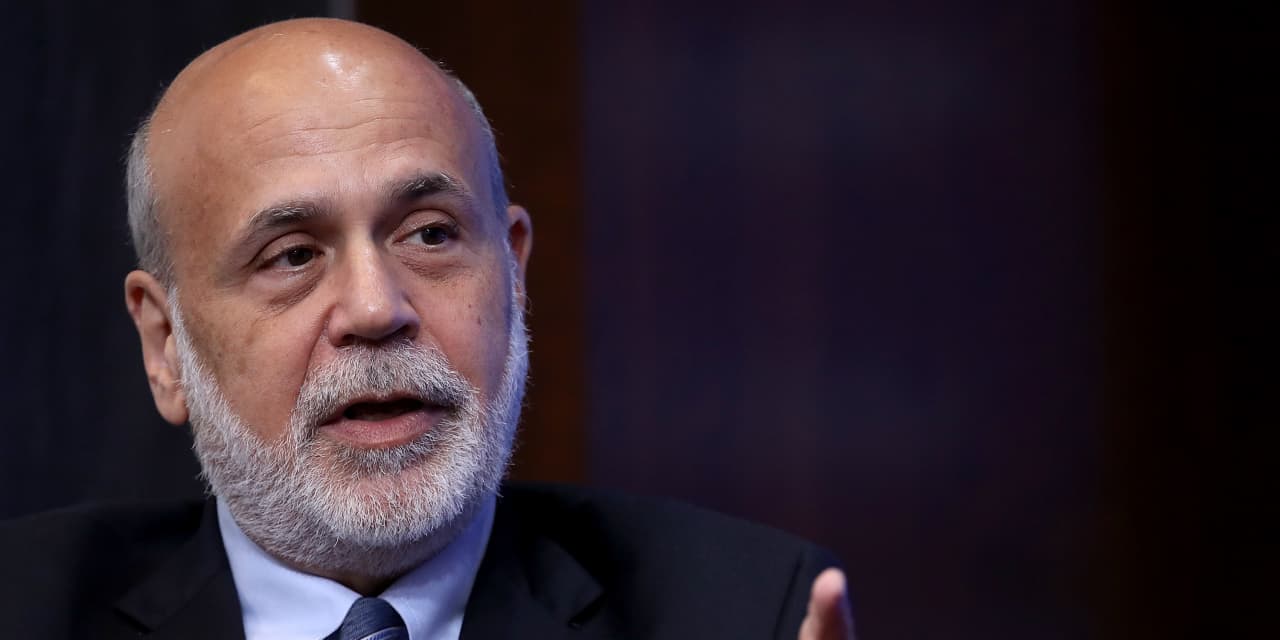

Bitcoin won’t become ‘an alternative form of money,’ or a store of value, says Ben Bernanke

Ben Bernanke, former chairman of the Federal Reserve, said that he doesn’t think bitcoin would take over “as an alternative form of money.”

Bitcoin BTCUSD,

Bernanke made the comment after bitcoin fell more than 55% from its all-time high in November while ether ETHUSD,

“If bitcoin were a substitute for fiat money, you could use bitcoin to go buy your groceries. Nobody buys groceries with bitcoin because it’s too expensive and too inconvenient to do that,” Bernanke said in the CNBC interview. “The price of celery varies radically day to day in terms of bitcoin and so there’s no stability either in the value of bitcoin,” Bernanke said.

Bitcoin supporters have argued that the Lightning network, which is layered on top of the Bitcoin blockchain, could improve the speed and reduce fees for transacting on the network.

Key Words: Bitcoin’s future isn’t as a payments network, says FTX’s Sam Bankman-Fried

Bernanke also said he doesn’t think bitcoin has the potential to serve as a “store of value” or “digital gold,” a narrative endorsed by many supporters of the cryptocurrency.

“Gold has underlying use value. You can use it to fill cavities. The underlying use value of a Bitcoin is to do ransomware or something like that,” Bernanke said in the interview.

Bernanke’s views on digital assets seem to have evolved over years. In 2013, in a letter to the Homeland Security committee, the Fed chair then pointed out the central bank’s longstanding view that though virtual currencies may pose risks related to law enforcement, “there are also areas in which they may hold long-term promise, particularly if the innovations promote a faster, more secure and more efficient payment system.”

In 2015, Bernanke told Quartz that bitcoin “was interesting from a technological point of view,” but it “has some serious problems,” citing its volatility and anonymity.

Also read: More consumers want to use cryptocurrencies for purchases, but merchants are hesitant to accept them