Currencies Roiled as Russia Sanctions Ripple in Global Markets

(Bloomberg) — Emerging-market currencies slumped and Australian bonds soared as global markets opened in Asia Monday, in some of the first signs of the growing financial fallout from Russia’s assault on Ukraine and the West’s response via sanctions.

Most Read from Bloomberg

The Russian ruble will be in focus, along with potential currency havens such as the U.S. dollar, which climbed against the euro and risk-sentiment proxies such as the Australian dollar. The South African and Turkish currencies slumped early on Monday as emerging-market currencies face contagion concerns. Australian 10-year bond yields dropped five basis points to 2.18%.

Hard-currency bonds from Russia and Ukraine will closely be watched following credit-rating cuts by major assessors late Friday, as will a swath of global markets from oil and wheat to Treasuries and bank stocks.

“Safe havens will likely remain bid in the current environment,” said Geoffrey Yu, senior strategist for EMEA Markets at BNY Mellon. “In currencies, we note that last week the yen and Swiss franc did not materially outperform, so we would just focus on dollar demand for the time being.”

The U.S. and its European allies stepped up their response to the escalating conflict as Vladimir Putin ordered Russia’s military advance to proceed, announcing plans to sanction the central bank in Moscow and cut off various Russian lenders from the critical SWIFT financial messaging system. That comes on top of earlier moves against the country’s biggest banks and restrictions on the nation’s bonds.

The euro fell more than 1% against the dollar, while the Australian dollar was off 0.6%. The Japanese yen, a traditional refuge, gained against the greenback, while Norway’s currency sank as the country began the process of excising Russian assets from its sovereign wealth fund. South Africa’s rand dropped more than 2% to as weak as 15.5092 per dollar, while the Turkish lira fell more than 1.5%.

Speculation mounted that the Russian currency could take a further hammering in global institutional markets as people in Russia scurried to get their hands on greenbacks and BP Plc moved to dump its shares in oil giant Rosneft PJSC.

“We would expect Russian bonds and currency to continue falling,” said Kathy Jones, a fixed-income strategist at Charles Schwab. “We also expect pressure on the euro due to the economic damage that may come from rising energy costs and potential decline in business activity and consumer confidence.”

Lenders within Russia offered dollar-ruble exchange rates far higher than the level of 83, where the market closed on Friday. Rates varied widely on Sunday, from 98.08 rubles per dollar at Alfa Bank to 99.49 at Sberbank PJSC, 105 at VTB Group and 115 at Otkritie Bank at 3:30 p.m. in Moscow.

Sanctioning Russia’s central bank is likely to have a dramatic effect on the country’s economy and its banking system, Elina Ribakova, deputy chief economist for the Institute of International Finance, said before the latest round of penalties was announced. “This would likely lead to massive bank runs and dollarization, with a sharp sell-off, drain on reserves — and, possibly, a full-on collapse of Russia’s financial system.”

Sanctions Echo Iran, Venezuela

The decision to hit the central bank is a first for an economy the size of Russia’s. The U.S. has previously sanctioned the central banks of adversaries such as Iran and Venezuela for funneling money that supported destabilizing activities in their respective regions. North Korea’s central bank is also blacklisted.

Russia on Friday had its sovereign credit score cut to junk by S&P Global Ratings, which lowered its ranking one notch to BB+. Moody’s Investors Service — which currently has Russia one step above speculative grade — said it was reviewing the nation for a potential reduction.

Ukraine, meanwhile, had its score lowered by Fitch Ratings to CCC from B, putting it seven steps below investment grade and on par with El Salvador and Ethiopia. Moody’s also has Ukraine on review.

These moves from the world’s major credit assessors came after U.S. and European measures to crimp Russia’s access to global debt markets, but before the latest developments regarding the central bank and the SWIFT system.

Russia remains financially stable thanks to its international reserves and low level of debt, the Finance Ministry in Moscow said in a statement Saturday, responding to announcements by the ratings companies. The Finance Ministry “will continue to maintain a responsible financial and budget policy,” according to the statement.

