Here are 30 stocks that Goldman Sachs likes when the economy stutters and markets gyrate

Wall Street is finding some traction for Tuesday, as investors wade through big earnings and ample, gloomy distractions.

Fighting has ramped up again in Ukraine as the battle begins for the country’s eastern front. Apart from the tragic humanitarian crisis, the conflict is already causing the World Bank and others to cut their global growth forecasts.

Where to invest against such a volatile backdrop? Our call of the day from Goldman Sachs strategists offer up a group of equities they say can hold their in these uncertain times.

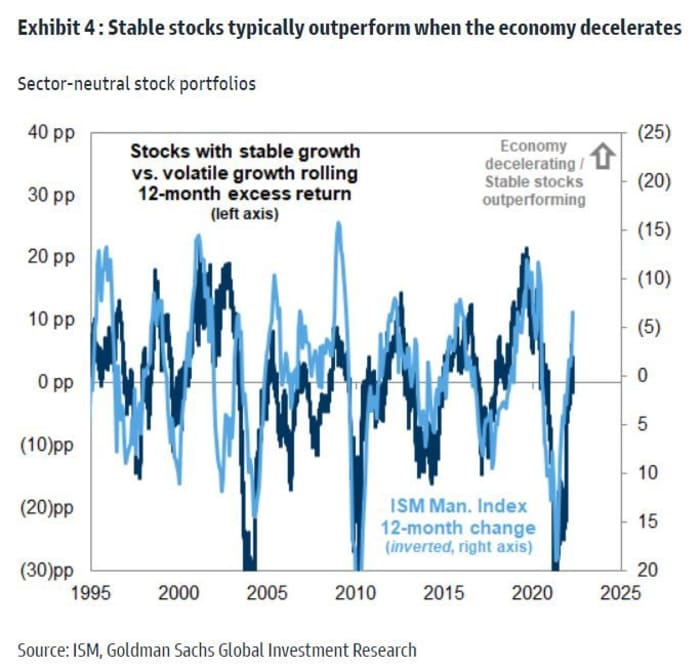

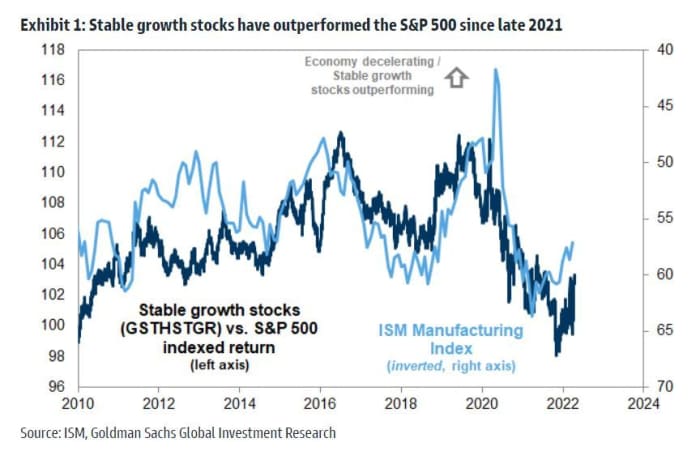

“Stable stocks –- those with low share price and earnings growth volatility -– typically outperform in environments of slowing economic growth and tightening financial conditions,” say a team led by Ben Snider and David Kostin in a note from late Monday.

After lagging dramatically against a strong global economic backdrop for the past two years, their stable stocks basket has outperformed the S&P 500 SPX,

Those stocks remain cheap, trading at a price/earnings premium of around 8% versus a 35-year average of 15%. During a similar batch of slowing growth and Fed tightening in 2018, the premium hovered at 20% for that group, they note.

“Despite recent outperformance, stable stocks do not appear to be pricing the slowdown suggested by recent industry rotations or our economists’ GDP forecasts,” said Goldman.

As for the stock names, their stable basket consists of 50 Russell 1000 RUI,

Below are roughly 30 of the 50 stocks Goldman listed:

Financials names include Marsh & McLennan MMC,

Finally, the bank named American Tower AMT,

Read: These 20 highly rated stocks are expected to rise at least 70% over the next year

The buzz

Netflix NFLX,

Plug Power PLUG,

American Campus stock ACC,

United UAL,

St. Louis Fed President James Bullard said he wouldn’t rule out a 75-basis point rate hike, with Chicago Fed President Charles Evans and Minneapolis’s Neel Kashkari due to speak Tuesday. Ahead of that, data showed a rise in housing starts.

As G20 finance ministers and central bankers meet in Washington, the International Monetary Fund, followed up the World Bank’s warning that the Ukraine war will take a toll on the global economy.

Russia has issued a new ultimatum to Ukrainian holdouts in Mariupol, as its forces launched a fresh attack on the eastern front of the country in what many see as a new phase of the war.

The markets

Stocks DJIA,

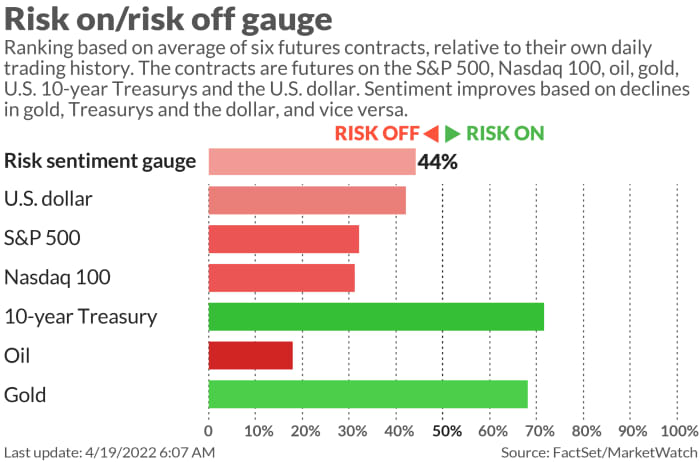

The chart

“While the close proximity in the timing between the first [Fed] hike and curve inversion perhaps points to a more truncated late-cycle period this time, the current cross-market setup does not point to a return to the correlation between curve flattening and subsequent bearish equity performance that existed during the late-1960s and through most of the 1970s,” said a JPMorgan team led by Jason Hunter.

They see a likely floor for the index at 4,100 to 4,300, and “view the current price action as a consolidation related to the initial removal of accommodative monetary policy.”

The tickers

These were the most-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| ATER, |

Aterian |

| NIO, |

NIO |

| TWTR, |

|

| MULN, |

Mullen Automotive |

| AAPL, |

Apple |

| NVDA, |

Nvidia |

| NILE, |

Bitnile |

Random reads

Longtime MSNBC national security analyst joins the fight in Ukraine

The “cash me outside” teen who shot to fame by trying to fight Dr Phil, pays all cash for $6.1 million mansion.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.