Appia’s Elliot Lake uranium-REE property includes 101 claims 3 km north of Elliot Lake. The property is also only 58 km northeast of Blind River, Ontario, where Cameco operates the world’s largest commercial uranium refinery.

Spurred by the necessities of the Cold War, uranium mines in Elliot Lake produced 362 million lb. of uranium oxide from 1955 through 1996.

The resources at Appia’s Elliot Lake project were last updated in 2013 and include two zones. Both zones are largely open along strike and down dip.

The Teasdale Lake zone has 14.4 million indicated tons grading 0.554 lb. uranium oxide per ton (for 8 million lb. contained metal) and 0.3.3 lb. total REE per ton (for 47.7 million lb. total REEs). The inferred portion is 42.4 million tons at 0.474 lb. uranium oxide (for 20.1 million lb. contained metal) and 3.14 lb. total REE per ton (for 133.2 million lb. total REE).

The Banana Lake zone contains only an inferred uranium resource of 30.3 million tons grading 0.91 lb. uranium oxide per tonne (for 27.6 million lb. contained metals).

Last year, Appia focused most of its exploration effort on its wholly owned Alces Lake REE property north of Lake Athabasca and about 34 km east of Uranium City. Drilling returned high-grade intersections of total rare earth oxides (TREOs) and gallium. The company reported finding massive monazite outcropping at surface at the Ivan and Dylan zones.

The company also flew 944 line-km of versatile time domain electromagnetic (VTEM) surveys targeting high-grade uranium mineralization over its North Wollaston and Loranger uranium properties. These two properties are polymetallic. In the case of North Wollaston, there is potential for molybdenum and REEs as well as uranium; and at Loranger the hunt may lead to uranium, zinc, copper and molybdenum.

Appia has a third uranium asset in northern Saskatchewan, the Eastside property close to the Manitoba border. It too is polymetallic, having potential for molybdenum, copper, platinum group metals (PGMs) as well as uranium. The uranium occurrences at Eastside have geophysical features, structures and rock types similar to known high-grade uranium deposits.

In January, Appia staked an additional 27,291 contiguous hectares of a prospective claim block 50 km south of Fond du Lac, Saskatchewan. Named Otherside, the property has similar geological and geophysical signatures to the Loranger property. Part of the Otherside claims were previously owned by Appia.

Appia has a market capitalization of C$47.6 million ($37.5m).

Azincourt Energy

Azincourt Energy (TSXV: AAZ; US-OTC: AZURF) makes uranium discovery its business. The company has three properties: East Preston and Hatchet Lake in northern Saskatchewan, and the Escalera uranium-lithium project in Peru.

The company owns over 70% of the 25,000 hectare East Preston exploration project situated in the western Athabasca Basin. Dixie Gold and Skyharbour Resources each have a 15% interest. East Preston is strategically located near NexGen’s Arrow deposit, Fission Uranium’s Triple R deposit, and the Spitfire joint venture of Cameco, Orano and Purepoint.

The East Preston project has multiple, classic targets for basement-hosted unconformity uranium deposits. Azincourt drilled conductive corridors along several zones last year, but no results were released. The work confirmed that geophysical conductors are structurally disrupted and host graphite, sulphide and carbonates. Anomalous radioactivity was recorded.

