U.S. Treasury market plagued with illiquidity as government bonds suffer worst week in years

Signs of trouble continue to show up in the world’s largest, most liquid government-securities market as government bonds logged their worst week in years and the U.S. central bank’s interest rate hiking cycle gets under way.

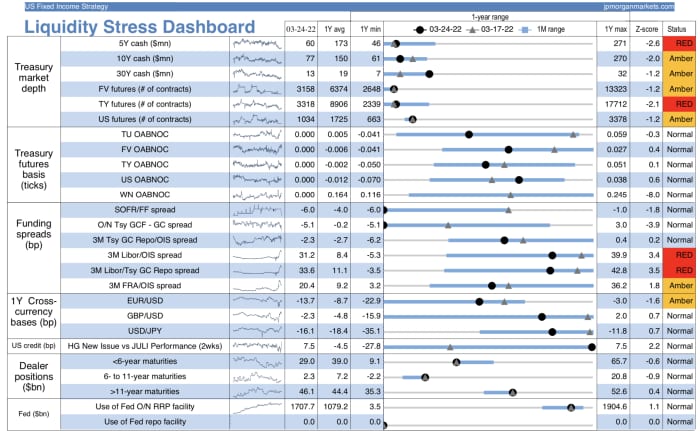

All six of the gauges used to monitor U.S. Treasury market depth — or the ease with which securities can be bought and sold without significantly impacting their prices — have remained at abnormal conditions for the month of March, according to JPMorgan Chase & Co.’s JPM,

The decline in Treasury market depth has corresponded with the recent substantial rise in yields as investors factor in the Fed’s first quarter percentage point rate increase since 2018 and the likelihood of possibly bigger moves to come. The biggest driver behind the market’s illiquidity is the narrative of a U.S. central bank “pushing rates higher,” according to JPMorgan rates strategist Alex Roever.

“We’ve had conditions for several months where cash market depths have been low, and part of that is because of rates backing up and being very sensitive to the Fed and inflation news,” Roever said via phone Friday. “That means it can be very painful to hold bonds and, in aggregate, it feels like we’re not seeing as many end users buy Treasurys bonds as we have before, with demand lower.”

JPMorgan’s dashboard captures more than two dozen different gauges of market conditions, most of them in the Treasurys market. In total, 10 of the gauges being monitored were flashing either a “RED” or “Amber” status as of Thursday, before Friday’s market action.

On Friday, two- TMUBMUSD02Y,