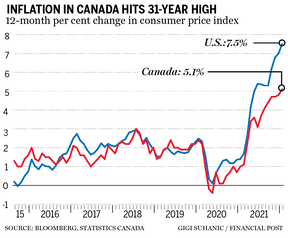

Inflation surges to three-decade high, piling pressure on Bank of Canada to raise rates

Kevin Carmichael: Inflation at this pace guarantees a raise in March and puts half-point hike in play

Article content

Canada’s main inflation gauge is glowing an even brighter shade of red.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The consumer price index (CPI) increased 5.1 per cent in January from a year earlier, marking the first time the index has exceeded five per cent since September 1991, Statistics Canada reported on Feb. 16.

Inflation at that pace guarantees the Bank of Canada will raise interest rates at the conclusion of its next round of policy deliberations on March 2, and could stoke debate over whether Governor Tiff Macklem and his deputies will lift borrowing costs by a half point instead of the customary quarter-point increase.

Macklem, who opted against raising the benchmark rate last month, has said repeatedly since December that he’s “uncomfortable” with inflation that has surged well past the central bank’s target of two per cent. The latest reading will rekindle worries that the Bank of Canada made a mistake by passing on an opportunity to raise interest rates in January and will now have to play catchup.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

To be sure, the Bank of Canada won’t be surprised by the CPI’s jump to 5.1 per cent from 4.8 per cent in December. The central bank’s latest economic outlook has the price index posting year-over-year increases that average 5.1 per cent over the first quarter.

But Macklem won’t like some of the details in Statistics Canada’s latest checks on the hundreds of goods and services it monitors to get a reading of overall price pressures. Excluding gasoline, the CPI increased 4.3 per cent from January 2020, the biggest gain since Statistics Canada introduced the measure in 1999 to get a cleaner read on underlying cost pressures because oil prices are so volatile. The new report shows inflationary pressures that began with commodity prices is now spreading throughout the economy.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The CPI surged 0.9 per cent from December, the largest one-month increase since January 2017.

All the groups that Statistics Canada uses to arrange the items in its price basket posted significant gains. The agency’s measure of shelter costs increased 6.2 per cent from January 2021, the fastest since February 1990.

Real-estate prices aren’t included in the CPI because Statistics Canada classifies homes as assets, since they aren’t something consumers purchase on a regular basis. However, housing prices influence other costs related to owning or renting a dwelling, including estimates of how much it would cost homeowners to replace their current living arrangements. Replacement costs surged 13.5 per cent from a year earlier, outweighing the disinflationary effect of lower mortgage costs, which were 6.8 per cent lower.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Food prices at grocery stores rose 6.5 per cent on the year, compared to 5.7 per cent in December, as reduced supply after a period of tough growing conditions around the world continued to fall well short of demand. Higher shipping costs from various disruptions in supply systems are also putting upward pressure on food prices, Statistics Canada said.

Gasoline remained a key driver of overall inflation. Prices increased more than 30 per cent from January 2021 as oil prices jumped amid worries that Russia was on the verge of invading Ukraine, aggravating the most intense period of geopolitics since the end of the Cold War.

“Simply put, this is far too hot for comfort for the Bank of Canada, so expect a steady series of rate hikes in the coming meetings,” Douglas Porter, chief economist at BMO Capital Markets, said in a note to his clients. “We look for four in a row to start, and it may well require much more than that to bring inflation to heel.”

• Email: [email protected] | Twitter: carmichaelkevin

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.