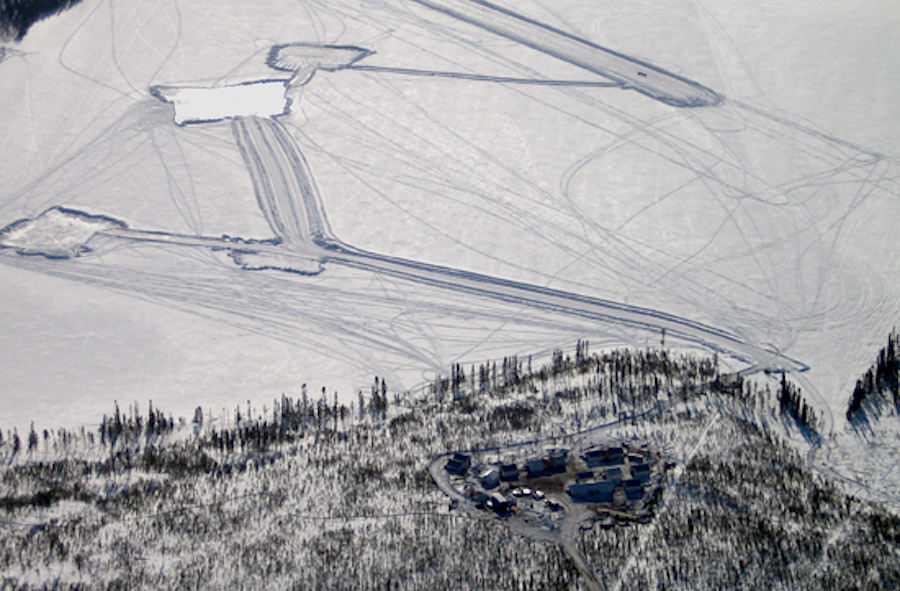

The construction of the winter exploration camp at Snoop Lake for the East Preston project began in January. The drill program will also prioritize the disrupted zones previously identified. Azincourt is also engaged in regular meetings with the Clearwater River Dene Nation and other rights holders as work proceeds at East Preston.

Hatchet Lake is located in the northeast extension of the Western Wollaston domain, again in the Athabasca Basin. The property is adjacent to the northeast margin of the basin on-trend with other uranium deposits and within 30 km of the Eagle Point mine owned by Cameco.

Azincourt is earning a 75% interest in Hatchet Lake from ValOre Metals. Two high-priority targets — Upper Manson and SW Scrimes zones — have been identified. Sampling done by owner ValOre Metals returned assays as high as 2.42% uranium oxide.

The Escalera Group in southeast Peru is 100%-owned. It consists of three concessions — Lituania, Condorlit and Escalera — covering a combined area of 7,400 hectares. Eleven of the best grab samples collected in 2018 assayed up to 0.12% uranium oxide.

Azincourt Energy has a market cap of $38.7 million ($30m).

Baseload Energy

Baseload Energy (TSXV: FIND; US-OTC: BSENF) has a 100%-interest in three prospective projects —Hook, Catharsis and Shadow — near the southeast rim of the Athabasca Basin.

The Hook project is located 40 km southeast of the McArthur River uranium mine owned by Cameco and Orono, and 60 km northeast of the Key Lake uranium mill, both of which are owned by Cameco and Orono. It was at Hook that Baseload made the Ackio high-grade uranium discovery last year.

Assays from the first drill hole at the target returned 0.5 metre grading 1.29% uranium oxide at 138.8 metres below surface and 0.5 metre grading 0.66% uranium oxide at 142.2 metres. The primary mineralized zone measures 15.5 metres thick grading 0.13% uranium oxide starting at 134.3 metres below surface.A second drill hole returned 0.5 metre grading 0.67% uranium oxide at 131.6 metres. Elevated uranium concentrations were also intersected in two additional holes: 5.5 metres grading 0.24% uranium oxide at 128.6 metres and 2 metres grading 0.24% uranium oxide at 99 metres.

Baseload says the drill core from Ackio is visually similar to other basement-hosted uranium deposits in the Athabasca Basin, and the discovery hole appeared similar to the Arrow deposit at the Rook I project that belongs to NexGen Energy.

Drilling at Ackio is in the early stages, but the company is beginning a 10,000-metre diamond drill program this winter. An initial resource estimate could follow later in the year.

Baseload is also planning to drill this year at its Catharsis property, 60 km south of the Athabasca Basin margin and 75 km southwest of the Key Lake mill. Numerous high-grade uranium surface showings have been made, and an airborne versatile time domain electromagnetic (VTEM) survey is to be completed in the first quarter, followed by 3,500 to 5,000 metres of drilling.

The Shadow project in the Virgin River shear zone will be the site of an airborne gravity survey beginning in the second quarter. The company is looking for potential basement-hosted deposits. Baseload is consulting with Indigenous communities about a possible drilling program there.

Baseload Energy has a market capitalization of C$58.8 million ($46.4m).

