Russia’s invasion of Ukraine could keep stocks sliding for weeks before the market finally hits bottom

U.S. stocks staged an impressive reversal on Feb. 24 — including a 950-point intraday move to the upside for the Dow Jones Industrial Average DJIA,

Market bottoms more typically are made when despondent investors throw in the towel. Yet the narrative being used to support the “bottom is in” belief in the Russia-Ukraine conflict is that stocks spring back quickly from geopolitical crises. As MarketWatch reported earlier this week: “Despite near-term volatility in the wake of geopolitical events over the past three decades, ranging from terrorist attacks to the start of wars, stocks have tended to bounce back relatively quickly, … rallying 4.6% on average in the six months following such crises dating back to 1990 and rising 81% of the time.”

Or consider this tweet a money manager sent out after the news broke that Russia had invaded Ukraine: “Excellent buying opportunities never feel good at the time.” After presenting one of the many lists of past geopolitical events that are circulating around Wall Street, the tweet continued: “Lesson? Buy when there’s blood in the streets.”

“ Like telling a boxer to celebrate being knocked down because it creates the opportunity to get up again. ”

These narratives gloss over the extent of the short-term losses that geopolitical events inflict on investors. The attitude adopted by the market’s cheerleaders is like telling a boxer to celebrate being knocked down because it creates the opportunity to get up again.

Another problem with these rosy pictures is that they subjectively use past geopolitical crises to prove their point. A far different conclusion emerges if we focus on a specific subset of global crises relative to this latest one: war.

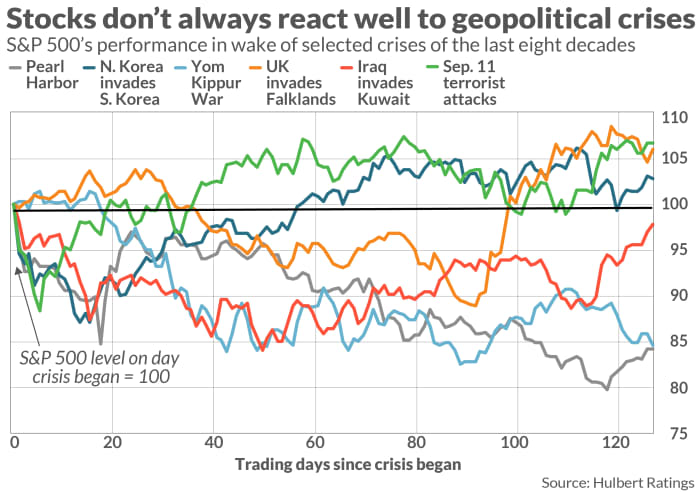

The chart below highlights six major geopolitical events since 1941 that involved military invasions and/or threats to national sovereignty. The chart plots the S&P 500’s SPX,

Notice too that it can take weeks or months following a crisis before the market hits bottom. The average across all six of the crises in the chart is 60 trading days — about three months. In no past crisis did the market bottom on the day of the invasion or attack.

Analysts are not wrong to point out that the market often registers a bottom several weeks after a geopolitical crisis. But it’s a matter of emphasis. It’s one thing to remind investors of this history when they expect that the worst is still ahead. It’s quite another to do so when investors believe that new bull-market highs will come later this year.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Also read: This market-timing model says you probably have too much money in stocks