The 145-year-old exchange responded by halting trade and in a later update announced the cancellation of all trades executed on or after 00:00 UK time on March 8 and deferring delivery of all physically settled contracts.

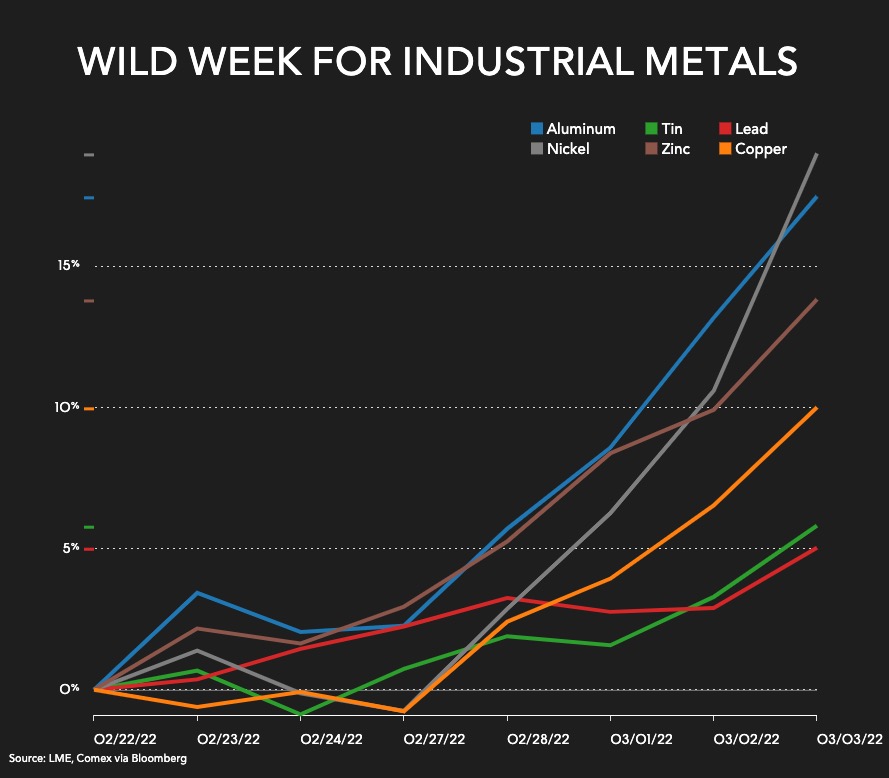

The LME said the move followed a close monitoring of the ongoing impacts of Russia’s invasion of Ukraine, as well as the recent “low-stock environment and high pricing volatility environment observed in various LME base metals, and in particular nickel.”

The move, BMO analyst Colin Hamilton said, will see questions resurface as to the efficacy of the LME to act as the market of last resort after the short squeeze in copper seen late last year.

“It is unlikely this is the last of extreme volatility we see in commodity markets,” Hamilton wrote.

The debacle brings back memories of one of the bourses darkest periods, known as the “Tin Crisis” of 1985, which saw the LME stopping tin trading for four years and pushed many brokers out of business.

Nickel prices have steadily climbed in the past year as battery makers try securing steady sources of the metal, which has quadrupled its value over the past week on fears of further curbs on supply.

Russia not only is responsible for about 10% of the world’s production, but Moscow-based Norilsk Nickel (MCX: GMKN) is the biggest provider of battery- grade nickel at 15% to 20% of global supply.

Demand for high-grade nickel was already set to outstrip supply this year because of the increasing popularity of electric vehicles.

[Click here for an interactive chart of nickel prices dating back to 1989]

Goldman Sachs has forecast the nickel market to be in a 30,000-tonne deficit in 2022, up from their August forecast of a 13,000-tonne deficit.

Tesla boss Elon Musk has identified the shortage of nickel as one of the biggest hurdles to ramping up production of EV batteries. He promised in 2020 millionaire contracts to miners able to provide the EV maker with sustainable nickel.