CanAlaska Uranium

CanAlaska Uranium (TSXV: CVV; US-OTC: CVVUF) had active uranium drilling programs last year at Waterbury, West McArthur and the Moon joint venture, all of which are located in Saskatchewan. It also drilled for copper at Quesnel, British Columbia, for nickel at Manibridge, Manitoba, and mounted ground exploration for diamonds in the northwestern Athabasca.

Waterbury is subdivided in the East property along the Cigar Lake corridor and the South property along the Rabbit Lake Fault. CanAlaska made a new polymetallic discovery at Waterbury South in the winter of 2021 at the unconformity of the clastic sediments and basement rocks.

Hole WAT-009 returned the best intersection of 405 parts per million (ppm) uranium, 2.42% nickel, 0.5% zinc, 0.4% lead, 801 ppm cobalt, 3.9 ppm silver, and 2.34% arsenic at about 349 metres in the basement rocks. The same hole returned several other intersections including 0.5 metre grading 84 ppm uranium in sandstone, and in the basement rocks, 64 ppm, 200 ppm and 68 ppm uranium.

Terra Uranium has an option to earn up to 80% interest in the McTavish and Waterbury East project, as defined by three earn-in stages. The Australian company will fund A$5 million ($4.5 million) in exploration with CanAlaska as operator until Terra’s interest reaches 60%, then the operator will be Terra. The option calls for delivering and filing a JORC compliant resource of at least 30 million lb. uranium oxide on either property and granting CanAlaska a 2.25% net smelter return royalty.

The Cree East uranium property is 35 km from the Key Lake mill and hosts a large unconformity uranium deposit. Nine targets have been selected using versatile time domain electromagnetic (VTEM) data with the A and B zones being the most promising.

In July 2017, CanAlaska bought out its joint-venture partner and is now seeking another partner for the project. Drilling in 2010 through 2012 intersected a large alteration zone of anomalous polymetallic enrichments.

CanAlaska completed numerous airborne and ground geophysical surveys at the West McArthur uranium discovery from 2005 to 2012. Cameco was granted an option on the property and began drilling in 2016, discovering the 42 zone the following year. CanAlaska (74% and operator) and Cameco (26%) formed a joint venture in 2019 to further test the potential.

West McArthur has several very large unconformity targets with large haloes between 700 and 900 metres below surface. A 5,000-metre summer drill program fully funded by CanAlaska began last August. Hole WMA063-1 returned 1.7 metres averaging 0.17% uranium oxide and 10 metres averaging 0.76% uranium oxide, including 2.6 metres at 1.62% uranium oxide.

The joint venture has approved a C$5 million exploration program at West McArthur for this year. Work will focus on the 42 zone area, a newly identified alteration and structure along the 2-km southwest extension.

CanAlaska took an option on the Key Extension property in September 2021. CanAlaska can earn a 100% interest from Durama Enterprises over a four-year period. The agreement includes payments of C$50,000, the issuance of 300,000 CanAlaska shares, and completion of work totaling C$850,000.

Work permit applications have been submitted to the province for the 2022 field season. A ground gravity survey along the Key Lake corridor, regional prospecting, and reinterpretation of a historical VTEM are planned. Targets will be chosen for drilling in late 2022.

CanAlaska has a portfolio of 11 other uranium properties scattered around the Athabasca Basin and is seeking joint-venture partners for most of them.

When not hunting uranium, CanAlaska explores for nickel in Manitoba’s Thompson Nickel Belt. This year drilling is planned at the Manibridge nickel property on a new high-grade discovery 2 km north of a past-producing nickel mine. A staged option agreement with D Block Discoveries has been granted.

The company is also active at copper projects elsewhere in northern Manitoba and in British Columbia. In addition, CanAlaska holds three claims with kimberlite potential north of Patterson Lake, Saskatchewan.

The market capitalization for CanAlaska Uranium is C$39.6 million ($31.2m).

Global Atomic

Global Atomic (TSX: GLO; US-OTC: GLATF) is the 90% owner of the Dasa uranium project under development in Niger. (The government of Niger holds the remaining 10% stake.) Global Atomic began exploration in 2007, and last year completed a feasibility study. The mining permit and environmental compliance certificate were also received in 2021.

