Apple: Here Comes a Monster Growth Cycle

Is the tech sector oversold? Wedbush’s Daniel Ives believes so, claiming it is more so than at any other point during the past 5 years.

However, change is in the air, and surveying the current landscape, the 5-star analyst believes there are plenty of opportunities on offer for investors right now. One, though, stands out the most. “Since the Fed decision last week we have seen a clear ‘risk on’ mentality starting to take shape as the Street picks up high quality tech stocks at what we would characterize as relative bargain prices.” Ives recently said. “We would strongly be buying cloud, software, cyber security, chips, and stalwart tech names led by FAANG with Apple (AAPL) our clear favorite.”

While supply chain shortages have yet to abate, based on Ives’ recent checks in Asia, the analyst says there are some “discernible improvements” as we head into the June quarter. And this bodes well for the upcoming iPhone 14 release.

Ives also believes the demand trends for the iPhone have been very strong, estimating that based on the 5G iPhone 12/iPhone 13 “Tag Team product cycle,” over the last 12 months, Apple has added around 300 bps of market share in the “key” China region.

Add in the expected sale of around 30 million units initially for the recently launched iPhone SE, and Ives thinks we are looking at “the strongest product cycle for Cook & Co. since 2015.”

In fact, given the market’s recent “risk off dynamic,” tech equities were sold off “indiscriminately across the board,” without proper consideration of their positioning. And with his checks indicating the digital transformation is no way slowing down, but actually gathering more steam, Ives believes Apple is “setting up for a monster growth cycle over the next 12 to 18 that is not baked into shares at current levels.”

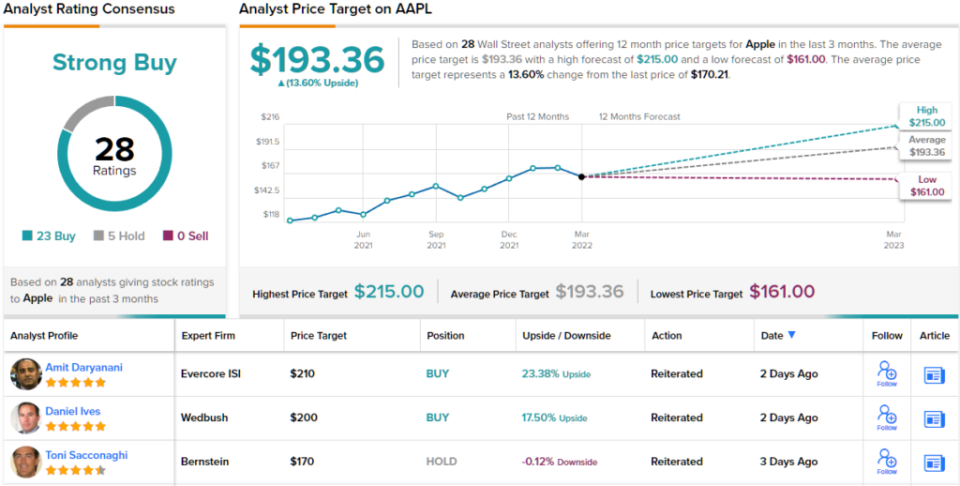

To this end, the analyst reiterated an Outperform (i.e., Buy) rating on Apple shares along with a $200 price target. The implication for investors? Upside of 17.5% from current levels. (To watch Ives’ track record, click here)

The majority of Wall Street analysts are in agreement here; the stock boasts a Strong Buy consensus rating, based on 23 Buys vs. 5 Holds. At $193.36, the average target suggests shares will climb ~14% higher in the year ahead. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.