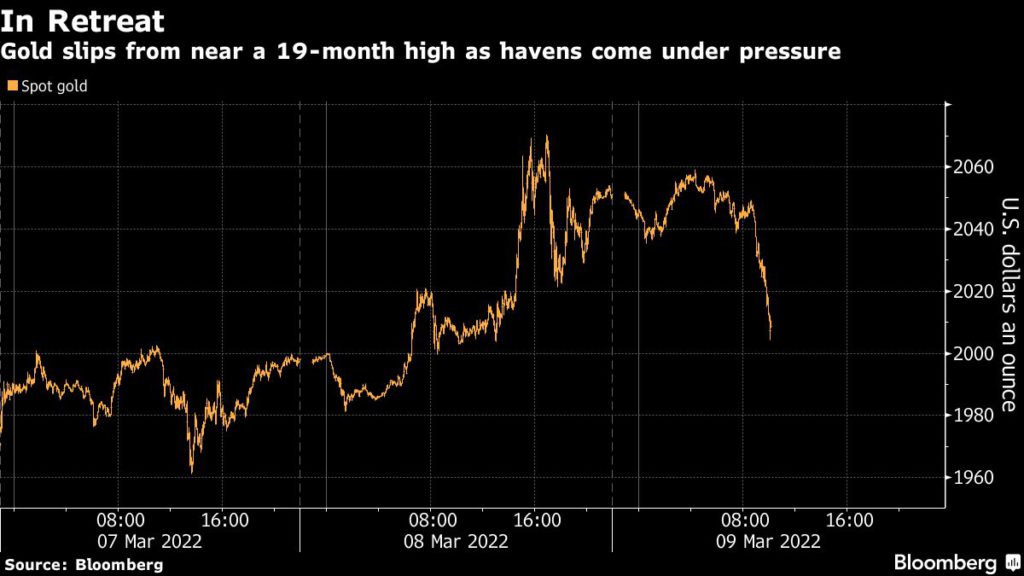

Gold price drops from 19-month high with risk sentiment improving

[Click here for an interactive chart of gold prices]

Treasuries and the dollar also fell on the improved risk appetite, while a retreat in oil prices helped riskier assets stage a comeback, with US stocks rebounding from a four-day selloff.

Despite the latest setback, bullion is still up 9% on the year as investors seek a hedge against the threat of an inflationary shock to the global economy.

Holdings in gold-backed exchange-traded funds have reached the highest since March 2021, with inflows of about 152 tonnes this year, according to initial data compiled by Bloomberg.

The impact of the war in Ukraine and sanctions on Russia have reverberated across the globe, driving commodities higher on supply woes. The latest move by the US to ban Russian oil has stoked further fears of stagflation, where prices rise while economic growth stutters.

“The ban on Russian oil by the US is causing more inflation jitters,” Howie Lee, an economist at Oversea-Chinese Banking Corp., told Bloomberg.

“We all saw that coming, but still, it feels like a rollercoaster drop moment. With this ban, oil is easily expected to trade at new records. By that correlation, it is not difficult to see why gold may also be trading at a new record high soon,” Lee added.

Michael McCarthy, chief strategy officer at Tiger Brokers, Australia, told Reuters that while a pullback to near $1,930 is likely, the long-term outlook remains positive.

“But if the current instability in geopolitical terms continues, it’s very likely we will seek fresh all-time highs for precious metals,” McCarthy added.

(With files from Bloomberg and Reuters)