Legendary stock picker Peter Lynch made a remarkably prescient market observation in 1994

A version of this post was originally published on TKer.co.

Peter Lynch, the legendary stock picker who ran Fidelity’s market-beating Magellan Fund for 13 years, made a prescient observation in a speech he gave to the National Press Club back in October 7, 1994.

It comes from the 38-minute mark of this video (via @DividendGrowth):

Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years. So I think — the market is about 3,800 today, or 3,700 — I’m pretty convinced the next 3,800 points will be up; it won’t be down. The next 500 points, the next 600 points — I don’t know which way they’ll go. So, the market ought to double in the next eight or nine years. They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That’s all there is to it.

When he says “the market,” Lynch is referring the Dow Jones Industrial Average, which closed at 3,797 on the day he gave the talk.

If you compound that by an 8% growth rate over 27.5 years, which would get you to present day, then you get 31,520.

The Dow closed Friday at 34,861, which is pretty darn close. For context, a 7% growth rate would’ve gotten you to 24,405 and a 9% rate would’ve gotten you to 40,613.

If you did this exercise with the S&P 500, which closed at 455 on the day of Lynch’s talk, then you’d get 3,778 assuming an 8% compound annual growth rate. The S&P closed Friday at 4,543. (A 9% rate would’ve gotten you to 4,867.)

According to S&P Dow Jones Indices, S&P 500 earnings per share (EPS) were $30.11 for the 12 months ending Q3 1994, around the time Lynch gave that speech. If you compounded that by 8% over 27.5 years, you’d get $250. S&P Dow Jones Indices estimates EPS for the 12 months ending March 2022 was actually $211, which is close. (They estimate S&P EPS will be $246 in 2023.)

Lynch was not predicting the precise point of the market in March 2022. He was talking about how markets trend over longer-term periods while acknowledging short-term volatility. If you allow him some margin of error to account for unpredictable short-term swings, then you may be able to better appreciate how his thoughts speak to some fundamental market truths we often talk about here at TKer.

I think three elements of what Lynch said are critical for investors to understand.

1: ‘Some event will come out of left field and the market will go down or the market will go up. Volatility will occur.’

This relates to TKer stock market truth No. 8: “The most destabilizing risks are the ones people aren’t talking about.“

Russia’s invasion of Ukraine is a good example. For investors, a conflict between Russia and Ukraine had not been a concern, so markets weren’t prepared for it. This would explain why stocks went into a deep correction amid the initial news and buildup.

With these types of unforeseen events, prices will swing wildly as markets digest every positive and negative development as the situation unfolds.

This stands in contrast to the risks everyone has been talking about, like inflation and tighter monetary policy. These risks had investors concerned for months before those fears were confirmed, and the actual news eventually had a limited effect on market volatility.

2: ‘I’m pretty convinced the next 3,800 points will be up; it won’t be down. The next 500 points, the next 600 points — I don’t know which way they’ll go.‘

Over time, the stock market’s biggest moves will be to the upside (which relates to TKer stock market truth No. 4), and the long game is undefeated (which is TKer stock market truth No. 1.) But you can certainly get smoked in the short term (TKer stock market truth No. 2).

As we discuss frequently here on TKer, big sell-offs are actually pretty normal. The S&P 500 experiences an average max drawdown (i.e., the biggest intra-year sell-off) of 14% a year.

For what it’s worth, the current market correction has seen the S&P 500 fall 12% from its high of 2022, which is less bad than average.

Lynch’s comment speaks to the advantage of a long-term investment horizon, which is a valuable edge most investors have.

3: ‘Profits go up 8% a year, and stocks will follow. That’s all there is to it.’

The stock market has historically usually gone up because earnings have usually gone up. That’s because earnings are the most important driver of stock prices, which is TKer stock market truth No. 5.

Check out this chart of S&P 500 earnings since 1986, courtesy of Yardeni Research. It’s on a logarithmic scale, which smooths out the curve you get when growth is compounding at a steady rate over time.

There’s some short term noise. But over time, earnings have been going up and to the right.

