Stock futures reverse early losses after Biden, Putin agree ‘in principle’ to summit

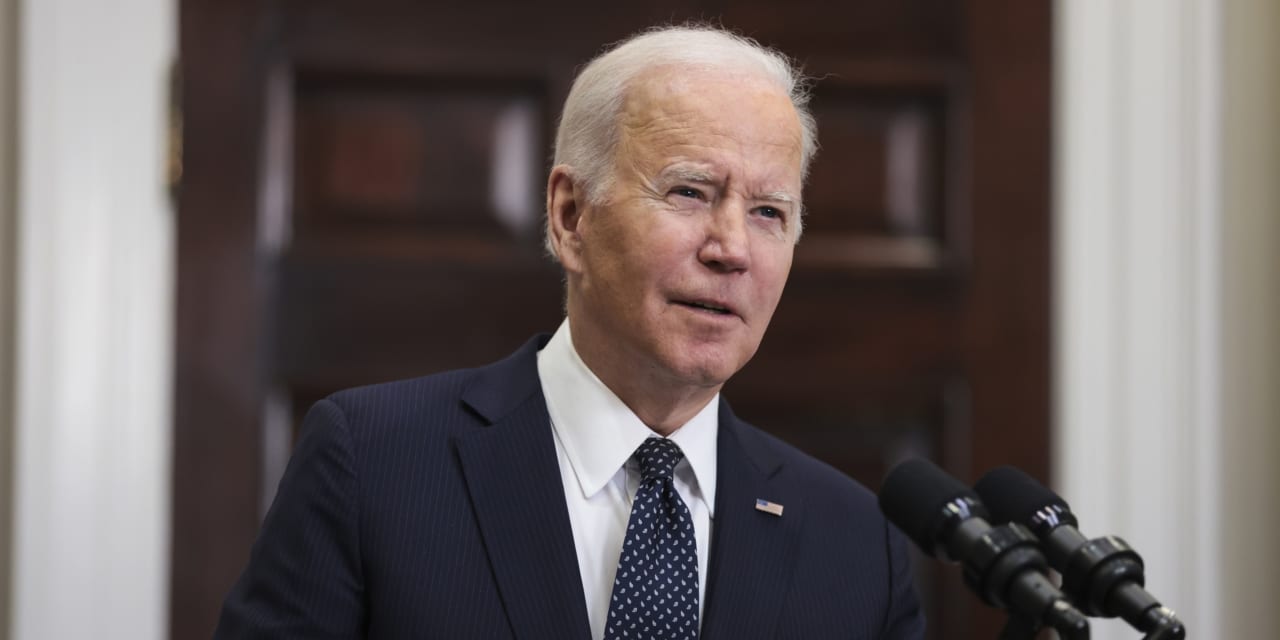

U.S stock-index futures bounced back from early-session losses Sunday after an announcement that President Joe Biden and Russia’s Vladimir Putin have agreed in principle to a summit to ease tensions over Ukraine.

Dow Jones Industrial Average futures YM00,

Oil prices CLH22,

Late Sunday, French President Emmanuel Macron’s office said that Biden and Putin have agreed “in principle” to a summit in the coming weeks, after a series of conversations with the French leader, but only if Russia does not invade Ukraine

The U.S. confirmed the announcement. “President Biden accepted in principle a meeting with President Putin … again, if an invasion hasn’t happened. We are always ready for diplomacy,” White House press secretary Jen Psaski said Sunday night.

That sharply defused tensions that had ratcheted higher earlier Sunday after Russia reneged on a pledge to withdraw tens of thousands of troops from neighboring Belarus at the conclusion of military exercises. U.S. officials said Sunday that Russia has decided to invade Ukraine, based on intelligence that field commanders have been given final to prepare for an attack. Diplomatic efforts to avoid war continue, however.

Read: What a Russian invasion of Ukraine would mean for the stock market, oil and other assets

The U.S. and its Western allies have vowed to impose tough sanctions against Russia if it invades, and Russia could retaliate by cutting oil and gas exports. Speaking at the Munich Security Conference on Sunday, Vice President Kamala Harris warned that U.S. consumers could be affected, paying higher energy prices.

Stocks have fallen for two consecutive weeks amid fears of a land war in Europe combined with rising inflation and the likelihood of multiple hikes in interest rates.

On Friday, the Dow DJIA,

For the week, the Dow dropped 1.9%, the S&P 500 fell 1.6% and the Nasdaq declined 1.8%.

U.S. markets will be closed Monday in observance of Presidents Day.