First Mover Americas: As Bitcoin Dips, Inflation ‘Breakevens’ Offer Hope to Bulls

Good morning, and welcome to First Mover, our daily newsletter putting the latest moves in crypto markets in context. Sign up here to get it in your inbox each weekday morning.

Here’s what’s happening this morning:

-

Market Moves: Bitcoin reverses early gains as Kremlin dashes hopes for Ukraine peace summit.

-

Featured stories: U.S. inflation breakevens suggest Fed’s tightening cycle may be shallow, support bitcoin’s long-term bull prospects.

CoinDesk TV show “First Mover,” is on a break due to President’s Day holiday in the U.S. and will return on Tuesday

Market Moves

By Omkar Godbole

Bitcoin is back on the defensive, with Kremlin calling the idea of a dialogue between Russian President Vladimir Putin and his U.S. counterpart Joe Biden premature and dashing hopes of a potential Ukraine peace summit.

The cryptocurrency was last seen trading near $37,600, representing a 2% drop on the day. Prices hit a high of $39,500 during the European hours after France championed the idea of a Biden-Putin dialogue over Ukraine. Rest of the cryptocurrencies have come off daily highs, tracking bitcoin with ether funds seeing renewed outflows, according to ByteTree data.

With the U.S. markets closed on account of the Presidents’ day holiday, bitcoin appears to be the only macro asset available for trading in the spot and derivatives market. As such, escalation of tensions between Russia-Ukraine may lead to sharp losses in the cryptocurrency.

The daily chart paints a bearish picture, with a rising trendline convincingly violated alongside a below-50 or bearish reading on the relative strength index and a negative MACD indicator.

The double whammy of Fed fears and lingering geopolitical tensions are likely to keep bitcoin under pressure in the short term. Calls for a 50 basis point rate hike in March have grown in the wake of the hotter-than-expected January inflation data released early this month.

Also read: Making Sense of India’s New Crypto Rules

Latest Headlines

Breakevens Support Bitcoin’s Long-Term Bull Case

By Omkar Godbole

Despite the recent crash, bitcoin bulls remain convinced of the cryptocurrency’s long-term prospects, with many anticipating a shallow Federal Reserve (Fed) rate hike cycle.

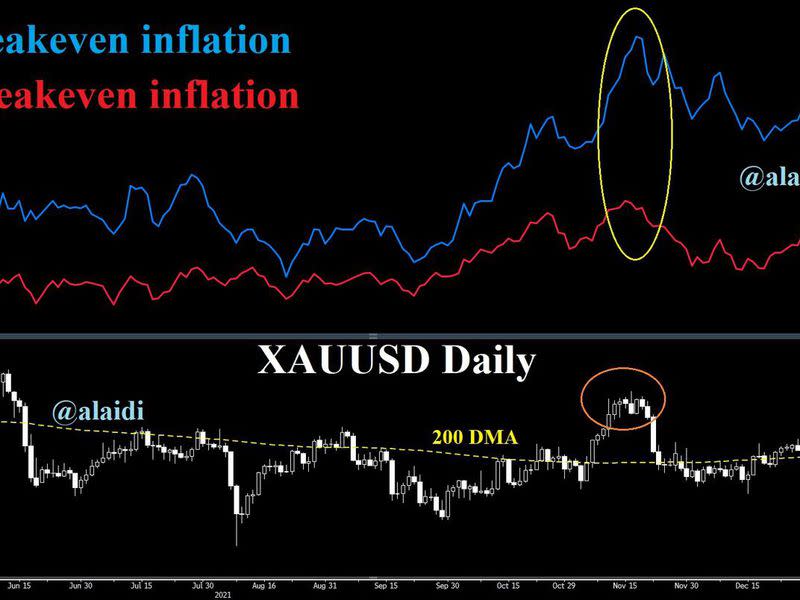

Data on U.S. inflation breakevens, which signal the expected path of price pressures over different timeframes, suggests they may be right.

The spread between the 10- and two-year breakeven inflation rates fell to a record low of -1.2% last week. That’s perhaps a sign of market players expecting inflation to drop back in the long term, weakening the case for aggressive and prolonged stimulus withdrawal by the Fed.

“It’s another way of telling us that inflation will drop back in the longer term, thereby possibly cutting the life of any Fed tightening campaign. An inflation level that is high enough to eliminate deflation fears, but low enough to keep Fed hawks at bay,” Ashraf Laidi, strategist and trader, founder of Intermarket Strategy and author of Currency Trading & Intermarket Analysis, said in a blogpost.

Inflation breakevens are calculated by subtracting the yield of an inflation-protected bond from the yield of a nominal bond during the same period.

The record low spread between the 10- and two-year breakeven rates suggest the Fed tightening fears may be overdone and bitcoin could survive the impending liquidity withdrawal.

According to Laidi, the narrowing spread probably helped gold chalk out gains in recent weeks. Meanwhile, bitcoin, often touted as digital gold, failed, perhaps due to its tight correlation with growth stocks.

Crypto financial services provider Babel Finance foresees bitcoin picking a strong bid along with growth stocks in the second half of 2022.

Axie Sales Surpass $4 Billion

By Omkar Godbole

Axie Infinity, a play-to-earn (P2E) game launched in 2018, has surpassed $4 billion in lifetime non-fungible tokens sales, according to data tracked by DappRadar.

“Nearly two million individual traders participated in the market palace, with the average Axie price at just under $200,” Ilan Solot, a partner at the Tagus Capital Multi-Strategy Fund, said in an email. ” Axie is now the third-largest in the space.”

The supposedly-recession-proof game has been a big hit in Philipines and other emerging economies, including India.

“I tried out Axie by sheer intrigue. I was curious to know how a relatively new game could amass 300K daily active users, which was in October 2021, post which I have played and studied a few other P2E models, namely – Skyweaver and Neon District,” Adwait Rangnekar, a Mumbai-based developer and former Axie player told CoinDesk in a WhatsApp chat.

“Online player communities thrive on an active and contributing user base. The Axie Comunity has a very strong online presence and averages more than 2 million daily active users, which attracts players. These numbers are similar to DOTA2, League of Legends (LoL), and MMORPG. Traders, like gamers, also seek a community that can offer avenues where they can get more done as a group,” Rangnekar added.