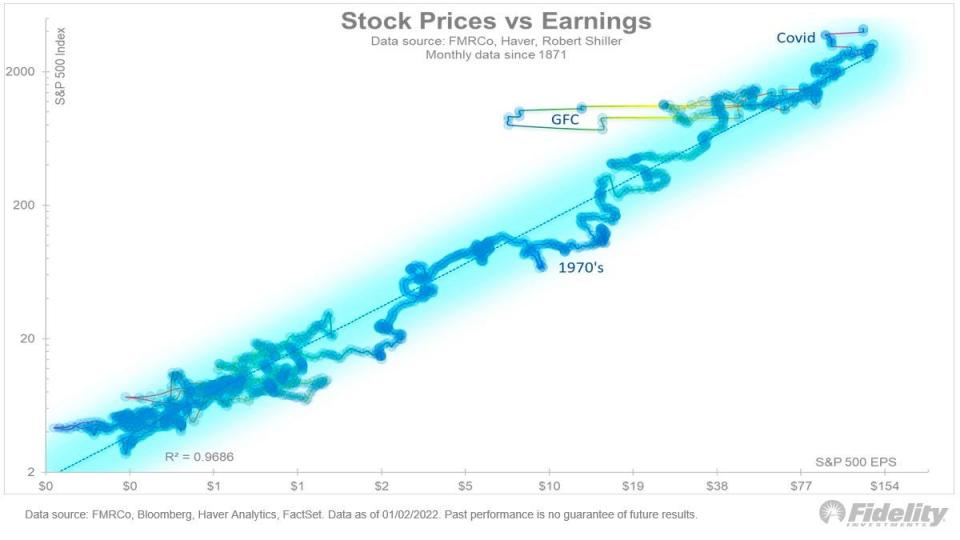

Jurrien Timmer, director of global macro at Fidelity Investments, recently shared a chart showing the tight relationship between earnings and stock prices.

Stock prices are on the y-axis, accompanied by earnings on the x-axis. The data goes back all the way to 1871. The r-squared of 0.9686 in this linear regression is very close to 1, which means earnings do an extremely good job of explaining how stock prices behave.

In other words, stocks go where profits go.

“That’s all there is to it,” Lynch said.

–

More from TKer:

Rearview ?

? Stocks rally: The S&P 500 climbed 1.8% last week. It’s now up 8.9% from its March 8 closing low of 4,170, but still down 4.7% since the beginning of the year. For more on big rallies amid market down turns, read this and this.

? U.S. economic growth accelerates: The S&P Global Flash U.S. PMI, an index of private sector activity, rose to an 8-month high of 58.5 in March. (Note: Any reading above 50 signals expansion.) From S&P Global chief business economist Chris Williamson: “The pace of U.S. economic growth accelerated sharply in March as COVID-19 containment measures were relaxed to the lowest since the pandemic began, offsetting a drag from growing concerns about the Ukraine War. Output across both manufacturing and services rose at a rate not seen since last June with inflows of new business surging at a rate not witnessed since the strong rebound of the economy seen in the second quarter of last year.”

? Lowest unemployment claims in decades: Initial claims for unemployment insurance benefits are at the lowest level since September 6, 1969, with the latest weekly tally sitting at 187,000. For more on the strength of the labor market, read this.

? But consumer sentiment sours: Despite strong labor market prospects, sentiment continues to be weak — largely due to inflation. The University of Michigan’s index of consumer sentiment fell to 59.4 in March, its lowest level since August 2011. From the survey’s chief economist Richard Curtin: “Inflation was mentioned throughout the survey, whether the questions referred to personal finances, prospects for the economy, or assessments of buying conditions. When asked to explain changes in their finances in their own words, more consumers mentioned reduced living standards due to rising inflation than any other time except during the two worst recessions in the past fifty years: from March 1979 to April 1981, and from May to October 2008. Moreover, 32% of all consumers expected their overall financial position to worsen in the year ahead, the highest recorded level since the surveys started in the mid-1940s.“ For more on sentiment, read this.

? But consumers are still spending: Despite inflationary pressures and other worries, consumers are still spending. Nike, General Mills, and Olive Garden-parent Darden Restaurants all confirmed strong sales during the three months ending in February. For more on what’s powering spending, read this.

? Mortgage rates are surging: The average 30-year fixed-rate mortgage carried a 4.42% rate, the highest since January 2019. From Freddie Mac: “Rising inflation, escalating geopolitical uncertainty and the Federal Reserve’s actions are driving rates higher and weakening consumers’ purchasing power. In short, the rise in mortgage rates, combined with continued house price appreciation, is increasing monthly mortgage payments and quickly affecting homebuyers’ ability to keep up with the market.“

? Pending home sales fall: The pending home sales index fell 4.1% in February. “Pending transactions diminished in February mainly due to the low number of homes for sale,” Lawrence Yun, chief economist at the National Association of Realtors, said on Friday. “Buyer demand is still intense, but it’s as simple as ‘one cannot buy what is not for sale.'”

? The Fed’s ready to get aggressive: In its effort to cool inflation, Fed Chair Jerome Powell said the central bank is prepared to get aggressive with tightening monetary policy. Here’s Yahoo Finance’s Brian Cheung: “Powell joked that ‘nothing’ could stop the Fed from a double bump in interest rates (50 basis points, instead of 25 basis points) at the central bank’s next policy-setting meeting in the first week of May. A 50 basis point increase out of a single meeting has not been done since 2000, but Powell emphasized that the Fed is not committed to a specific path.“ For more on tighter monetary policy, read this and this.

Up the road ?

The highlight of the week will be the March jobs report on Friday. Economists estimate that U.S. employers added 475,00 jobs during the month. From Wells Fargo economists: “Job growth has been surprisingly strong and steady in recent months, with nonfarm payrolls growing an average of 582K the past three months. The resilient pace of hiring has been facilitated by workers flowing back into the labor force, as constraints around COVID have eased and financial needs have risen.“

A version of this post was originally published on TKer.co.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube