Dalian iron ore price hovers near 7-month high on China stimulus hopes

The most-traded Dalian iron ore for September delivery ended daytime trading 0.5% higher at 867.50 yuan ($136.24) a tonne.

Rising for a fourth straight session, Dalian iron ore touched a session high of 879 yuan, near Monday’s seven-month peak at 882.50 yuan.

Still, traders were cautious in pushing iron ore prices higher following the Dalian exchange’s announcement of higher transaction fee and margin requirement for speculative trading.

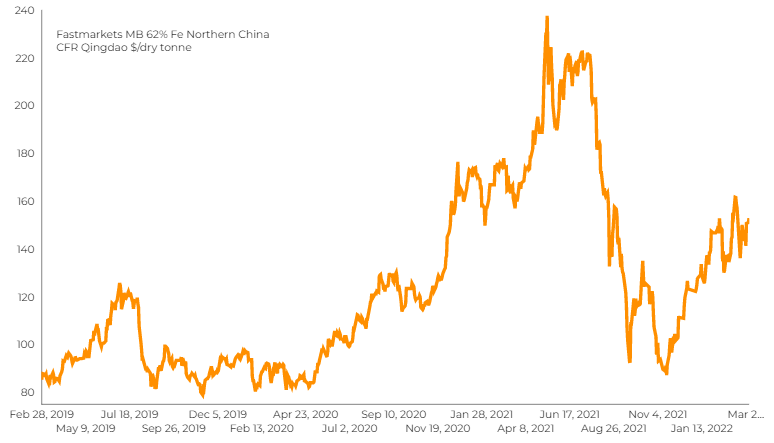

Dalian iron ore has risen about 30% this year, notwithstanding recent moves by Chinese authorities to curb a rally amid concerns about inflation as commodity prices soared.

“Expectations of policy support in China outweighed concerns of weaker demand amid lockdowns,” ANZ commodity strategists said in a note.

Related: Simandou iron ore mine developers risk penalties if timeline missed, Guinea says

Fitch Ratings, in a statement, said the costs of iron ore and coal were likely to remain high in 2022 due to geopolitical tensions and state-mandated measures to reduce carbon emissions.

It also expects steel demand to recover “quite strongly” in the second quarter when the lockdowns are lifted.

Despite the lockdowns, traders said some mills particularly in China’s steel production hub in Tangshan city and factories in other areas hit by the coronavirus surge continued to operate.

(With files from Reuters)