[Click here for an interactive chart of copper prices]

Global stock markets fell after US consumer prices showed the biggest annual increase in 40 years, which is expected to prompt tighter monetary policy from the US Federal Reserve.

“Today it’s really risk-off sentiment in financial markets and the dollar is up based on yesterday’s CPI. There’s also likely some profit-taking after the run-up we’ve seen,” said Julius Baer analyst Carsten Menke.

“In terms of the bigger picture, there’s a general cooling of the economy in China. Infrastructure and property are both key in terms of driving metals demand and we do not expect a quick reversal in either.”

Menke forecasts LME copper to ease to $9,500 a tonne in three months and to $8,750 in 12 months.

The Yangshan copper premium, an indication of physical demand in China, slid to $38 a tonne on Friday, the weakest since July last year and down from $102 two months ago.

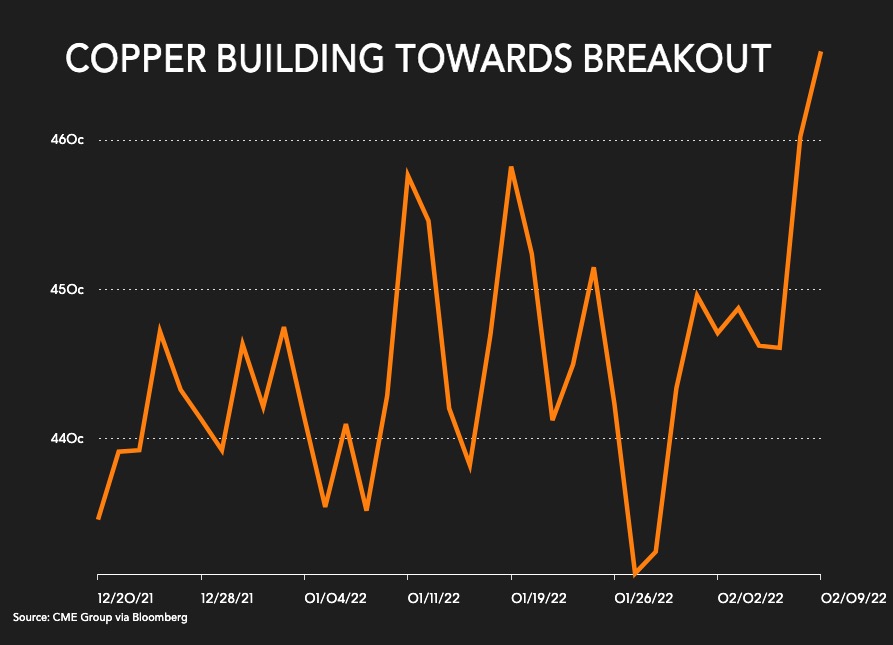

Copper price “breakout”

In a new research report Goldman Sachs says the copper price is “building towards a breakout” as worries about the global economy, particularly China’s engine of growth – property, begin to ease:

“With a diversified set of demand drivers – from EVs to electrical grids – sustaining a very tight micro into 2022, we believe that copper will reprice once these broader macro concerns abate.”

Goldman says the limited seasonal build-up of copper inventories from record low levels – currently at just over 200,000 tonnes scarcely enough to cover three days of global consumption – is “entirely insufficient to tackle” its expected deficit of 197,000 tonnes for this year.

“The longer this continues, the higher the risk of extreme scarcity episode by the end of the year,” Goldman said in its report released Tuesday.

Goldman believes the copper market has just two years of primary production growth left.

In the report Goldman reiterated its bullish forecast for copper to average $11,875 a tonne ($5.40/lbs) in 2021, rising steadily to $15,000 ($6.80/lbs) during 2025.

($1 = 6.3593 Chinese yuan)

(With files from Reuters)