Not only was the company busy with feasibility and permits last year, but it also ran a successful pilot plant, signed a marketing agreement, engaged advisors to assist in project debt financing, and made a production decision. CMAC-Thyssen was hired to collar the portal and begin underground development.

Meanwhile, Global Atomic embarked on a 15,000-metre drill program to increase phase one resources and update phase two resources. The best recent hole of this program returned 65 metres grading 5.49% uranium oxide including 12.5 metres grading 14.24% uranium oxide.

The feasibility study outlined a high-grade, long-life project with the first phase of production that carries a 12-year mine plan. It would produce a total of 45.4 million lb. of uranium oxide — 4.7 million lb. annually in years 2 to 8, and 2.3 million lb. in each of years 9 to 13. The average all-in sustaining cost is estimated to be US$21.93 per lb. yellowcake.

According to the feasibility study, resources at Dasa stand at 25.6 million indicated open pit tonnes grading 1.71% uranium oxide and 710,000 indicated underground tonnes grading 3.25% uranium oxide. The total indicated resource contains 101.6 million lb. uranium oxide.

The inferred resource includes 18.9 million open-pit tonnes grading 1.36% uranium oxide and 3.4 million underground tonnes grading 4.15% uranium oxide. The total inferred resource contains 87.6 million lb. uranium oxide.

The initial capital requirement is $207.6 million, split $61.9 million for mine development, $143.2 million for the processing plant, and $2.6 million for the tailings management facility. Sustaining costs would be another $137.3 million. Payback would be achieved three years after production starts in 2024, assuming a uranium price of $35 per pound.

The after-tax net present value with an 8% discount rate at Dasa is $157 million, and the internal rate of return is 22.7%.

Global Atomic says it will minimize carbon emission from Dasa by using solar power to supplement the project’s energy needs and by the use of battery-electric mining vehicles.

The company also maintains a 49% sake in the Befesa Silvermet operation In Turkey, which recovers zinc from local furnace dust and waste from local steel mills. A new Waelz kiln was commissioned in 2019 and produces about 50 million to 60 million lb. zinc annually in a 70% zinc concentrate. This operation provides cash flow to the company, allowing it to pursue the Dasa project and six exploration projects in Niger.

Global Atomic has a market cap of C$567.5 million ($447m).

IsoEnergy

IsoEnergy (TSXV: ISO) has over 20 uranium exploration properties scattered around the eastern and southern regions of the Athabasca Basin. Chief among them is the 100%-owned Larocque East project, home of the high-grade Hurricane discovery. This property was acquired in May 2018.

The Hurricane zone was first identified two months later when the discovery hole returned 8.5 metres grading 1.26% uranium oxide, including 2.5 metres grading 3.58% uranium oxide. Mineralization was intersected about 325 metres below surface. Drilling completed last year continued to return high-grade intersections from relatively shallow depths. Initial assays included 12 metres grading 5.2% uranium oxide, including among other higher grades, a 2 metre section assaying 27.6% uranium oxide in hole LE21-78C1.

Additional highlights from the program included 0.5 metre grading 0.1% uranium oxide and 3.5 metres grading 2.3% uranium oxide, including 2 metres grading 4%, including 0.5 metre grading 9% in hole LE21-80; 0.5 metre grading 0.2% uranium oxide and 4.5 metres grading 0.9%, including 1 metre grading 1.4% in hole LE21-82; and 3 metres grading 0.5% uranium oxide, including 0.5 metre grading 1.9% in hole LE21-84.

The initial assays also identified the presence of nickel. The highest nickel occurrence was 16.2% over 1.4 metres in hole LE21-82. The three other holes returned 0.1% to 1.1% nickel along their lengths.

The known mineralization at Hurricane extends over a 1 km strike length and is 12 metres thick and 93 metres wide in an unconformity-hosted deposit. It is just 40 km from the McClean Lake mill owned by Orono, Denison and OURD Canada. The property has no lake or water cover.

