Shopify Stock Gets a Price Target Cut. But There Are Reasons to Be Bullish.

Tech stocks got rocked on Wednesday, with the tech-heavy Nasdaq falling 1.4% after two straight days of gains — hurt by a shock-and-awe earnings miss at tech bellwether Netflix, which reported its first decline in subscriber numbers in 10 years.

The damage began with Netflix, but wasn’t contained to Netflix. For no apparent reason other than simple investor revulsion over growth stocks, Shopify (SHOP) stock also sold off Wednesday. And yet, while there was no specific news to explain Shopify’s freefall yesterday, it’s possible that investment bank Piper Sandler primed the pump for a selloff when, on Tuesday, analyst Brent Bracelin released a note slashing his price target on Shopify stock by $100, to $800.

In his research note, Bracelin warned of “increasing execution risks” at Shopify, “tied to 1) inflationary pressure on consumer spending, 2) a shift in consumer behavior that favors services over consumer goods, 3) tough comparisons vs. stimulus aided tailwinds one year ago, and 4) an economically sensitive model with GMV driving approximately 70% of sales.” So basically, Bracelin blamed the economy for his price target cut.

It’s Shopify’s dependence upon gross merchandise volume (GMV) that most worries Bracelin, noting that for every $1 billion more (or less) merchandise sold through Shopify’s clients, Shopify itself gains (or loses) $19 million in revenue. And according to the analyst, Shopify is likely to see about a 16% sequential decline in GMV for Q1 2022 (to $45.4 billion), which is 4% worse than previously predicted.

That’s the bad news. The good news is that — in apparent contradiction to his theory that GMV declines directly translate into revenue declines, Bracelin is cutting his Q1 revenue estimate for Shopify by only 1.4%, to $5.84 billion.

The other good news is that, although less revenue than he previously hoped Shopify would bring in, $5.84 billion would still represent 27% year-over-year revenue growth for Spotify, on only 22% y/y growth in GMV. Furthermore, across the whole of 2022, Bracelin predicts that Spotify will enjoy 25% GMV growth — not as good as the 47% GMV growth seen in 2021, to be sure, but still a very respectable number. And on top of all that, Bracelin predicts that the economy will improve, and Spotify’s sales accelerate, once we’re over the hump of 2022. As early as 2023, he sees sales growth improving to 35%.

For this reason, despite lowering his GMV forecast for 2022, and for 2022 as well, and despite also lowering his “multi-year revenue outlook” for the company, Bracelin nonetheless continues to recommend buying Shopify stock.

As the analyst sums up: “SHOP remains one of the highest quality franchises to own in commerce software with attractive prospects over the next 3-5 years powering a diverse base of 2M+ merchants.” And with Bracelin positing an $800 target price for the stock, but Shopify shares costing only $525 currently, that means there’s still an opportunity for investors to buy today, and enjoy a 58% profit on Shopify stock a year from now. (To watch Bracelin’s track record, click here)

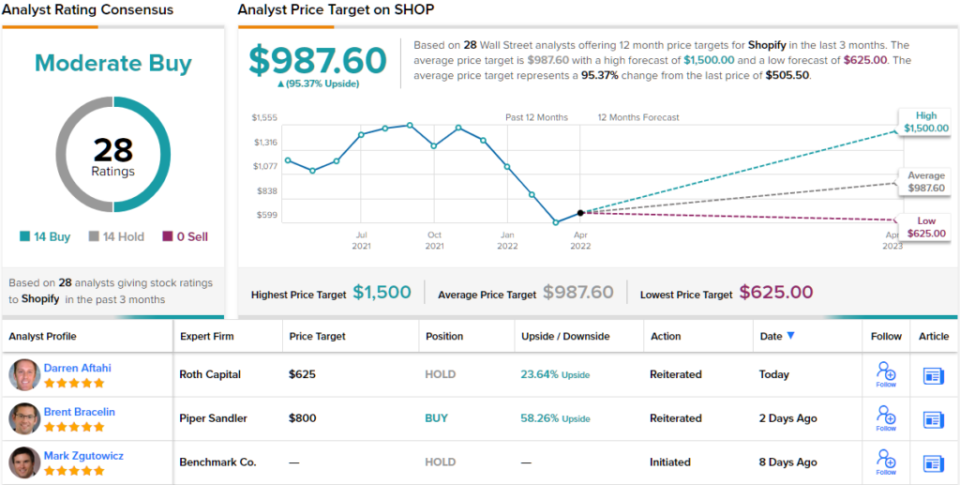

Overall, Bracelin represents the bullish view – Wall Street is somewhat divided on this stock. There are 28 recent analyst reviews, 14 to Buy and 14 to Hold, making the consensus rating a Moderate Buy. A clearer picture emerges where the price target is concerned, as on average, the analysts expect shares to add ~95% over the next 12 months. (See SHOP stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.