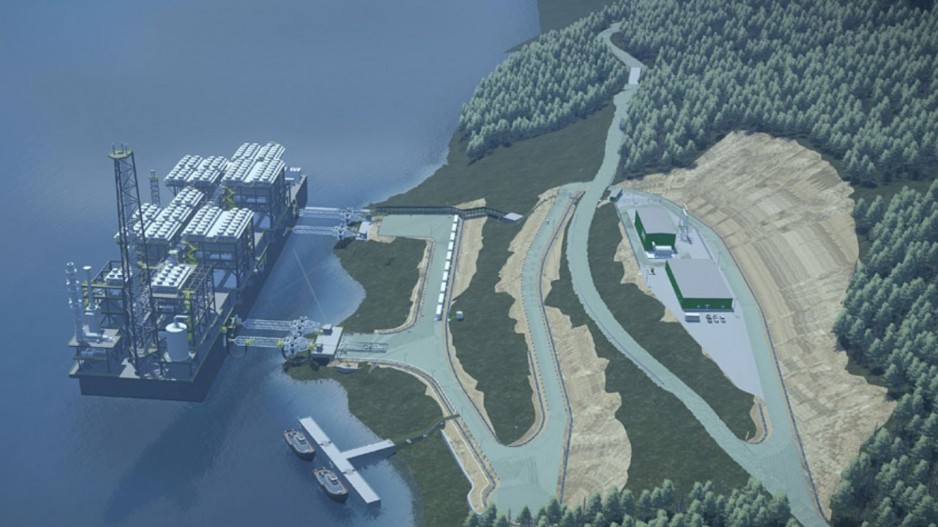

The Cedar LNG project is being developed by the Haisla First Nation on fee-simple land owned by the Haisla on Douglas Channel, near the Rio Tinto aluminum smelter and LNG Canada plant, which is still under construction.

“With Cedar LNG, we have more than a seat,” Haisla chief Crystal Smith said last week at Globe Forum 2022. “We are owners, and we are setting the standards we believe in.

“One of the important decisions we made was to power the facility entirely with renewable energy.”

Compared with LNG Canada, which would export 13 million tonnes of LNG annually, Cedar LNG is modest in size. Its annual production capacity would be three million tonnes.

It wouldn’t be the first LNG project proposed by First Nations in B.C., but it might become the first to be built.

The Kwispaa LNG project was a partnership between the Huu-ay-aht First Nation and Steelhead LNG Corp. But that project stalled in 2019, after Steelhead LNG announced it was pushing the pause button.

One of the challenges for that project is that it would need a new natural gas pipeline to get gas to Vancouver Island. The Haisla’s Cedar LNG project doesn’t have that problem, because the Haisla have a natural gas offtake agreement with LNG Canada and the Coastal GasLink pipeline.

Last year, the Haisla secured a major industry partner in Pembina Pipelines (TSX:PPL), a

C$25 billion midstream company that has built and operates oil and gas pipelines and processing facilities in Western Canada.

“Just the project management and infrastructure management capabilities of a company like a Pembina, as well as their financial capabilities, I think that’s hugely valuable,” said Brad Hayes, president of Petrel Robertson Consulting Ltd., which serves the oil and gas industry.

Cedar LNG also has a new CEO with extensive experience in the industry – Doug Arnell, chairman of Methanex Corp. (TSX:MX), CEO of Helm Energy Advisors Inc. and former CEO of Golar LNG (Nasdaq:GLNG).

Should the project get the green light from federal and provincial environmental regulators, the Haisla and Pembina expect a final investment decision to be made in 2023. With a four-year construction period and a seven-to-nine-month commissioning, Cedar LNG is aiming for exports to begin in mid-2027.

Morgan Stanley Research has recently predicted that demand for LNG could increase 25 per cent to 50 per cent by 2030. McKinsey likewise forecasts that demand will grow by about 3.5 per cent annually to 2035.

One advantage that Cedar LNG project has, from a capital cost perspective, is that no new pipeline needs to be built. When the Haisla signed agreements on the LNG Canada project, it negotiated a natural gas offtake agreement with the Coastal GasLink project. It also proposes to reduce construction costs by going with a floating LNG terminal, which would be built in Asia.

The Haisla project appears to have taken a design page from Woodfibre LNG. Like Woodfibre, Cedar LNG is going with an air-cooled design (as opposed to water cooling) and electric drive.

Using e-drive, the project would draw a significant amount of power: 169 to179 megawatts (MW), which would be delivered through a new eight-kilometre, 287-kilovolt transmission line running from a BC Hydro substation in Kitimat to the terminal. To put that in perspective, the Site C hydroelectric dam will have a generating capacity of 1,100 MW.

“Cedar has confirmed with BC Hydro that sufficient electricity is available to power the project during operation,” Cedar LNG said in a project description filed as part of the provincial environmental assessment process.

E-drive is more expensive than natural gas power, but would significantly lower the plant’s greenhouse gas (GHG) intensity.

Cedar LNG estimates its LNG would have a GHG intensity of just 0.08 tonnes of carbon dioxide equivalent (CO2e) per tonne of LNG produced (tCO2e/t). The global average intensity for LNG production is 0.26 to 0.35 tCO2e/t.

The B.C. government’s Greenhouse Gas Industrial Reporting and Control Act sets the benchmark for LNG plants at 0.16 tonnes tCO2e/t. So the LNG produced by the Haisla would be 50 per cent lower than the benchmark.

And while air cooling also might also add costs, it addresses environmental concerns associated with water cooling, since the water used in the cooling process would need to be pumped into the ocean – something the Haisla rejected early on.

“Haisla Nation does not support the use of seawater cooling as they do not consider the marine effects associated with this cooling method to be acceptable,” the company says.

Since the project proposes a floating LNG terminal, it will have a relatively small land footprint, compared with land-based terminals. The main land-based infrastructure needed will be an eight-kilometre power transmission line and a feeder pipeline to take natural gas from the Coastal GasLink pipeline terminus.

Whereas 5,000 workers are currently employed on the C$18 billion LNG Canada project in Kitimat, Cedar LNG would be built with a workforce of about 500.

Cedar LNG plans to time the project’s construction to coincide with the wind-down of LNG Canada terminal construction to capitalize on an experienced workforce already in Kitimat.

As with any other project, First Nations must be consulted as part of the EAO process. There are seven First Nations that must be consulted, including the Haida, because LNG carriers – about 50 annually – would pass through Haida territorial waters.

The Cedar LNG project is in a public comment period in the environmental assessment process, which ends April 14.

(This article first appeared in Business in Vancouver)