IsoEnergy’s other uranium exploration properties in Saskatchewan include Geiger, Collins Bay Extension, Thorburn Lake, and Radio. Last year it drilled 4,200 metres in 12 holes at the Geiger property, 20 km from the McClean Lake mill. It also flew an airborne geophysical survey over the Collins Bay Extension.

The company has launched a winter exploration program that includes 11,900 metres of diamond drilling at Larocque East to expand the Hurricane zone and ground geophysical surveys at Geiger, Ranger and Hawk.

Late last December, IsoEnergy divested its Mountain Lake uranium property in Nunavut under terms of an option agreement with Consolidated Uranium. This property had a historical inferred resource of 1.6 million tonnes grading 0.23% uranium oxide for 8.2 million contained pounds.

The market capitalization of IsoEnergy is C$359.8 million ($283m).

Standard Uranium

Standard Uranium (TSXV: STND; US-OTC: STTDF) is exploring northern Saskatchewan for high-grade deposits. The wholly owned flagship Davidson River project lies near the southwest rim of the Athabasca Basin. It covers a potential extension of the structural trend that hosts Fission Uranium’s Triple R deposit and NexGen Energy’s Arrow deposit.

Standard completed the phase two summer drill campaign last year at Davidson River, but assays were unavailable at press time. The company did say that hole DR-21-022 from 330.5 to 331 metres had radioactivity measured by a handheld scintillometer of 700 counts per second (cps). Six other half-metre intersections returned 310 to 560 cps, the highest of which came from hole DR-21-017 at about 461 metres below surface.

The company intends to drill the four trends — Thunderbird, Bronco, Warrior and Saint — this summer. The Bronco and Thunderbird trends have several untested geophysical targets remaining. The work is fully permitted, and the company says that local First Nations have been engaged with the project.

The 100%-owned Sun Dog uranium project is on the north rim of the Athabasca Basin near the historic Uranium City area. Historical work included airborne and ground surveys, underwater and lake bed surveys, and wide-spaced reconnaissance drilling. The drilling returned 0.1% uranium oxide over 1 metre within graphite-rich basement rocks. A site visit in 2020 confirmed historical surface showings that returned grab samples of 3.58%, 1.7% and 0.7% uranium oxide.

The 2022 Sun Dog work will include a ground gravity survey, follow-up mapping, geological work on surface, and continuing community engagement. The inaugural drill program is scheduled for winter 2022.

The Atlantic, Canary and Ascent properties (all 100%-owned) collectively make up what Standard Uranium calls the “Eastern Basin” projects for their location on the east side of the Athabasca Basin. Based on the success of nearby exploration programs such as IsoEnergy at its Hurricane deposit, the company believes these properties could be targets for future drill testing.

Standard Uranium has a market cap of C$22.7 million ($17.9m).

Trench Metals (TSXV: TMC) is exploring for uranium deposits, the latest of which, Higginson Lake, covers 2,312 hectares about 52 km northeast of Stony Rapids, Saskatchewan. Trench Metals was granted an option to acquire 100% of the project in October last year.

The property hosts two historical areas of mineralization: the Corrigan Lake showing and the Higginson Lake showing, about 550 metres northwest of the Corrigan Lake showing. Previous owners estimated resources containing 4.4 million lb. uranium oxide at Corrigan Lake and 400,000 lb. uranium oxide at Higginson Lake.

Trench Metals is reviewing the historical data and observations ahead of an exploration program.

Trench owns 100% of the Gorilla Lake property in the heart of the Athabasca Basin near the former Cluff Lake uranium mine, which operated from 1981 to 2002 and produced over 62 million lb. of yellowcake. The closed mine is now owned by Orono.

Drilling in the mid-1970s by previous owners at Gorilla Lake intersected two zones of mineralization. One zone returned 7 metres grading 0.17% uranium oxide, including 1 metre grading 0.82% uranium oxide. The second hole returned 2 metres grading 0.20% uranium oxide.

The summer 2021 exploration program saw the team clear access to the site, select radioactive boulders, and take rock and drill samples for analysis at the Saskatchewan Research Council. The highest scintillometer reading observed from the samples was 4,400 counts per second (cps). Assay results are pending.

The market cap of Trench Metals is C$33.5 million ($26.4m).

(This article first appeared in The Northern Miner)