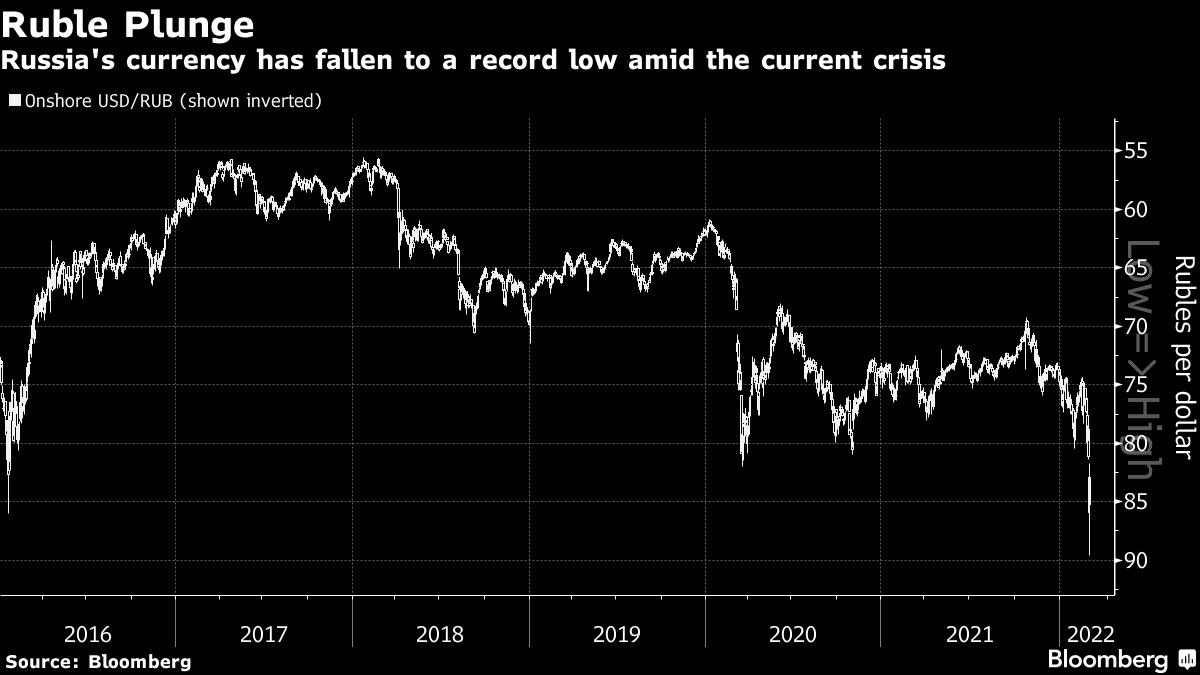

Prices for Russian and Ukrainian assets have already plummeted during the conflict. The ruble plunged to a record and is down around 10% this year against the dollar — more than twice as much as the next worst performing major currency — and the Ukrainian Hryvnia has dropped around 8%.

Russian stocks have fallen by around a third so far in 2022, while prices for country’s foreign-currency debt went into free fall and the cost of insuring against non-payment through credit default swaps soared.

Global Markets

The biggest global securities markets, meanwhile, have been somewhat torn in their response. U.S. and European stock markets witnessed a rebound late last week after initially diving as war broke out. U.S. Treasuries, the world’s largest bond market, have been caught between investors’ desire for a haven in times of turmoil — which tends to fuel demand for the safest instruments and drive down U.S. yields — and the potential inflationary effects of this conflict, which could put upward pressure on rates.

One potential concern could be the move to exclude at least some Russian entities from the SWIFT system. U.S. equities rebounded late Thursday after President Biden at that stage avoided moves involving the bank messaging system, and then they surged Friday at a time when Russia said it was willing to hold talks with Kyiv.

In addition to events on the ground in Ukraine, and the response of different nations to it, investors will be keenly attuned to the impact of rising commodity prices and how central policy makers react. And on that front, the key individual is set to be Federal Reserve Chair Jerome Powell, who is scheduled to testify before Congress in the coming week.

The move to ban some Russian lenders from SWIFT could also have wider effects on global funding markets. The decision could result in missed payments and giant overdrafts within the international banking system and spur monetary authorities to reactivate daily operations to supply the market with dollars, according to Credit Suisse AG strategist Zoltan Pozsar.

Volatility could amp up Monday and is already heading for its biggest two-month surge in a year, according to a gauge of cross-asset expectations for price swings in Treasuries, U.S. stocks and global currencies. Treasuries are leading the way, with the MOVE Index of implied volatility jumping to the highest since the early stages of the Covid pandemic.

(Adds Australian bond yields in second paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.