IBM first-quarter results beat estimates

IBM shares rose 3% in extended trading on Tuesday after the technology services company issued first-quarter results that beat expectations.

Here’s how the company did:

- Earnings: $1.40 per share, adjusted, vs. $1.38 per share as expected by analysts, according to Refinitiv.

- Revenue: $14.2 billion, vs. $13.85 billion as expected by analysts, according to Refinitiv.

Revenue in the period rose 7.7% from a year earlier, IBM said in a statement. This is the company’s first full quarter without the managed infrastructure services business it spun off into an entity called Kyndryl. Sales to Kyndryl added 5 percentage points to revenue growth in the quarter.

Net income from continuing operations jumped 64% from a year earlier to $662 million. Overall net income declined 23%.

IBM called for revenue growth in constant currency in the high single digits for 2020, with an additional 3.5 percentage points of growth from Kyndryl.

In the first quarter, IBM’s software segment generated $5.77 billion in revenue, which was up 12% and above the $5.63 billion consensus among analysts surveyed by StreetAccount.

Consulting revenue rose 13% to $4.83 billion, it’s higher than the $4.6 billion StreetAccount consensus.

Revenue from infrastructure fell 2% to $3.22 billion, as clients prepare for IBM’s next-generation mainframe computer later this year.

Also during the quarter, IBM said Francisco Partners agreed to buy its Watson health-care data and analytics assets in a deal reportedly worth over $1 billion. IBM issued updated historical figures for its high-margin software segment to better reflect its financials without those businesses.

In early March, IBM said it stopped doing business in Russia after the country invaded Ukraine. IBM also announced the acquisitions of environment data analytics software maker Envizi and telecommunications consulting firm Sentaca.

IBM’s stock has been outperforming the S&P 500 this year, falling about 3% as of Monday’s close, while the broader index is down 6%. Investors have rotated into value stocks in 2022, given rising interest rates and the war in Europe.

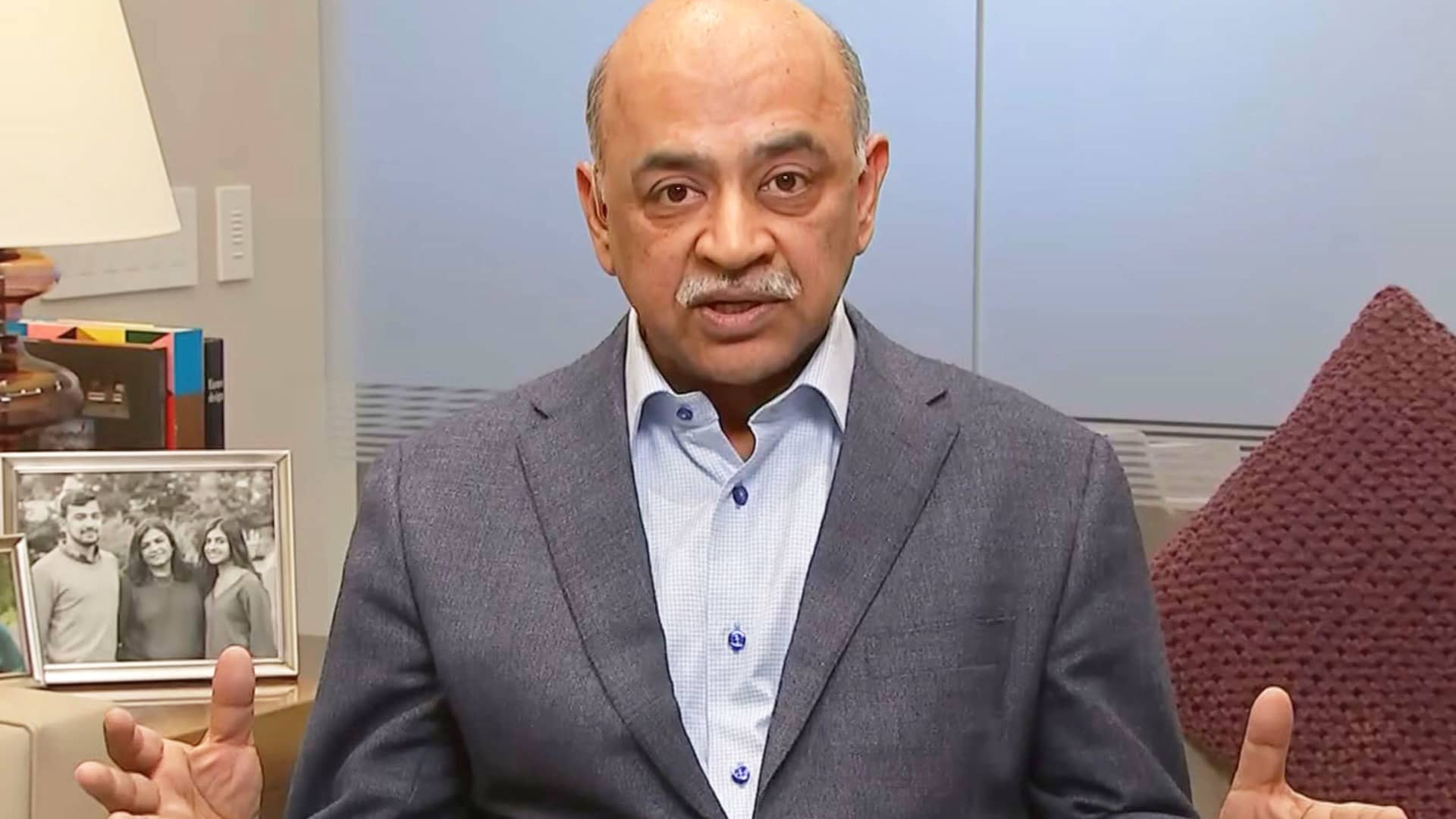

Executives will discuss the results with analysts on a conference call starting at 5 p.m. ET.

This is breaking news. Please check back for updates.